Financial development and the cost of equity capital: Evidence from China

Jeong-Bon Kim,Mary L.Z.Ma,Haiping Wang

aCollege of Business Administration,City University of Hong Kong,Hong Kong

bSchool of Administrative Studies,York University,Canada

Financial development and the cost of equity capital: Evidence from China

Jeong-Bon Kima,*,Mary L.Z.Mab,1,Haiping Wangb,2

aCollege of Business Administration,City University of Hong Kong,Hong Kong

bSchool of Administrative Studies,York University,Canada

A R T I C L E I N F O

Article history:

Received 25 April 2015

Accepted 26 April 2015

Available online 16 June 2015

JEL classifcation:

G3

G15

G18

Financial development

Cost of equity capital

Law and fnance

China

This study examines the relation between province-level fnancial development and the cost of equity in China.Our main fndings are that(1)stock market development reduces the cost of equity in general,but the efect diminishes signifcantly in state-owned enterprises(SOEs)and frms with high growth potential or innovation intensity and(2)banking development only marginally lowers the cost of equity,but the efect is stronger in non-SOEs.Further analysis reveals that stock market development substitutes for such institutional factors as accounting quality,law enforcement,stock market integration and the split-share structure reform in lowering the cost of equity.We also fnd that lack of banking competition and banking marketization and under-development of the non-state economy partially account for the weak efect of banking development on the cost of equity.

?2015 Sun Yat-sen University.Production and hosting by Elsevier B.V.This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

1.Introduction

This study examines the impact of regional fnancial development on the cost of equity capital in China, using a large sample of Chinese frms listed on the Shanghai Stock Exchange(SHSE)and Shenzhen Stock Exchange(SZSE)over the period from 1998 to 2008.Specifcally,following the approach of Jayaratne and Strahan(1996)and Guiso et al.(2004a,2004b),we investigate whether and how regional province-level fnancial development within the same country is associated with the cost of equity,and how the relation isconditioned upon institutional infrastructures such as legal enforcement,accounting quality and other regulations.

Over the past two decades,voluminous research has extensively examined the role of fnancial development in lowering economy-wide uncertainty and increasing economic performance and growth in a cross-country setting.3For example,King and Levine(1993a),Levine(1997),Levine and Zervos(1998),and Beck and Levine(2002)examine relations between fnancial development and economic growth in across-countrysetting;Raddatz(2006)examines relations between fnancial development and uncertainty in economic growth in across-countrysetting.A notable exception is Guiso et al.(2004b)and Hasan et al. (2009)in that both studies examine the relation in asingle countrysetting of Italy and China,respectively.The consensus of these studies is that fnancial development accelerates economic growth and/or reduces its uncertainty by providing better fnancial services such as more efcient liquidity provision,better risk diversifcation and reduced information,agency and transaction costs.Nevertheless,previous research leaves still unresolved the question of whether and how fnancial development,as an independent institutional factor,afects the cost of equity capital.This line of research suggests that fnancial development reduces the cost of equity through enhancing liquidity provision(Levine, 2005),improving risk diversifcation(Acemoglu and Zilibotti,1997;King and Levine,1993b)and constraining agency costs and information asymmetry(Grossman and Stiglitz,1980).However,the relation between fnancial development and the cost of equity could be endogenous because both are likely to be afected by common institutional infrastructures such as legal enforcement,disclosure regulation or security regulations.For example,La Porta et al.(1997,2002a)show that a country’s legal institution is a key determinant of its fnancial market development and Rajan and Zingales(1998)and Brown et al.(2013)associate fnancial disclosure regulation with fnancial development.The cost of equity is shown to be associated with institutional factors such as security regulations(Hail and Leuz,2006),accounting disclosure requirements(Bushman and Smith,2001; Bushman et al.,2004)and insider trading regulations(Bhattacharya and Daouk,2002).

Previous research also has paid relatively little attention to the impact of fnancial development on a frm’s cost of equity in transitional economies and emerging capital markets,wherein certain unique characteristics of their banking sector and stock markets,including state or government interventions in fnancial markets may shape the relation in a diferent way.For instance,in China,the stock market is characterized by a government-controlled listing process and the dominance of state-owned and politically-connected frms with preferential bank lending(Aharony et al.,2000;Li et al.,2008;Hung et al.,2012).4For example,in China,overseas listing regulation requires approval from various government agencies such as ministries in central and provincial governments and the China Securities Regulatory Commission(CSRC).Hung et al.(2012)report that SOEs with strong political connections are more likely to be approved to list overseas,but their post-listing performance is worse,suggesting that their approval is driven by political motivation or private benefts and may not lead to efcient capital allocation.Existing evidence suggests that fnancial development under this backdrop can increase the cost of capital.Particularly,using a crosscountry sample,Jain et al.(2012)fnd that state ownership increases the cost of equity.Their fnding suggests that in transitional economies like China where the stock market consists mainly of state-owned enterprises (SOEs),stock market development can possibly increase shareholders’investment risk and thus the cost of equity.David(2008)shows that stock market development,coupled with short-sale constraints,engenders a high level of liquidity and investor heterogeneity,thereby resulting in excessive speculative activities.The banking sector in China is characterized by a lack of competition,and dominance of state-owned banks,lending discrimination against non-SOEs and lending preference to SOEs.In this setting,banking development can possibly deteriorate capital allocation efciency(Wurgler,2000;Dinc?,2005;Wiwattanakantang et al., 2006;Claessens et al.,2008)and bank monitoring efciency(La Porta et al.,2002b;Chen et al.,2011a).

Combined,an important implication from the above discussion is that fnancial development may not necessarily decrease the cost of equity,and it may increase the cost of equity in certain scenarios.Therefore,the direction of the relation between the two is,in general,an open empirical question.Examining this issue in the Chinese setting is interesting and important for the following reasons.First,it helps us gain additional insights into whether and how stock market and banking development determine the cost of equity,and how their efects in emerging and transitional economies like China difer systematically from those predicted in developed economies.Second,China is the largest transitional economy in the world and its continuous and rapid fnancial development since the 1980s represents features of an emerging market in general and also exhibits unique Chinese characteristics.The richness of the common and unique features of China’s fnancialdevelopment,along with its large cross-sectional or cross-regional variations,allows us to examine the relation between regional(province-level)fnancial development and the cost of equity in a single country setting.

Third,a single country setting does not sufer from the confounding efects caused by other institutional and country-level factors in cross-country studies which are difcult to control for.As prior research shows, fnancial development in a country is shaped by the legal and regulatory considerations at the country level, such as corporate and security laws,bankruptcy laws and accounting rules,which may contaminate its association with the cost of equity in a cross-country setting.However,this is not a concern in a single country setting because regional fnancial development in each province is shaped by the same nation-wide legal and regulatory considerations.Moreover,to the best of our knowledge,data on province-level institutional characteristics are publicly available only in China.These data availability enable us to assess the moderating efect of institutional infrastructures on the within-country relation between regional fnancial development and the cost of equity.5For example,Fan et al.(2011)provide a comprehensive database on the marketization index and sub-indexes that proxy for the institutional development in a province or provincial municipal city in China from 1998 to 2010.These measures cover the following aspects of marketization:the relation between the government and market,the development of non-state sectors,product market and factor market in the economy and the development of market intermediary and the legal environment.

Finally,our evidence from a cross-province study can be generalized to cross-country research because provincial fnancial markets are segmented and mimic national ones.Provincial fnancial markets in China are normally geographically fragmented due to the informational advantages and monitoring efciency associated with geographical proximity.They also share home bias and market segmentation similar to those in the U.S.and international settings.6Petersen and Rajan(2002)fnd that the U.S.banks rely heavily on local deposits and lend in their business,and Garc?′a-Herrero and Vazquez(2007)report substantial home bias in the international allocation of bank assets.Refer to Ivkovic and Weisbenner(2005), Pirinsky and Wang(2006)and Lee(2011)for home bias and state-level market segmentation in the U.S.stock market.For example,local investors have trading behaviors that difer signifcantly from those of other investors in China(Lei and Seasholes,2004)and provincial branches of large banks are usually headquartered in the capital city or other large cities of a province.In addition,the level of integration of provincial and national fnancial markets represents an upper bound for the integration of national and international markets.

Our empirical strategy involves measurement of fnancial development and the cost of equity.To empirically measure fnancial development,we consider both stock market and banking development.Specifcally, we measure stock market development as the ratio of market capitalization or market liquidity to GDP at the province level,and banking development as the ratio of total bank loans to GDP in a province.As many listed frms in China experienced relatively high growth opportunities during our sample period of 1998–2008,theex post realizedreturn is unlikely to capture the real underlying cost of equity.We therefore employ theex ante expectedcost of equity implied by market prices and earnings expectations to measure the cost of equity.

Our main results are summarized as follows.First,the cost of equity decreases with stock market development,consistent with the well-documented efect of stock market development mitigating economy-wide uncertainty.We fnd,however,that this efect is less pronounced in frms with higher growth or more intensive innovation.This fnding suggests that the government-controlled listing process in China fails to provide suffcient equity fnancing to these frms.Second,banking development is weakly and negatively associated with the cost of equity,consistent with the notion that the lack of banking competition and state-ownership of large banks decreases banking efciency.The association diminishes in frms with higher growth or more intensive innovation,consistent with fndings in prior cross-country studies(Brown et al.,2013;Hsu et al.,2014)that banking development generally does not support frm growth and innovation.Third,stock market and banking development have virtually no impact on the cost of equity for SOEs,while they have a signifcant impact on reducing the cost of equity for non-SOEs.This fnding suggests that government intervention in SOEs adversely afects the benefts of fnancial development.

We next examine the moderating efects on the negative relation between stock market development and the cost of equity of institutional factors such as earnings quality,law enforcement,stock market integration and the split-share structure reform.We fnd that the negative relation is stronger in regions with lower earnings quality and/or weaker law enforcement,implying that stock market development substitutes for theseinstitutional infrastructures in reducing the cost of equity.We also fnd that the negative relation is weaker in regions with high market integration and in the period subsequent to the share-issue structure reform in 2005. The evidence supports the notion that by providing more investment freedom and risk-sharing benefts,the cost of capital efect of stock market development substitutes for those of stock market integration and the split-share structure reform.The above fndings,taken together,suggest that stock market development substitutes for various institutional factors in lowering the cost of equity.

Then we explore how banking development characteristics and related institutional factors account for the weaker efect of banking development on reducing the cost of equity.We fnd that the cost of equity efect of banking development is weaker in regions with low banking competition,low banking distribution efciency and a low degree of development of the non-state economy.Finally,our baseline results are robust to controlling for the moderating efects of institutional factors,potential endogeneity with respect to stock market development and banking development,and the use of alternative proxies for stock market development, banking development and the cost of equity.Overall,our fndings suggest that stock market development is an independent institutional infrastructure that afects the cost of equity.

This study contributes to the existing literature in the following ways.First,it extends research on the relation between institutional and legal factors and the cost of equity.Prior studies show that the cost of equity is inversely associated with a number of institutional factors,including enforcement of insider trading regulations(Bhattacharya and Daouk,2002),accounting disclosure rules,security regulations and cross-listing (Hail and Leuz,2006,2009),and efective corporate governance(Chen et al.,2009,2011b).In contrast, Ben-Nasr et al.(2012)and Jain et al.(2012)show that the cost of equity increases in government ownership. Complementing these studies,we provide original evidence that stock market development is another independent institutional infrastructure that lowers the cost of equity,but its efect is discounted for SOEs relative to non-SOEs.

Our study is also closely related to recent research on fnancial development and innovation.In a crosscountry setting,Brown et al.(2013)and Hsu et al.(2014)report that stock market development increases long-run growth in research and development(R&D)investment and innovation,particularly for small frms, whereas credit market development has little impact on its growth.Our fnding that the inverse relation between regional stock market development and the cost of equity is weaker for growing and innovative frms in China provides counterevidence to that of Brown et al.(2013)and Hsu et al.(2014),and points to a weakness of the stock market development in China.

In addition,our study advances research on the interaction between stock market development and institutional factors in afecting the cost of equity,for which prior studies report both a substitutive and a complementary relation.Specifcally,Ball(2001)argues that accounting infrastructure complements the overall economic,legal and political infrastructures in forming a disclosure system that afects the cost of equity. In contrast,Hail and Leuz(2009)show that strengthened investor protection via U.S.cross-listing substitutes for home country legal protection in decreasing equity costs.Chen et al.(2009)also report that national legal protection substitutes for frm-level governance.Extending these studies,we show that stock market development substitutes for accounting quality,legal enforcement,market integration and the national split-share structure reform in lowering the cost of equity.

Moreover,our study is relevant to the literature on fnancial development in China.Allen et al.(2005)show that fnance is not the key driver for economic growth in China;Guariglia and Poncet(2008)and Chang et al. (2010)also fnd that banking development is not either.7Guariglia and Poncet(2008)and Chang et al.(2010)report that banking development decreases or is unrelated to economic growth in China,respectively.In contrast,Hasan et al.(2009)document that stock market development does facilitate economic growth in China.Extending these studies,we fnd that banking development weakly decreases the cost of equity,while this cost-decreasing efect is signifcant for stock market development.Our result that the lack of banking competition accounts for the weak efect of banking development on lowering the cost of equity is also consistent with prior evidence about the negative features of the banking sector in China(e.g.,Lin et al.,2012).

Lastly,our evidence has policy implications to fnancial market regulators in China and other transitional economies.The banking system in China has been undergoing a series of regulatory reforms since the 1990s, but their efectiveness is controversial(Ho,2012).8These reforms in the 1990s include,for example,separating policy banks from commercial banks,transforming urban credit cooperatives into commercial banks,granting limited licenses to foreign banks and non-state banks,and introducing standard accounting and prudential norms.More reforms were implemented after China’s entry into the World Trade Organization(WTO)in 2002,such as liberalizing interest rates,increasing operational freedom and partially privatizing state-owned banks.Our result about the weak equity cost efect of banking development shows the necessity and urgency of deepening the ongoing banking reforms and suggests that alleviating lending discrimination against non-SOEs,improving banking competition and developing the non-state economy may be possible reform avenues.The fndings about the abated efect of stock market development on lowering the cost of equity in SOEs,innovation-intensive frms,and/or frms with high growth potential highlight the importance of reforming the IPO regulations to ofer a level-playing feld to these frms.

The remainder of this study is organized as follows.Section 2 presents a brief overview of the institutional background.Section 3 develops relevant theories.Section 4 describes the research design.Section 5 reports the main results.Section 6 conducts further analysis.Section 7 performs robustness checks.The fnal section, Section 8,concludes the paper.

2.Institutional background

The fnancial system in China includes a fast growing equity market and a large state-controlled banking sector.The equity market consists of two stock exchanges SHSE and SZSE,and it is the largest stock market among emerging economies in terms of the ratio of market capitalization to GDP(Allen et al.,2012).Since its establishment in 1990,the stock market in China has been growing rapidly and plays an increasingly signifcant role in the Chinese economy and the world economy.9By the end of 2008,the equity market in China is the fourth largest in the world,with 1625 stocks listed on the two stock exchanges;it has total market capitalization of RMB 12136.6 billion,accounting for 40.37%of GDP in China(China Securities Regulatory Commission(CSRC),2008).Despite its enormous size and rapid growth,the stock market in China has some downside characteristics that constrain its capital allocation role.One of the most ominous is that the listing process favors SOEs and private frms with political connections.China’s stock markets were initially used as a vehicle for privatizing SOEs rather than raising capital for frms with growth opportunities(Ayyagari et al.,2010).Since the establishment of the stock markets,there has been a split-share structure in listed SOEs—approximately two-thirds of shares owned by the state and legal persons were not tradable.10A legal person is defned as“an organization that has capacity for civil rights and capacity for civil conduct and independently enjoys civil rights and assumes civil obligations in accordance with the law.”(The General Principles of Civil Law of the People’s Republic of China,1986,Chapter III).This predominance of non-tradable shares in listed SOEs constrains risk-sharing and stock liquidity,and posed a major problem in the Chinese stock market.In April 2005,CSRC initiated the split-share structure reform to convert all non-tradable shares into tradable shares,and most listed SOEs were required to complete the reform by the end of 2007.In spite of improvement over time,the listing process still favors SOEs,particularly those in strategic industries and in regions with stronger local political connections(Li et al.,2008).Under such circumstances,the stock market development in China implies that more equity funding resources go to SOEs;therefore,it may not lead to an overall reduction of systematic risk and improvement of capital allocation in the economy.In addition,the Chinese stock market also features excess speculation and high turnover,mainly driven by retail investors(Bailey et al.,2009;Allen et al.,2012).As of the end of 2008,the annual stock turnover ratios in SHSE and SZSE have reached 392.52%and 469.11%,respectively.

The banking system in China is much larger than its equity market and Chinese frms rely heavily on bank loans for their external fnancing needs.The banking sector has experienced rapid growth and consistent reforms since 1980.It was initially dominated by the big four state-owned banks,but the number of collective, private and foreign banks continues to grow.11The four largest banks in China are Agricultural Bank of China(ABC),Bank of China(BOC),Industrial and Commercial Bank of China(ICBC)and People’s Construction Bank of China(CBC).However,the big four state-owned banks still dominate thebanking sector and they favor SOEs and private frms with political connections in their lending decisions, discriminating against other non-SOEs such as small town and village enterprises and other private frms (Brandt and Zhu,2000;Chang et al.,2010;Lu et al.,2012).12For example,Lu et al.(2012)suggest that Chinese non-SOEs can reduce lending discrimination through holding bank ownership and then they enjoy benefts of lower interest expense and better lending terms.State-owned banks are the least efcient in performing banking functions,while foreign banks are the most(Berger et al.,2009).Government intervention over lending and other banking services still remains,although this intervention is decreasing over time(Ho, 2012).The banking sector also lacks competition despite continuous banking reforms such as improving bank governance,partially privatizing state-owned banks and bringing in strategic foreign investors.Lin et al. (2012)report that by the end of 2009,the big four banks have market share of 52.1%and 46.5%in terms of deposits and loans,respectively.

3.Theoretical framework

3.1.Stock market development and the cost of equity

Stock market development generally lowers the cost of equity by improving liquidity provision,information production,risk diversifcation and external monitoring.First,stock market development increases liquidity provision and decreases liquidity shocks for frms that rely on external fnancing and/or have high liquidity needs(Aghion et al.,2004;Levine,2005;Raddatz,2006;Hasan et al.,2009),and thus improves capital allocation efciency in the economy(Wurgler,2000).Recent studies of Brown et al.(2013)and Hsu et al. (2014)report that stock market development supports technical innovations and long-run R&D investment, primarily for small frms that rely more on equity fnancing.High liquidity,capital allocation efciency and advanced technology decrease investment risk,and consequently,investors demand a lower required rate of return for providing capital.

Second,with the development of the stock market,market participants face more intense competition and have stronger incentives to seek private information and trade on it(Grossman and Stiglitz,1980;Kyle,1984; Holmstrom and Tirole,1993).This helps lower information asymmetry between informed and uninformed investors(Holden and Subrahmanyam,1992,1994;Foster and Viswanathan,1993),alleviate adverse selection problems and ultimately reduce the cost of equity.13Armstrong et al.(2010)and Akins et al.(2012)argue that information asymmetry increases the cost of equity and that this efect is magnifed in illiquid and imperfect markets,suggesting that stock market development mitigates the adverse cost of capital efect of information asymmetry.

Third,stock market development expands the investor base and improves market liquidity.This facilitates cross-sectional risk diversifcation and inter-temporal risk-sharing,which in turn reduces the cost of equity. Idiosyncratic risk is not easily diversifable and usually priced in reality(Merton,1987;Ang et al.,2010; Malkiel and Xu,2006).However,the improved risk diversifcation and risk-sharing in a more developed stock market help investors better diversify idiosyncratic risk,which in turn lowers the cost of equity.

Fourth,stock market development improves external monitoring over invested frms,which alleviates standard agency problems,and thus,lowers the cost of equity.It also facilitates the incorporation of frm-specifc information into stock prices;as a result,previously disadvantaged outside investors are now better informed, have stronger monitoring capability and are exposed to less agency problems(Diamond and Verrecchia,1982; Jensen and Murphy,1990).Moreover,fnancial development also encourages information search by sophisticated investors and facilitates their external monitoring.Enhanced external monitoring better curbs managerial opportunism and lowers agency costs,and ultimately,the cost of equity decreases(Healy and Palepu, 2001;Ashbaugh-Skaife et al.,2006).14Bhide(1993)posits a contrasting view that higher liquidity,which is associated with the more developed U.S.stock markets,reduces institutional investors’and other investors’monitoring incentives,because it is cheaper and easier to sell shares of poorly-performing frms. This argument implies that stock market development may increase the cost of equity.However,Ashbaugh-Skaife et al.(2006)suggest that this is not a concern since institutional investors decrease the cost of equity through undertaking careful corporate governance and reducing agency cost.The above discussions,taken together,suggest that stock market development is inversely associated with the cost of equity.

However,some unique characteristics of the Chinese stock market suggest that stock market development may increase the cost of equity.First,the initial objective of stock market development in China was not to improve capital allocation efciency but to facilitate external fnancing to SOEs and politically-connected frms.Hence,unlike most developed stock markets around the world,the Chinese stock market may not provide sufcient funding to growing or innovative frms which are the drivers of economic growth.Second,the Chinese stock market has fewer institutional investors and fnancial analysts compared with more mature stock markets,and is dominated by individual investors who lack privileged access to inside information and often exhibit irrational trading behavior(Eccher and Healy,2000;Yeh and Lee,2000).Accordingly, the stock market development in China may play only a limited role in facilitating the incorporation of private information into stock prices,reducing information asymmetries or enhancing external monitoring.Lastly, the Chinese stock market is also characterized by high turnover and excessive speculation driven by retail investors(Bailey et al.,2009;Allen et al.,2012).Both features discourage investors from relying on fundamentals.In addition,external monitoring is weakened because transient investors have no incentives and power to monitor management closely(Xu and Wang,1999).15Xu and Wang(1999)provide anecdotal evidence that the efective turnover ratio in the Chinese stock market ranges from 700%to 1000%.Combined,the stock market development in China may not necessarily enhance,or may even possibly deteriorate,the efciency in economy-wide capital allocation and external monitoring.This may in turn increase systematic risk,and thus,the cost of equity.

The above reasoning from both sides suggests that stock market development is a key factor in infuencing the cost of equity.However,whether it decreases or increases the cost of capital in such an emerging stock market as China cannot be directly inferred from existing studies.In addition,the trade-ofbetween the positive and negative impacts of stock market development may difer between SOEs and non-SOEs.Government ownership in SOEs brings about government interference and expropriation,and increases the cost of equity, as shown by Ben-Nasr et al.(2012)in a cross-country setting.In addition,SOEs in China may not use equity fnancing efciently to maximize shareholder value even though they are favorably treated in the IPO process and have better equity funding with stock market development.In contrast,non-SOEs,though they are disadvantaged in the equity fnancing process,tend to make more efcient use of the funding and liquidity associated with stock market development.

3.2.Banking development and the cost of equity

Banking development in general is expected to decrease the cost of equity for several reasons.First,banks play an important role in providing liquidity and external funding to borrower frms,and higher frm liquidity generally lowers economy-wide systematic risk(Diamond and Dybvig,1983).In addition,fnancial development,particularly banking development in developing economies,allows better inter-temporal risk-sharing and mitigates stock return volatility(Allen and Gale,1995).Further,banking development facilitates private information production because banks and other fnancial intermediaries(e.g.,credit rating agencies)are information producers and processors for borrower frms(Ramakrishnan and Thakor,1984).Given that information production involves large fxed costs,banking development improves the economies of scale and lowers the production cost(Diamond,1984;Veldkamp,2006).Lastly,with privileged access to borrowers’inside information,banks are better able to monitor borrower frms at a low cost(Diamond,1984;Fama, 1984).Banking development strengthens a bank’s external monitoring over its borrowers,thereby mitigating potential moral hazard and adverse selection problems associated with the information asymmetry between potential borrowers and outside capital suppliers.The above reasoning suggests that banking development mitigates economy-wide systematic risk and reduces the cost of equity capital.

However,some unique features of the banking sector in China weaken the potential mitigating efect of banking development on the cost of equity.First,the big four state-owned banks in China have dominant market share in the banking sector and one of their primary goals is to support SOEs and politically-connected frms(Brandt and Zhu,2000;Chang et al.,2010).Accordingly,their focus is not on traditional banking functions such as liquidity provision,information production,capital allocation,risk-sharing and externalmonitoring.Evidence shows that their liquidity provision and credit allocation are far from efcient since their lending decisions depend primarily on political motives rather than on the borrowers’credit quality(Cull and Xu,2005;Cull et al.,2009).A variety of government interventions,such as credit and interest rate controls, state guarantees and government-directed lending policies,grant further lending privileges to SOEs. Meanwhile,they also exacerbate lending discrimination against other non-SOEs such as small town and village enterprises and private frms.

Second,state-owned banks do not have a strong motivation to produce frm-specifc information and monitor borrower frms because they cannot force SOEs to repay their loans without causing political problems (Chang et al.,2010;Chen et al.,2011a).This weakness could lead to an economy-wide unfavorable efect and increase systematic risk especially for SOEs.Third,the historical market segmentation and government interference in the Chinese banking sector deter banking competition.Insufcient competition also deteriorates banking efciency in allocating capital(Lin et al.,2012),which has an economy-wide efect and increases systematic risk.16Specifcally,the four state-owned banks have their own specialization in a designated sector of the economy,and the central bank’s strict control over interest rates for deposits and loans prohibits price-based competition(Wong and Wong,2001).The main responsibility of ABC was to receive deposits in rural areas and extend loans to agricultural production projects and township industries.The CBC focused on appropriating funds for capital construction from the state budget through the Ministry of Finance.The BOC focused on deposits and loans for foreign exchange and international transactions,and the ICBC focused on the fnancing of commercial and industrial activities in urban areas.Since banking development without structural reform does not alleviate and even worsens these inherent problems,it may not bring about an overall improvement of bank functionality to generate benefcial economy-wide efects and decrease the cost of equity.

Therefore,the efect of banking development on the cost of equity depends on the trade-ofbetween the positive and negative sides of banking development in China.This trade-ofmay difer between SOEs and non-SOEs.Due to government interference and expropriation,SOEs in China do not utilize their privileged loan fnancing efciently for shareholder value maximization,even though their privileged loan fnancing increases with banking development.In contrast,non-SOEs are more sensitive to,and thus more efciently use increased funding associated with banking development,which alleviates lending discrimination against them to a certain extent.

4.Research design

4.1.Data and sample

Our accounting and stock market data are collected from the China Securities Markets and Accounting Research(CSMAR)database,and frm ownership data from the China Center for Economic Research (CCER)database.We obtain most measures for institutional factors from a database on province-level institutional development in China developed by Fan et al.(2011).We start with a sample of listed frms on SHSE and SZSE for the period of 1998–2011 to retrieve frm-level stock market and accounting data to compute measures ofex antecost of equity capital,stock market development and banking development.However, calculating theex antecost of equity capital measures requires at least three-year-ahead earnings’data,and therefore,our fnal sample spans the period from 1998 to 2008.We also eliminate frm-years with missing data for control variables.We winsorize all variables at the 1st and 99th percentiles of their empirical distributions to mitigate the impact of outliers.Following Hail and Leuz(2006,2009),we do not exclude frms in the fnancial and utility industries.Our fnal sample consists of 10,321 frm-years for 1281 non-fnancial and fnancial frms listed on SHSE and SZSE from 1998 to 2008.

4.2.Implied cost of equity capital measures

We use theex anteimplied cost of capital to measure the cost of equity capital.Both theex anteimplied cost of capital and theex postrealized stock return are two widely used cost of capital measures.Compared with theex antemeasure,theex postmeasure is noisier and incurs non-trivial estimation errors because it alsocaptures shocks to a frm’s growth opportunities(Stulz,1999)and incorporates diferences in expected growth rates(Bekaert and Harvey,2000;Hail and Leuz,2006).17Additional criticisms to the realized return measure are that it is a poor and potentially biased proxy(Elton,1999),its standard techniques require a fairly long time-series(Stulz,1999)and that it generates large standard errors and produces imprecise estimates(Fama and French,1997).This weakness is especially severe in China’s stock market where many listed frms are at the growth stage,shocks to a frm’s growth opportunities are frequent and the growth rates of expected future cash fow vary substantially across investors.In contrast, theex antecost of equity measure is free from these problems because its valuation models explicitly control for both future cash fows and growth potential in the estimating process(Hail and Leuz,2006,2009). Therefore,theex antemeasure is more appropriate in capturing the underlying cost of equity for listed frms in China.

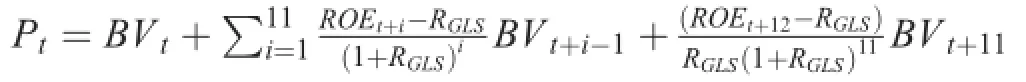

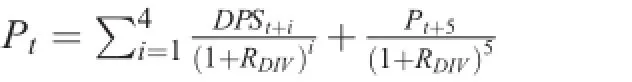

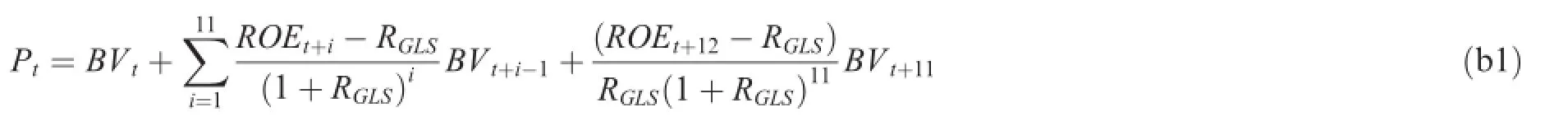

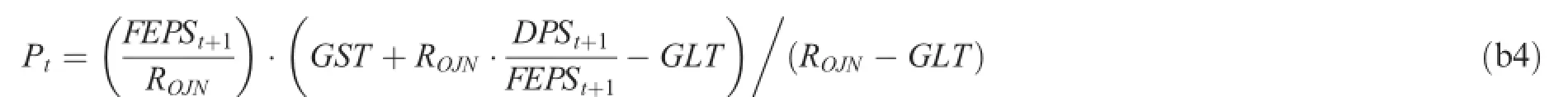

Following Hail and Leuz(2006,2009)and Ben-Nasr et al.(2012),we adopt four implied cost of equity measures derived by the estimation methods proposed by Gebhardt,Lee and Swaminathan(GLS,2001),Botosan and Plumlee(DIV,2002),Easton(price-earnings-growth(PEG),2004),and Ohlson and Juettner-Nauroth (OJN,2005),denoted byRGLS,RDIV,RPEG,andROJN,respectively.Diferent from the case in the U.S.setting, the analyst forecast data in China are unavailable for the majority of our sample years(1998–2004).We thus follow Chen et al.(2011a)and use realized one-year-ahead earnings to substitute expected future earnings for all model estimations.Although realized earnings have high volatility and add noise to our estimation to some degree,they do not systematically infate the cost of capital estimation as do analysts’earnings forecasts in the U.S.setting.18Specifcally,in the U.S.setting,analysts forecasts are,on average,optimistically biased(e.g.,O’Brien,1988;Richardson et al.,2004) and this optimism likely leads to an upward bias in the estimated cost of capital(e.g.,by 2.84%as reported in Easton and Sommers,2007).Among the four measuresRGLS,RDIV,RPEGandROJN,we useRGLSin most of our empirical analysis because prior studies consider it the best measure in China’s capital market(Chen et al.,2011a).RDIVis possibly subject to estimation error because Chinese listed frms do not often distribute dividends.RPEGandROJNrequire positiveEPSgrowth and apply to only a non-representative small subsample with consistent earnings growth,which may cause severe selection bias.For example,only 4509 and 3953 out of 10,321 observations in our fnal sample haveRPEGandROJNvalues,respectively.AlthoughRPEGis a preferable measure in the U.S.setting(Botosan and Plumlee,2005),it is not the best one in China.Therefore,we employRGLSas our main measure rather than using the average of all implied cost of equity measures which is often used in the U.S.or other international studies.A description of the detailed procedures for estimatingRGLS,RDIV,RPEGandROJNis summarized in Appendix B.

4.3.Financial development measures

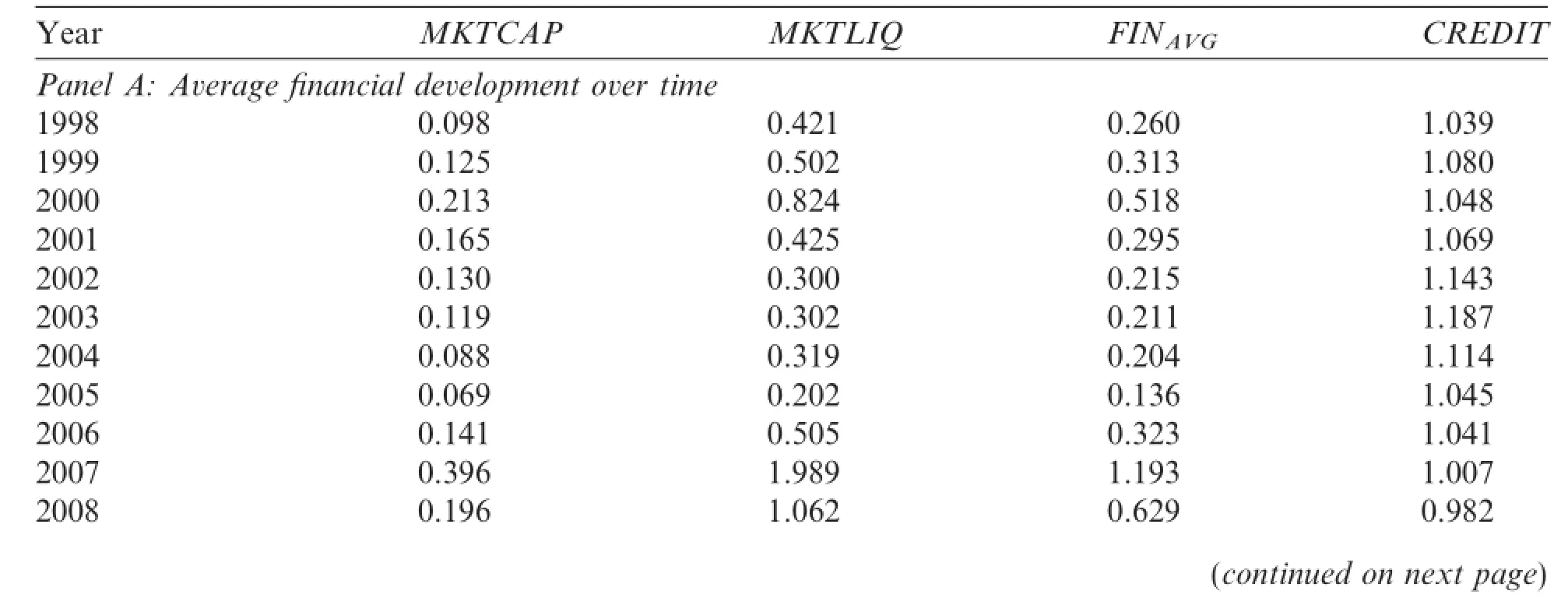

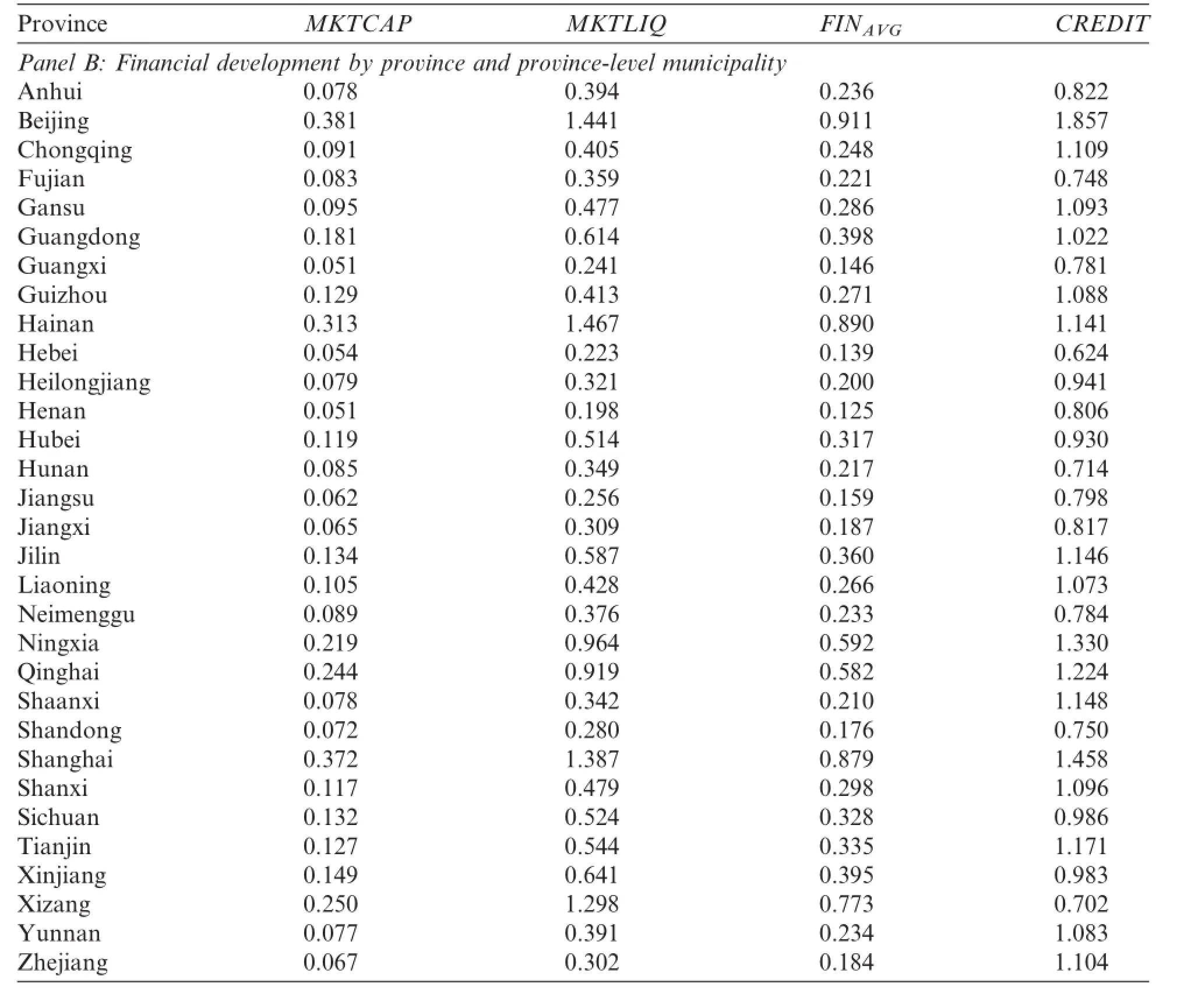

In our main tests,we use stock market and banking development to proxy for fnancial development. Following the conventional literature(e.g.,Demirguc-Kunt and Levine,1996;Wurgler,2000),we adopt both value-based and liquidity-based measures for stock market development,that is:(i)the ratio of total market value of all shareslistedon SHSE and SZSE at the end of a year to GDP in the same year,denoted byMKTCAPand(ii)the ratio of the total market value of all sharestradedin a year to GDP in the same year, denoted byMKTLIQ.We also use the average ofMKTCAPandMKTLIQ,denoted byFINAVGas an alternative measure.Following Wurgler(2000)and other fnancial development studies,we measure banking development as the ratio of annual total bank loans to GDP,denoted byCREDIT.We calculate these measures for each province or a province-level municipality where banks and listed frms are headquartered at the fscal year end(Hasan et al.,2009;Ayyagari et al.,2010).Appendix C reports the mean values of these stock market and banking development measures by year and by province.

4.4.Model specifcation

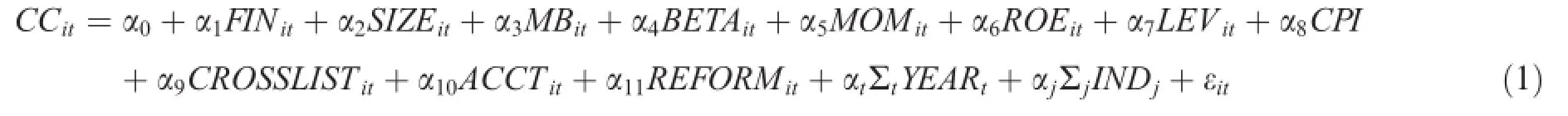

We estimate the following ordinary least squares(OLS)regression model for our main analysis,extending Hail and Leuz(2006,2009),Chen et al.(2011a,2011b)and Ben-Nasr et al.(2012):

whereCCrefers to one of the four implied cost of equity capital measures:RGLS,RDIV,ROJNandRPEG.FINrefers to the stock market development measuresMKTCAP,MKTLIQ,FINAVG,or the banking development measureCREDIT.Model(1)controls for other known determinants of the cost of equity used in related studies(Hail and Leuz,2009;Chen et al.,2011a,2011b;Ben-Nasr et al.,2012):frm size measured as the natural logarithm of the market value of equitySIZE;book value to the market value of equityMB;market betaBETA;return momentumMOM;ratio of earnings to book value of equityROE;ratio of total liabilities to total assetsLEV;infation rate in the future twelve monthsCPI;dummy for cross-listingCROSSLIST;indicator variableACCTfor the implementation of the new accounting standards in 2007;indicator variableREFORMfor the split-share structure reform in 2005;and dummiesYEARandINDfor fxed year and industry efects.We expect α1to be negative if stock market development and banking development decrease the cost of equity.Drawing on prior studies,we expect the coefcients onSIZE,MB,MOM,ROEandACCTto be negative,while those onBETA,LEVandCPIto be positive.We do not make directional predictions for coefcients onCROSSLISTandREFORM.19Chen et al.(2011a)and Hail and Leuz(2009)report mixed evidence for the coefcients onCROSSLISTin the China setting and international setting,respectively.The split-share structure reform in China could afect the relation between fnancial development and the cost of equity through its risk-sharing and price impact when more shares come to the stock market(Xin and Xu,2007;Li et al.,2011), which have opposite efects on the cost of capital.If the risk-sharing efect(price impact efect)dominates,REFORMis expected to be negatively(positively)associated with the cost of equity.

5.Empirical results

5.1.Descriptive statistics

Table 1 presents summary statistics for the full sample with Panel A providing descriptive statistics for all main test variables.The means(medians)of the implied cost of equity capital measuresRGLS,RDIV,RPEGandROJNare 6.873%(5.610%),8.856%(4.850%),11.238%(9.130%)and 14.844%(12.821%),respectively.These estimates are consistent with prior studies on Chinese,U.S.and international capital markets.Specifcally, the reported meanRGLSis comparable to that of 6.600%for Chinese listed frms in Chen et al.(2011a) and 7.690%for forty countries in Hail and Leuz(2009).The meanRDIVof 8.856%is comparable to that of 11.40%in Botosan and Plumlee(2002).The meanRPEGof 11.238%is consistent with a fgure of 13.080%in an international setting in Hail and Leuz(2006).The meanROJNof 14.844%is comparable to that of 12.440%for Chinese listed frms in Shen(2007)and 13.77%in Hail and Leuz(2006).For the stock market development measures,the mean(median)of the capitalization-based measureMKTCAPis 0.163(0.102) which is consistent with the reported value of 0.139 by CSRC(2008)for the same period,and the mean(median)of the liquidity-based measureMKTLIQis 0.659(0.390).The mean banking development measureCREDITis 1.064,which is comparable to that of 1.010 in Wu et al.(2012).

Panel B reports the coefcients of Pearson pair-wise correlations among our main test variables.The correlation coefcients among the four cost of capital measures range from 0.348 to 0.945,consistent with Botosan and Plumlee(2005)that reports a range between 0.300 and 0.860.The evidence is also in line with the reported correlations amongRGLS,RPEGandROJNin Hail and Leuz(2006),which is between 0.300 and 0.860,and in Ben-Nasr et al.(2012),which is between 0.549 and 0.948.These high correlations suggest that the four measures capture the same underlying construct for the cost of equity capital.In addition, the four estimates are all signifcantly negatively correlated with frm size,with its coefcients ranging from -0.353 to-0.083.They are also signifcantly negatively correlated with theMBratio and return momentumMOM,but positively correlated with market beta when the coefcients are signifcant.These signifcant correlations between the four estimates and frm risk variables further strengthen the empirical validity for our cost of equity measures.Importantly,the four cost of equity estimates are all signifcantly negatively correlated with the fnancial development measures,with coefcients ranging from-0.217 to-0.020.Though onlysuggestive of the underlying relation,these negative correlations provide initial evidence that in China,province-level regional fnancial development lowers the cost of equity capital.We next conduct multivariate analyses.

Table 1 Descriptive statistics.

5.2.The efect of stock market development on the cost of equity

?

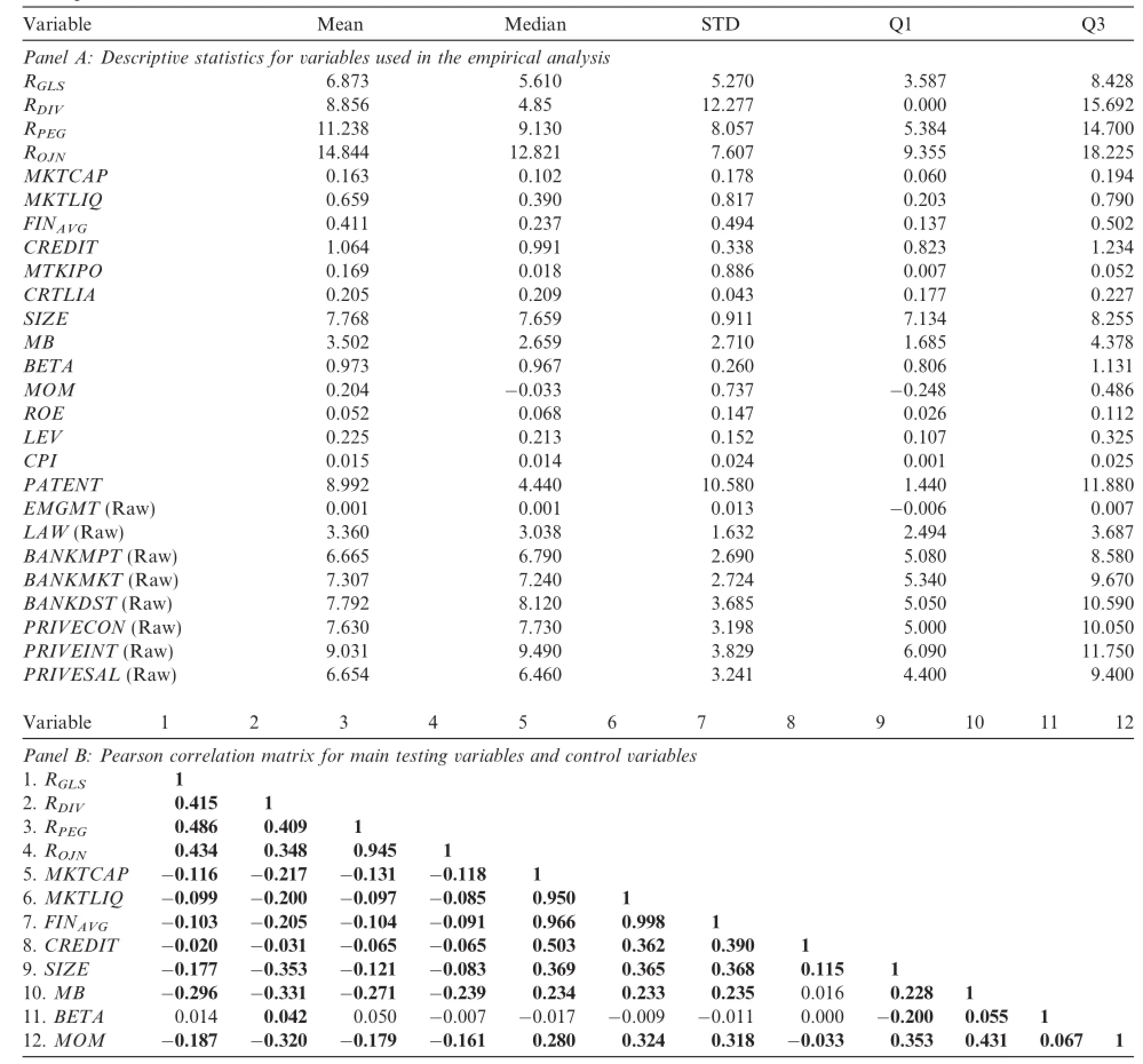

Table 2 presents the results of OLS regressions examining whether regional stock market development explains the variation in the cost of equity beyond its conventional determinants.In Table 2,the dependent variable is the cost of equity estimateRGLSin all models,with Models 1–3 reporting the results for the fullsample,Models 4–6 for the subsample of non-SOEs,and Models 7–9 for the subsample of SOEs.Models 1–3 show that the three stock market development measures—the market capitalization based measureMKTCAP, the market liquidity based measureMKTLIQand their averageFINAVG—are all signifcantly negatively associated with the cost of equity measureRGLS,with coefcients(t-statistics)of-0.116(-2.94),-0.026(-3.01) and-0.043(-3.00),respectively.The results imply that a one standard deviation increase inMKTCAP,MKTLIQorFINAVG,which is 0.178,0.817 or 0.494,respectively,leads to a decrease inRGLSof about 206.5,212.4 or 212.4 basis points,respectively.Similarly,for the non-SOE subsample,these stock market development measures are also signifcantly negatively related toRGLSin Models 4–6,with a one standard deviation increase inMKTCAP,MKTLIQorFINAVGcorresponding to 576.7,57.7 or 578.0 basis points of decrease inRGLS,respectively.In contrast,for the SOE subsample,these stock market development measures are only weakly negatively related toRGLSin Models 7–8.The result suggests that for the subsample of SOEs, the negative side of stock market development in China cancels out its benefcial side;government interference and expropriation induce additional investment risk,and consequently,result in an insignifcant efect of stock market development on the cost of equity.The diferences in results between SOEs and non-SOEs are also consistent with our expectations,and imply that the result for the full sample is mainly driven by non-SOEs.

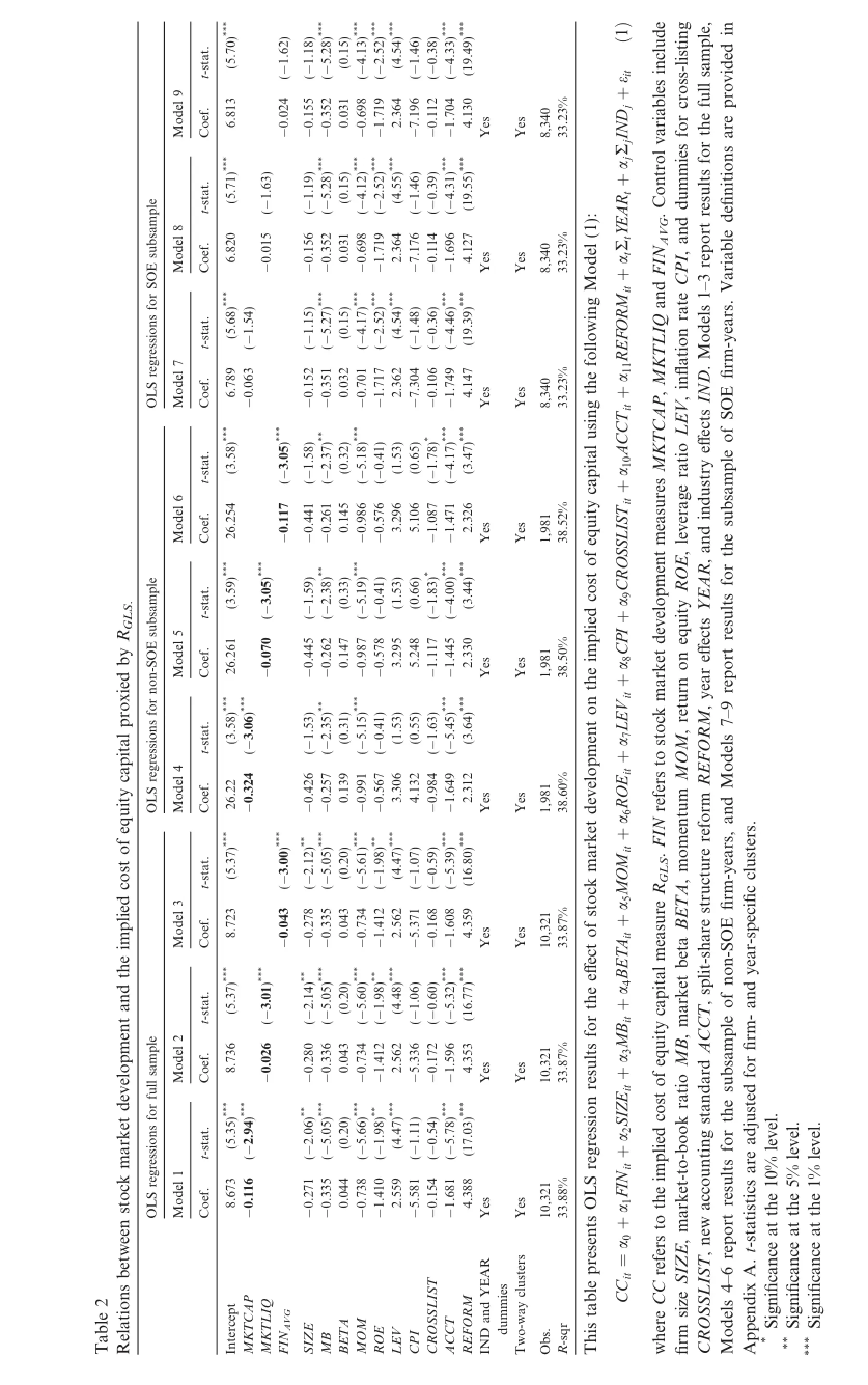

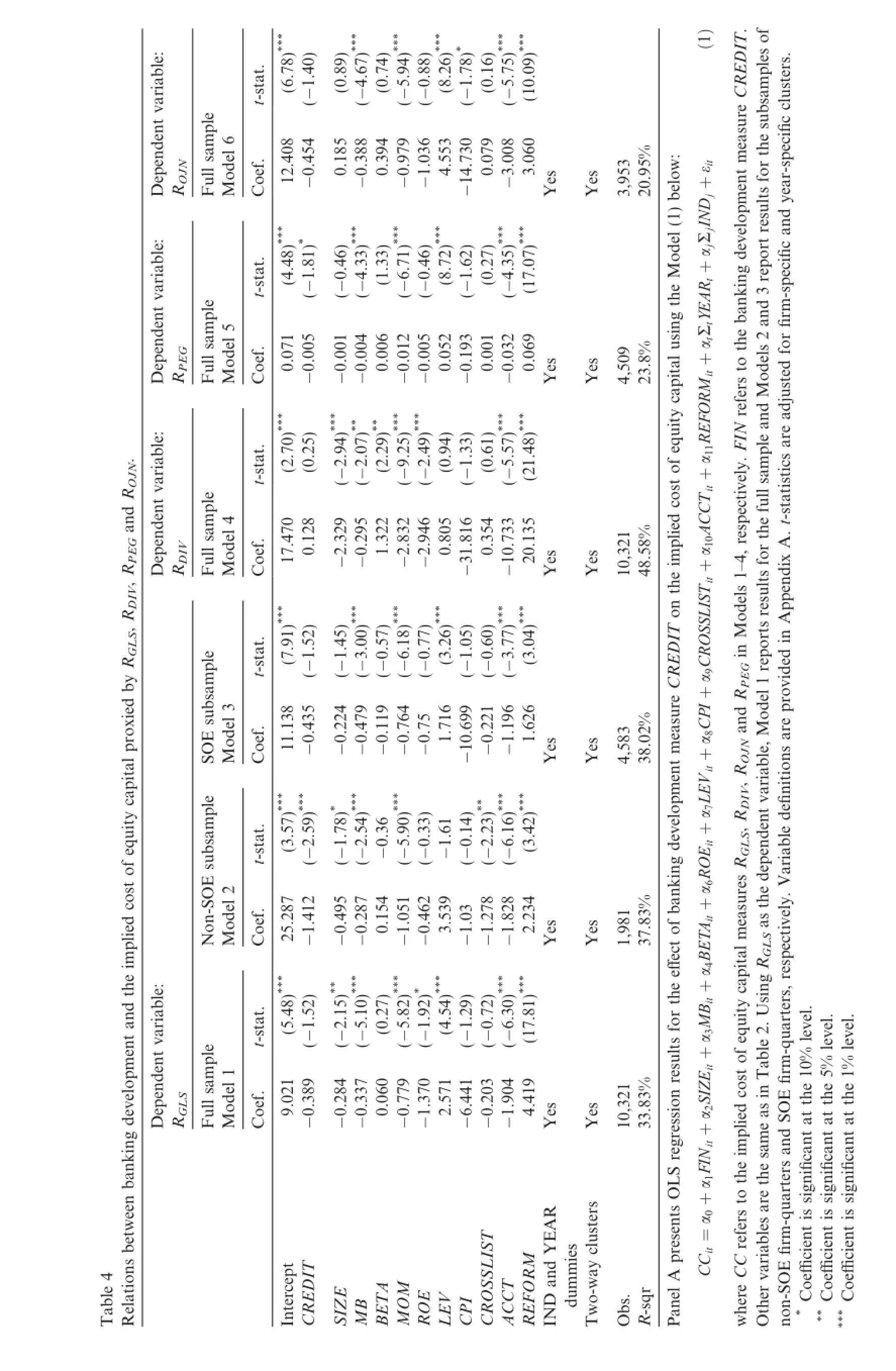

Table 3 presents results for the efects of stock market development on alternative estimates of the implied cost of equity,RDIV,RPEGandROJN,withRDIVused in Models 1–3,RPEGin Models 4–6 andROJNin Models 7–9.As shown in Table 3,all stock market development measures,MKTCAP,MKTLIQandFINAVG,are signifcantly negatively associated withRDIV,RPEGandROJN,rendering further support to the fndings in Table 2 and indicating our results are robust to alternative implied cost of equity measures.Results for control variables in Tables 2 and 3 are consistent with those reported in prior research:frm size,market-to-book ratio,return momentum,return on equity and the indicator for new accounting rules are all negatively related to,while market beta and leverage ratio are positively associated with,all the cost of equity estimatesRGLS,RDIV,RPEGandROJN.The coefcient of the indicator for the split-share structure reform is signifcantly positive,suggesting that the price impact dominates.

In summary,the results in Tables 2 and 3 show that stock market development lowers the cost of equity after controlling for all other known determinants of the cost of equity.These results suggest that investors generally charge a lower risk premium to frms located in regions with more developed stock markets.We explain that the positive side of stock market development in China such as providing liquidity,reducing information asymmetry and enhancing external monitoring dominates its negative side,and on net,leads to a lower cost of equity.

5.3.The relation between banking development and the cost of equity capital

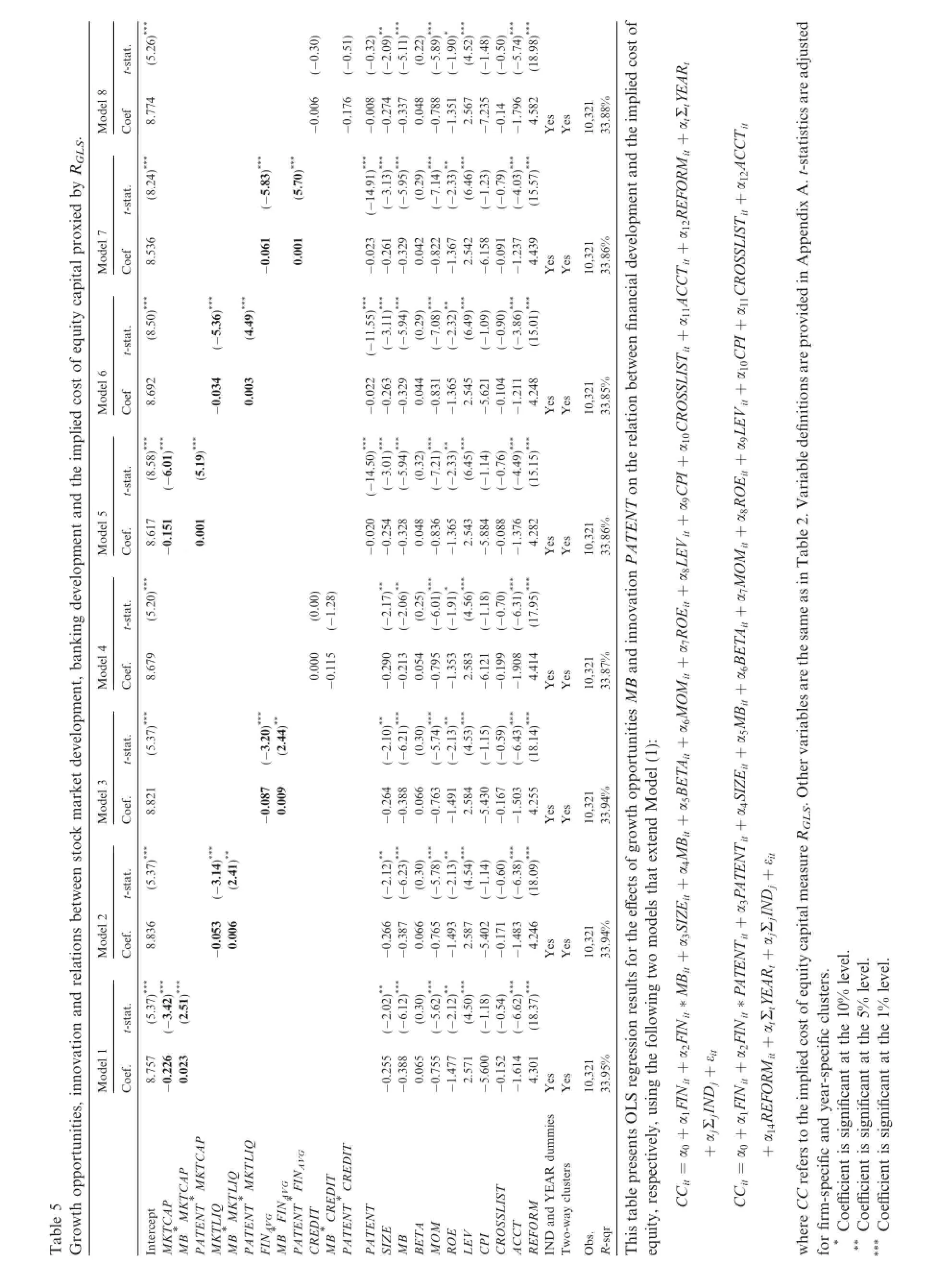

In this subsection,we examine the relation between banking development and the cost of equity for the full sample and the subsamples of non-SOEs and SOEs,respectively.Table 4 reports the estimation results.For the full sample,the banking development measureCREDITis insignifcantly associated with the cost of equity measuresRGLS,RDIVandROJN.Only whenRPEGis used as the dependent variable is the coefcient onCREDITsignifcantly negative at the 10%level.The relatively weak efect of banking development on mitigating the cost of equity is consistent with our argument that the pervasive state ownership of the big four banks and the lack of banking competition in China constrain a bank’s legitimate functions of liquidity provision,risk-sharing,monitoring and information production.Therefore,regional banking development in China plays a limited role in alleviating systematic uncertainty in the economy and is only weakly negatively associated with the cost of equity.We also split the full sample into non-SOE and SOE subsamples.In Model 2,banking developmentCREDITis signifcantly negatively associated with the cost of equityRGLSfor the non-SOE subsample.In contrast,in Model 3,it is weakly negatively associated withRGLSfor the SOE subsample.The results support the argument that banking development generates more incremental benefts to non-SOEs,and thus,investors charge a lower cost of capital.However,for SOEs,the negative side of banking development dominates its cost-reducing efect,and the efect is further enhanced by the negative side of government ownership and interference in SOEs,thus resulting in an insignifcant relation between banking development and the cost of equity in these frms.

* ****** stat..69)**.30).69).10)**.38).59)**t-(63.96)**(-(14.70)**(-(05.57)**(-(-1.06)(81.41)(-(04.28)**(-(8del 9Moef..751.115.386.873.223.300Co11-00.265 -0-14.544**-00.361 -11.8890.181 -22.923 Yes Yest-stat. (6.70)*** 3.82)***(-(1.27)4.71)*(-(0.69)5.58)***(-(-1.06) 1.39)(-(8.08)*** (0.36)4.12)***(-(8.43)*** del 8 0.260 -0.071ef.Co0.360-0.38711.786-0.870-1.2254.546 1.737-1Mo0.173 -2.2532.903 le:ROJNYes Yes * * * (0.71))**)**(6.66)*** (1.37))**(0.42))*** * t variabt-stat. (8.21)**4.53* 4.66(-5.57(-) (-(-1.031.51)(-4.94(-enDependdel 77 (9.19)**Moef. Co11.634-0.2910.27-0.3835 0.36-0.890-1.202195 4.54-12.650.20-2.5321 3.01Yes Yes 3.37)**(-(-(-1)**6.35)**9)** . stat. dROJt-* *(4.23.39)**(1.2(8.7* 0.13) * 1.39)6)N(-(-(-* (-del 6 (0.4(15.10)**0.59)2)**ef. an0.065010004-0.0MoCo0.0061107-0.0-0.1-0.0-0.0-0.0-0.00.052680.00225G0.068 Yes Yes ,RPE4.35)***** 3.27)*** .2.2(4t-stat.3)**0.15) (81.38)4)(18)(-(-6.36)**RDIV(-(04.36)**(-(-* 3.29)*** .7(-(14.92)**.4* del 5 (-capital proxied by0004Co0.065GMoef.01.0.0.0-0.0.0-0.1-0.0-00.0061107-00.00225le:RPE-00.067 -00.05267Yes Yes * * * *3.83)**.80)**t variab0.60)0)***t-stat. )**(16.37)**3.89)**.31)(-(0.13)*** (4(-(-4.32)**(-(-.52)(-(15.83(-(81.44) Depend0.58) endel 4 uityMo* 0.05) ef.3 0.060.050.000.06ofeqCo-0.003-0.000-0.011-0.0062 -0.1742 -0.0278 Yes Yes st****)**(2.73)**)**)**(0.83))***t-stat. plied co2.799.15)**-0.0046 * * 5.262.832.03)**2.56(2.22)**0.00(0.88)) (-(-(-(-(-1.27)**(-(-(21.04e imdel 3 d thMoef. Co17.360-0.088-2.252-2.754-3.0260282 0.76-30.450.48-10.22Yes Yes 2)**1.30* 20.082t an*3)**2.71)*** 2.84)**9.18)*** * 5.22)*** en1.27)1)(2.7(-t-stat. (2.22.04)**-0.2879 2.56)*** 8)pm(-(-(-(-(0.8(-(0.8(-(20.99)**develodel 2 ef.86.3535687.0.2.2**-20.479 .0-020Co-0**-217-30.762 et-30.378 Mo-10.19769.7.0Yes Yes een stock markle:RDIVriab)***t-stat.)*** (2.71)*** (-t va3.052.82)**(-(-2.02)*(2.21)**1.30954269.05)*(-(-2.55)*** (0.88)(-1.29)(0.87)5.43)***(-(21.25enDependdel 1Moef.Co17.259-0.237-2.238-0.28501.31-2.763-3.02160.750.8886 -3s betw0.510.372-120.143Yes Yes RelationTTable 3ISYEmmtAPIQSLRMd tercepFINAVies InMKTCTLGMKSIZEMBTAMEVIOSBEMOROLECPCRCTACFORED anARduo-way clustersINTw38%3,95.2del(1): 21g Moinllowe fo3,953 21.27%g thusinlesampll3,953.26%e fu21r thcapital fo4,509 23.82%uityeqofstplied co4,509 23.8%e imtht onenpm4,509 23.8%develoetstock mark10,32148.66%ect ofe efr thlts fo10,3214%48.6resuS regressionOL10,32148.65%tstable presenObs.rR-sqisTh(1)trolr onies foinedαjΣjINDj+εit.CdFINAVGmmand duare providnsI,Rt+CPitio+αtΣtYEALIQanKTratedefn,MfationleRMitAPVariabTCinV,D.FO+α11REMKratioLEINefectsCTitt measuresdustry+α10ACenpmE,leverageRO,andinISTitdeveloOSSLetuityARe stock markeqYEonectsα9CRrn+α8CPI+retuth,year eftoM,tuRErefersmMORMFOVit+α7LE.FINenomrmNEit,m+α6ROdROJanTABEarket betastructure refo+α5MOMit,RPEGRDIV,split-shareclusters. TAitCT+α4BEcapital measures,md year-specifcACk ratioMBdard+α3MBituity-bstanooaneqtingunfoarket-tor frm-+α2SIZEitofst,mstedjuplied coSIZEnew accoα1FINitlevel.level.e imare adISe 5%e 1%thtoSLOS=α0+e 10%level.t-statisticse frm sizeT,thththreferscludgCRA.ceatceCCitereCCles inixcance atat**Signcross-listinpend***SwhifvariabAp*Signifcanignifcan

le:t variabt-stat. (6.78)*** 1.40)(-(0.89)4.67)***(-(0.74)5.94)***(-(-0.88)(8.26)*** 1.78)*(-(0.16)5.75)***(-(10.09)*** enleDependsampROJNlldel 6 FuMoef. Co12.408-0.4540.185 -0.3880.394 -0.979-1.0364.553 -14.7300.079 -3.0083.060 Yes Yes le:***** 4.35)**(4.48)**0.46) t variabt-stat. 1.81)*(-(-(-4.33)**6.71)**(-(-(1.33)0.46)(8.72)*** 1.62)(-(0.27)(-(17.07)**enleDependsampRPEGlldel 5 FuMoef. Co0.071 -0.005-0.001-0.012-0.005-0.193(2.29)**0.006 0.001 0.052 -0.0320.069 Yes Yes .le: dROJNt variabt-stat. (2.70)*** (0.25)2.94)***(-(-2.07)**-0.0049.25)***(-(-2.49)*** (0.94)1.33)(-(0.61)5.57)***(-(21.48)*** enleansamp,RPEGDependRDIVFulldel 4 Moef. Co17.4700.128 -2.329-0.2951.322 -2.832-2.9460.805 -31.8160.354 -10.73320.135Yes YesS,RDIV* **** (-(-(-RGLplet-stat. (7.91)**1.52)(-(-(-(-(-(-0.57) 1.45)3.00)**6.18)**0.77)(3.26)**1.05)0.60)3.77)*** (3.04)**capital proxied bybsamE sudel 3 SOMoef. Co11.138-0.435-0.224-0.479-0.119-0.764-0.751.716 -10.699 -1.196Yes 1.626 Yes uityple eqbsamt-stat. (3.57)*** 2.59)***(-(-(--0.36 1.78)* 2.54)*** 5.90)***(-(--1.61 0.33) 0.14)(-(-(-2.23)**-0.2216.16)*** of(3.42)*** stplied coE sun-SONodel 2Moef.Co25.287-1.412-1.0510.154-0.287-0.4623.539 -1.03 -1.828-1.2782.234 Yes Yes d the imle:**** (5.48)**(-(-(-1.52) 5.82)*** (0.27)t ant-stat. (-(-5.10)**2.15)**-0.4951.92)* (4.54)*** t variab1.29)0.72)6.30)**en(17.81)**(-(-(-pmg develoenleDependsampRGLSFulldel 1 Moef. Co9.021 -0.389-0.284-0.3370.060 -0.779-1.3702.571 -6.441-0.203-1.9044.419 Yes Yes ineen bankTARs betwRelationttercepITISies Table 4MBTAMEVIOSEDSLRMd YEmmInCRSIZEBEMOROLECPCRCTACFOREDano-way clustersINduTw(1).ITofEDplest measureCRe subsamclusters. 3,953 20.95%w:beloεitenrthdel(1)pmresults fod year-specifce MoαjΣjINDj+g develortc anecifg thARt+ine bankd 3 repo4,509 23.8% capital usin+αtΣtYEthtodelsfo2 anr frm-spuityRMitFOrefersd MostedjueqINan+α11REectively.Fleare adofstCTitllsamp10,32148.58%plied corespe fut-statisticse im+α10ACr thA.th1–4,lts foixonISTitdelsITApEDOSSLMoinrts resupend1 repoα9CRined+α8CPI+4,583 t measureCRdRPEGel38.02%anodle,MJNare providenVitROnspmitiog develoLEt variabendefnEit+α7LS,RDIV,leinRGe dependVariab1,981 37.83%bankthect of+α6ROTAitas+α4BEcapital measuresgRGLSe efr thlts fo+α3MBitUsinequityarters,respectively.level.level.10,32133.83%resustofplied coin+α2SIZEitTable 2.S regressione 10%level. thththe 1%e 5%atatatasanE frm-que imartersifififα1FINitcantcantcantOLthe samed SOtstosignrefersles are thE frm-quis=α0+signsigns.rCCitefereCCPanel A presenR-sq*COther variabn-SOOboefcientt isiscien**Conowh*Coefcient**

5.4.Firm growth,innovation and their impact on the relation between fnancial development and the cost of equity

We next examine whether and how frm growth and innovation afect the relation between stock market development,banking development and the cost of equity.As mentioned earlier,the listing process in China favors state-owned(mature)frms and discriminates against fast-growing and innovation-intensive frms,especially when they are non-SOEs.This systematic bias may weaken the negative relation between stock market development and the cost of equity.We measure a frm’s growth potential as the market to book ratioMB,following Hail and Leuz(2009).We gauge a frm’s innovation intensity by the ratio of the number of patent applications to the number of researchers in a province reported in Fan et al.(2011)and denote it byPATENT.We then add the interactions ofMBandPATENTwith the three stock market development measures ofMKTCAP,MKTLIQandFINAVG,respectively,to Model(1)to examine their moderating efects on the relation between stock market development and the cost of equity.

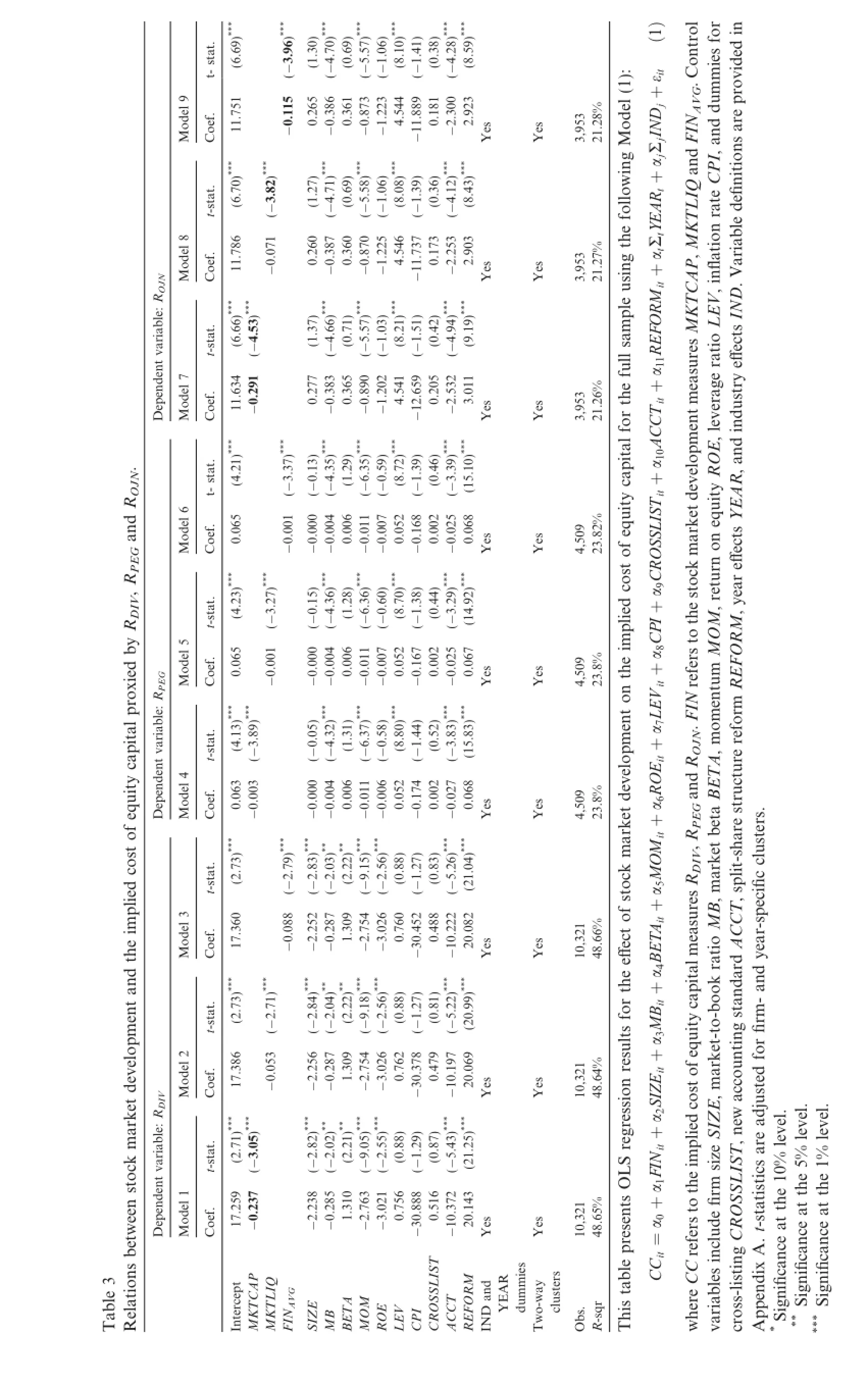

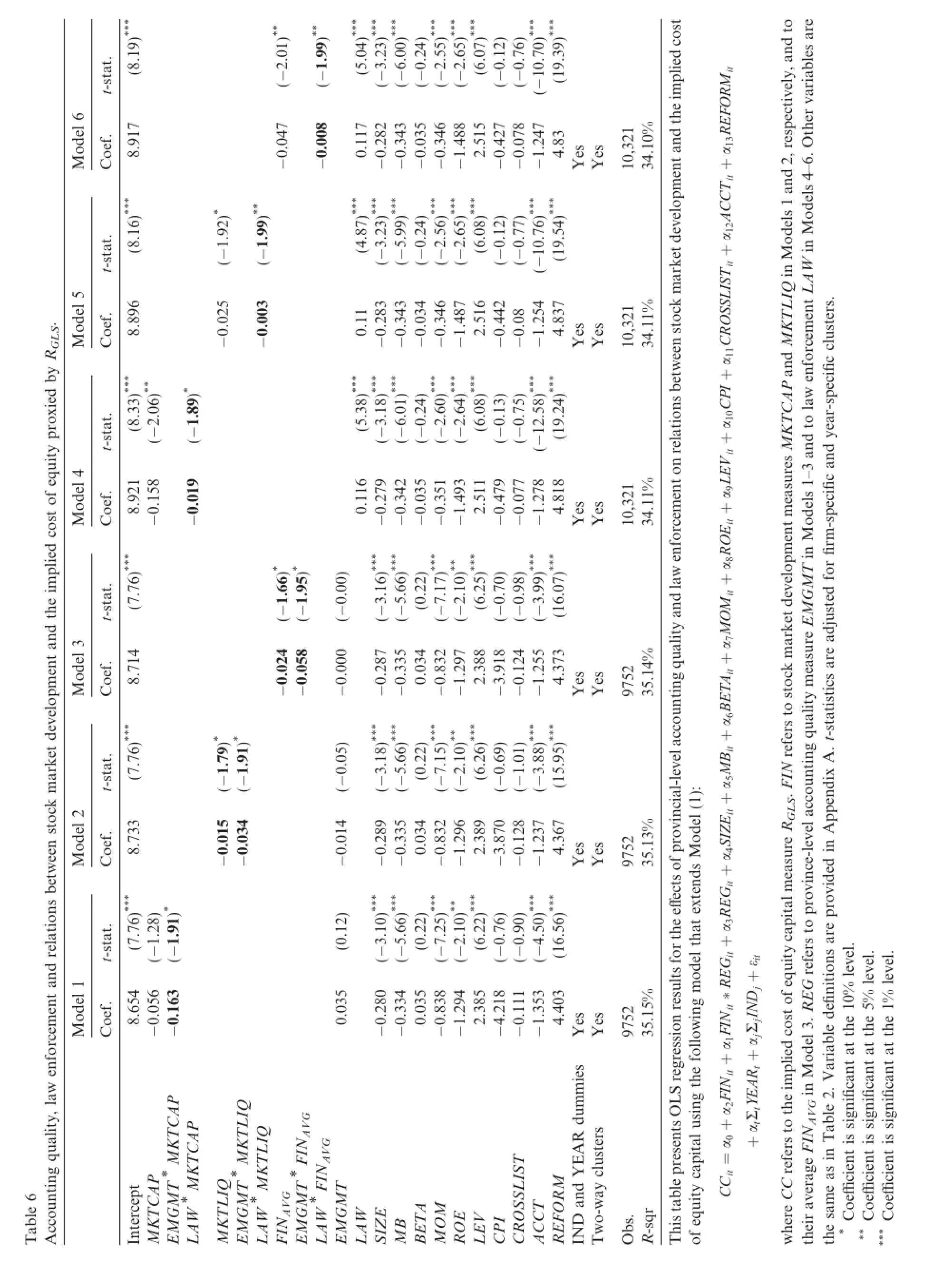

Table 5 reports the estimation results.Panel A reports the interactions of growth potentialMBwith all stock market development and banking development measures.The coefcients on the interaction terms are all signifcantly positive in Models 1–3,supporting the prediction that the mitigating efect of stock market development on equity cost diminishes in frms with high growth opportunities.Similarly,the interactions of innovation intensityPATENTwith all stock market development measures are also signifcantly positively associated with the cost of equityRGLSacross Models 5–7 in Panel B.Untabulated results reveal that the same efects still hold for the non-SOE subsample,suggesting that our results are unlikely to be driven by listing discrimination against non-SOEs.The results in Table 5,taken together,show that the negative association between stock market development and the cost of equity is weaker for frms with high growth opportunities and intensive innovation,which is consistent with our expectations.

However,the above fnding is in contrast to evidence in Brown et al.(2013)and Hsu et al.(2014)where stock market fnancing generally leads to substantially higher long-run R&D investment.This inconsistency points to a weakness of the Chinese stock market of failing to provide sufcient equity fnancing to frms with high growth potential and innovation intensity.A direct policy implication is that the role of stock market development in improving capital allocation efciency and reducing the cost of equity can be enhanced should there be stock market regulations that mitigate equity fnancing biases against fast-growing and innovationintensive frms.In all models,the coefcients onMKTCAP,MKTLIQandFINAVGper se and their sum with the corresponding interactions are still negative,indicating that the baseline result that stock market development decreases the cost of equity holds even after accounting for the moderating efects of growth potential and innovation intensity.

Models 4 and 8 of Table 5 indicate that the coefcients for the interactions of growth potentialMBand innovation intensityPATENTwith banking developmentCREDITare statistically insignifcant,consistent with the view that frm growth potential and innovation intensity do not alter the efect of banking development on the cost of equity.This fnding is consistent with the evidence in Brown et al.(2013)and Hsu et al. (2014)that credit market development generally does not enhance innovation and growth potential.In both models,the coefcients onCREDITper se and its sum with the corresponding interactions are still insignificant,indicating that the baseline result that banking development is insignifcantly associated with the cost of equity holds even after incorporating the efects of growth potential and innovation intensity into our analysis.

6.Further analysis:the efects of institutional factors

6.1.Accounting quality,legal enforcement and the relation between stock market development and the cost of equity

*(5.26)**))))**** )***** 0.30)))**)**2.09(-0.51(-(-(-(-5.11(0.22))**0.325.89(-(-)*1.90(4.52)**1.48(-(-(-5.74(18.980.50del 8Moeft-stat. 8.774 0.048 2.567 4.582S.Co-0.176-0.008-0.274-0.337-0.788-7.235-0.14-1.796Yes YesRGL********* 4.03)**(8.24)**5.83)**.70)**0)-0.006.91)**(-(-(-capital proxied byeft-stat. (-(5143.13)**5.95)**7.14)**(0.29)(-(-2.33)**-1.351(6.46)*** 1.23)(-(-(-0.79) (15.57)**del 7MoCo8.536 0.001 -0.023-0.261-0.3290.042 -0.822)**-1.3673.20)***-0.0612.542 -6.158-0.091-1.2374.439 Yes Yes )*** 11.55)**(4.49)**)*** (8.50)**** * (0.29))*** * * * * uity)))**5.94(-(-(-(-(-(-(-5.36)**7.08eq3.11(-(-2.321.09(15.01(6.49)**0.90)**stof34del 6 plied coeft-stat. 3.86226329MoCo8.692 3.14)***-0.00.003 -0.0.2.3-0-00.0443165.8.3-02.33)**-12.545210411.6.1.2-5-0-14.248 Yes Yes e im**d th(8.58)*** 6.01)*(-(5.19)*** 14.50)***(-(-(-t-stat.3.01)*** 5.94)*** (0.32)7.21)***(-(-(6.45)*** 1.14)(-(-(-(10.76)4.49)*** 5.15)*** t anendel 5 ef.71 pmMoCo8.61-0.1510.00-0.0200.04-0.8362.17)**-0.2542.54-5.884-1.3653 -0.088-1.37624.28Yes Yes g develo*0)*** * *6.31)**t-stat. 6.01)**1.28)6)**(5.2(-(-* (-5)(0.02.06)**-0.3288 (0.2(4.51.91)* 1.18)(-(-(-inbank(-(-0.70) (17.95)**t,del 4 ef..1152.10)**-0MoCo8.679 0.000 -0.290.213.795-0-00.054 .121-0.353-6en-14.414 .199.908Yes Yes pm*****develot-stat. (5.37)**(-(2.44)**(-(-6.21)**(0.30)5.74)**(-(-2.13)**-12.583 (4.53)**6.43)*** 1.15)(-(-(-0.59) (18.14)**eteen stock markdel 3 876488Moef. Co8.821 -00.009 .02.12)**-0.2.3-00.0666391.7.4-0-5.4.1.5Yes -0Yes -14.255 (5.37)*** (-(2.41)**t-stat. (0.30)5.78)*** 6.23)*** (-(-(4.54)*** (-(-(-(1(-(-2.13)**-12.5843067030.60) d relation1.14) 6.38)*** del 2 s betw538.09)*** 6687Moef. Co8.836 -0.00.006 -0.3)**-0.20.0666593-0.7)**-1.42.587027183-5.4-0.1-1.44.246 Yes Yes an)*** )*** )))*** 6.62t-stat. (5.37)*** 3.42vation(-(2.51)*** 2.026.12(0.30))*** (-(-5.62(-(-2.12(4.50)*** (-(-(-(11.180.54)***8.37nodel 1 inef. 8.757 0.023 0.065 2.571 4.301 ities,MoCo-0.226-0.255-0.388-0.755-1.477-5.600-0.152-1.614Yes Yes rtuniesIQAPmmpoGTLAPTCITduopEDIQTLTRMd YE*FINAVITMBTETL*MKITISNTIQtAPtercepTC*MKGrowMBTEMBTEMBTENT*MKARVGTable 5thNTSLTC*MKNTMKED*CRInMKPAED*CRVG*FINANTPAFINAPACRPATEPASIZEMBTAMEVIOSBEMOROLECPCRCTACFORED anINTwo-way clustersofst218%plied co,3.81033e imd tht anenpm10,32133.86%develocialaneen fn10,32133.85%betwe relationthon216%NT10,333.8TEPAvationno10,32133.87%d inanitiesMBrtunpo10,32133.94%opdel(1): growthMoofectsatextendth10,32133.94%e efr thlts foo modelsresug twS regressionllowin215%e fo,3.91033OLusing thtstable presenObs.rR-sqisThuity,respectively,eqstedRtju+αtΣtYEAare adRMitCTitFO+α12RE+α12ACA.t-statisticsISTitixpendCTitOSSLApα11ACα11CRinedISTit+OSSL+α10CPI+are providnsα10CRVititiodefnα9CPI++α9LEEitleVit++α8ROα8LEitM Table 2.VariabEit+inasα7RO+α7MOTAite sameMit++α6MO+α6BEles are thTAit+α5MBitvariab+α5BEerthS.O+α4MBit+α4SIZEitNTitTEεit+α3SIZEit+α3PATitαjΣjINDj+capital measureRGLMBitRt+uitylevel.level.α2FINit**PATEN+αtΣtYEAeqofstclusters. e 10%level.ththth+α2FINitplied cod year-specifce 5%e 1%α1FINit+εitatatat+αjΣjINDj+α1FINitRMitFO+α14REe imcantifififcantcantthtoissignsignCCit=α0+CCit=α0+refersc ansignecifereCC*Cr frm-spoefcientt isiscien**Coef*Coefcientwhfo**

We now examine whether and how accounting quality and legal enforcement afect the negative relation between stock market development and the cost of equity,and whether the cost of equity efect of stock market development still holds after considering these moderating efects.Existing evidence suggests that stock market development either complements or substitutes for accounting quality and legal enforcement in its relation with the cost of equity.Ball(2001)reports that high-quality accounting standard implementation at the frm level complements high-quality accounting standards and strong legal enforcement at the nationallevel in reducing the cost of equity.In contrast,Hail and Leuz(2009)show that enhanced investor protection via U.S.cross-listing substitutes for strong legal protection in the home country in lowering the cost of capital. Prior research documents that accounting standards promote stock market development at the country level (Rajan and Zingales,1998;Brown et al.,2013)and legal factors stimulate fnancial development(La Porta et al.,1997,1998;Beck et al.,2003).In short,prior research suggests that stock market development could either substitute or complement accounting quality and legal enforcement in afecting the cost of equity. Under the substitution(complementary)scenario,the mitigating efect of stock market development on the cost of equity becomes weaker(stronger)for frms in regions with higher accounting quality and/or stronger law enforcement.

To test the two predictive scenarios,we add the interactions of stock market development with provincelevel accounting quality and law enforcement to Model(1).Extending Leuz et al.(2003),we measure accounting quality using province-level earnings management denoted byEMGMT,with a lower value indicating better province-level accounting quality.20Specifcally,we calculateEMGMTby the following procedures.We frst compute performance-matched discretionary accruals for all frm-years for each province-year and then,obtain the median performance-matched discretionary accrual for each province-year.Finally, we calculateEMGMTas the percentile ranking value of these provincial median values for each province in a year.This measure captures the combined consequence of insiders’earnings management activities and accounting rules and thus,addresses the concern that accounting rules can be circumvented by insiders and do not refect actual reporting practices.Following the convention of Chinese studies,we measure legal enforcement by the total number of lawyers relative to the population in a province,the legal enforcement index that captures the protection of shareholders’rights in Fan et al.(2011).The index is multiplied by negative one(-1)and denoted byLAW,such that the higher the value ofLAW,the worse the legal enforcement in a provincial region.

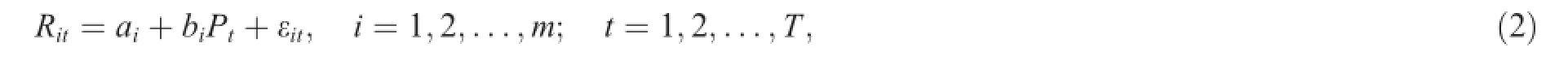

Table 6 reports the results for the moderating efect of accounting qualityEMGMTin Models 1–3 and law enforcementLAWin Models 4–6.Models 1–3 reveal that the interactions ofEMGMTwith each of the three stock market development measuresMKTCAP,MKTLIQandFINAVGare negatively associated with the implied cost of equity and the associations are signifcant at the 10%level.The results suggest that the mitigating efect of stock market development on the cost of equity is stronger for frms withlowprovince-level accounting quality,which is in line with the prediction under the substitution scenario.Models 4–6 show that the interactions between law enforcementLAWand each of three stock market development measures are all negatively associated with the equity cost measureRGLSand the association is signifcant at the 10%level.This again supports the substitution scenario.Therefore,we conclude that fnancial development substitutes for both accounting quality and law enforcement in lowering the cost of equity.21We also follow Leuz et al.(2003)and use the ratio of“small profts”to“small losses”in each province in a year,denotedSPROFIT,as an alternative measure for accounting quality.We fnd that the results using this alternative measure remain qualitatively unchanged.In addition,Fan et al.(2011)also use the total number of accountants in a population at the provincial level as a sub-index of legal enforcement for the protection of shareholders’rights.When using its negative value as an alternative measure for legal enforcement,the results are qualitatively the same as those reported forLAW.The coefcients onLAWper se are all signifcantly positive,consistent with prior evidence that strong legal enforcement is inversely associated with the cost of equity(Hail and Leuz,2006;Albuquerque and Wang,2008;Chen et al.,2009, 2011).22Albuquerque and Wang(2008)argue analytically that weak investor protection induces overinvestment for which investors require a higher equity premium.In a cross-country setting,Hail and Leuz(2006)and Chen et al.(2011b)document that strong country-level law enforcement and shareholders’rights decrease the cost of equity.Across Table 6,the coefcients on stock market development measures per se are signifcantly negative in most models,suggesting that the baseline results in Tables 2 and 3 are still preserved after considering the moderating efects of accounting quality and legal enforcement.

6.2.Market integration,split-share structure reform and the relation between stock market development and the cost of equity

t-stat.(8.19)*** 2.01)**(-1.99)**(-(5.04)*** 3.23)***(-(-(-(-(-6.00)*** 0.24)2.55)*** 2.65)*** (6.07)*** 0.12)(-(-0.76)10.70)***(-(19.39)*** del 6Moef.Co8.917 -0.047-0.0080.117 -0.282-0.343-0.035-0.346-1.4882.515 -0.427-0.078-1.2474.83Yes Yes * *(8.16)***** * (-1.92)* 1.99)**(-(-(-(-(-(-*3.23)**5.99)*** 0.24)2.56)**2.65)**(4.87)**(6.08)**0.77)t-stat.0.12) (-(-10.76)*** (-(19.54)**.del 5 MoSef.RGLCo8.896 -0.025-0.0030.11-0.283-0.343-0.034-0.346-1.4872.516 -0.442-0.08-1.2544.837 Yes Yes proxied by(8.33)*** 2.06)**1.89)* (5.38)*** 3.18)***(-(-(-(-(-t-stat. (-(-6.01)*** 0.24)2.60)*** 2.64)*** (6.08)*** 0.13)(-(-0.75)12.58)*** uity(-(19.24)*** eqofstdel 4 ef. 8.921 0.116 2.511 4.818 plied coMoCo-0.158-0.019-0.279-0.342(0.22)-0.035-0.351-0.479-0.077-1.278Yes Yes * * * * * e im(-(-t-stat. 1.95)* (-(-1.66)* (7.76)*** * d th(-0.00) 3.16)**7.17)**5.66)**(-(-2.10)**-1.493(6.25)**0.70)(-(-(-(16.07)**0.98)3.99)**ent andel 3 pmef. 8.714 0.034 2.388 4.373 develoMoCo-0.024-0.058-0.000-0.287-0.335-0.832-3.918-0.124-1.255Yes Yes * *(7.76)*** * * * een stock markett-stat. (-(-1.91)* 0.05) 1.79)* (-(0.22)3.18)**(-(-5.66)*** 7.15)**(-(-2.10)**-1.297(6.26)**0.69)(-(-(-(15.95)**del 2 1.01)3.88)**Moef. Co8.733 0.034 2.389 4.367 s betw-0.015-0.034-0.289-0.335-0.832-3.870(0.12)-0.014-0.128-1.237Yes Yes * * * * (-(-(-t-stat. (7.76)**1.28) * 1.91)* * (-(-d relation(-(-(0.22)3.10)**7.25)**2.10)**-1.2965.66)**(-(-(6.22)**0.76) *4.50)**0.90) (16.56)**ent anrcemdel 1Moef.Co8.654 -0.056-0.1630.035 -0.280-0.3340.035 -0.838-1.2942.385 -4.218-0.111-1.3534.403 Yes Yes folaw enies ality,APIQmmAPduTLIQquGM*FINARMd YETCTLVG*MKTISTCTable 6unARtingtAPTTCTMOEVIOSGMtercep*MKAccoIQTVGTLW*MKGMEMWGMEMLAT*FINAMKInMKW*MKLAMBTAM VGSLFINAEMLAEMWLASIZEBEROLECPCRCTACFOREDanINTwo-way clustersstplied coe im10,32134.10%d tht anenpmdeveloet10,32134.11%een stock marks betwrelation10,32134.11%t onenrcemfod law enality an975235.14%qutinguncial-levelacco975235.13%provinofs Model(1): ectse efextendr thatlts fodel th975235.15%resuS regressioning mollowe foOLg thtstable presencapital usiniseqs.rR-squityObThoftoRMitles are FO+α13REectively,andOther variabCTitd 2,resp4–6.+α12AC1 andelsdelsinWinMoMoISTitOSSLIQTLtLAenα11CRdMKrcemclusters. +α10CPI+anfoAPTCMKd tolaw enVitd year-specifc+α9LE1–3 anecifc anEitt measuresenModels+α8ROpmr frm-spality measureEMsteddeveloTinGMfoMit+α7MOetjuTAitare ad+α6BEstock markto+α5MBitrefersINtingqut-statisticsunixA.SIZEitS.Faccoce-levelpendApinGit+α4 ed+α3REcapital measureRGLtoprovinare providEGitεituityns*ReqGrefersitiolevel.level.+α1FINitαjΣjINDj+stofREdel 3.defnlee10%level.thththplied coe 5%e 1%α2FINitRt+MoVariabatatate im+αtΣtYEAincantcantcantthGififif=α0+toTable 2.signreferseir averageFINAVsignsigninisCCitereCCascien**Co*Cwh*Ce sameoefcientt isisefoefcientthth**

We now examine whether stock market integration and the split-share structure reform substitute or complement stock market development in improving risk-sharing,and thus,in decreasing the cost of equity. Previous research suggests that integration of stock markets across diferent economies attracts foreigninvestors and enhances risk-sharing among domestic and foreign investors,which in turn decreases the cost of equity.For example,De Jong and De Roon(2005)report that stock market integration across countries decreases the cost of equity in emerging markets by improving risk-sharing.The predominance of non-tradable shares in the stock market in China poses a major problem because excess holdings of a stock expose shareholders to high idiosyncratic risk.The split-share structure reform implemented in 2005 allows holders of non-tradable shares to publicly trade and reduce their shareholdings such that their equity portfolios can be more diversifed(Li et al.,2011).Therefore,the reform facilitates risk-sharing between owners of non-tradable and tradable shares and thus may reduce the cost of equity(Li et al.,2011).

Similar to the stock market integration and the split-share structure reform,stock market development improves inter-temporal risk-sharing by attracting potential investors and facilitating their risk-sharing with current investors.However,it is an empirical question whether and how this inter-temporal risk-sharing function of stock market development,the cross-sectional risk-sharing function of market integration and the split-share structure reform afect the efect of stock market development on lowering the cost of equity. Stated another way,the moderating efects of market integration and the split-share structure reform on the negative relation between stock market development and the cost of equity are empirical questions.23However,the split-share structure reform also produces a negative price impact by allowing more shares into the market in a short time (Xin and Xu,2007;Li et al.,2011).Xin and Xu(2007)show that frms located in regions with better institutional development tend to ofer lower compensation to owners of tradable shares in executing the reform,suggesting that the negative price efect and fnancial development also substitute for each other in afecting the cost of equity.Therefore,analysis from the perspective of the negative price impact of the reform also leads to the same conjecture.

To test the efect of stock market integration,we frst construct a measure for stock market integration in a province and in other provinces by extending procedures suggested by Korajczyk and Viallet(1989)and Levine and Zervos(1998).We initially estimate the interceptaifrom the following CAPM model at the end of a calendar year for each frm.24There are two types of market integration measures,one is time-invariant and the other is time-variant.Korajczyk and Viallet(1989), Bekaert and Harvey(1995),Stulz(1999),Rajan and Zingales(1998)and de Jong and de Roon(2005)argue or implicitly hold that market integration increases gradually over time and all use time-varying market integration measures.

whereRitis the excess monthly return for frmiin monthtin excess of the monthly risk-free rate in the same month.Ptis the excess return on a value-weighted portfolio of A-shares in the two stock exchanges,SHSE and SZSE.Assuming that the above CAPM model is reasonable and applicable for the China setting,the absolute value of the interceptaiestimated from Model(6)should capture market integration for each stocki.The stock market integration for each provincial market in each year is estimated as minus one(-1)times the average of the absolute value ofaiacross all A-share stocks in a province in each year such that a higher value indicates higher market integration.Our market integration measureMINTGis an indicator for low market integration that equals one for frms that fall within the lowest quarter of market integration in the sample and zero otherwise.

We add the indicator variable,MINTG,and its interaction with stock market development to Model(1)to test the efect of stock market integration.As shown in Panel A,Table 7,across all models,the interaction terms ofMINTGwith all three stock market development measuresMKTCAP,MKTLIQandFINAVGare signifcantly negative.The results support a substitutive relation between stock market development and market integration in lowering the cost of equity.In addition,stock market development measures per se remain signifcantly negatively associated with the cost of equity,confrming that their relations are robust to the incorporation of the market integration efect.

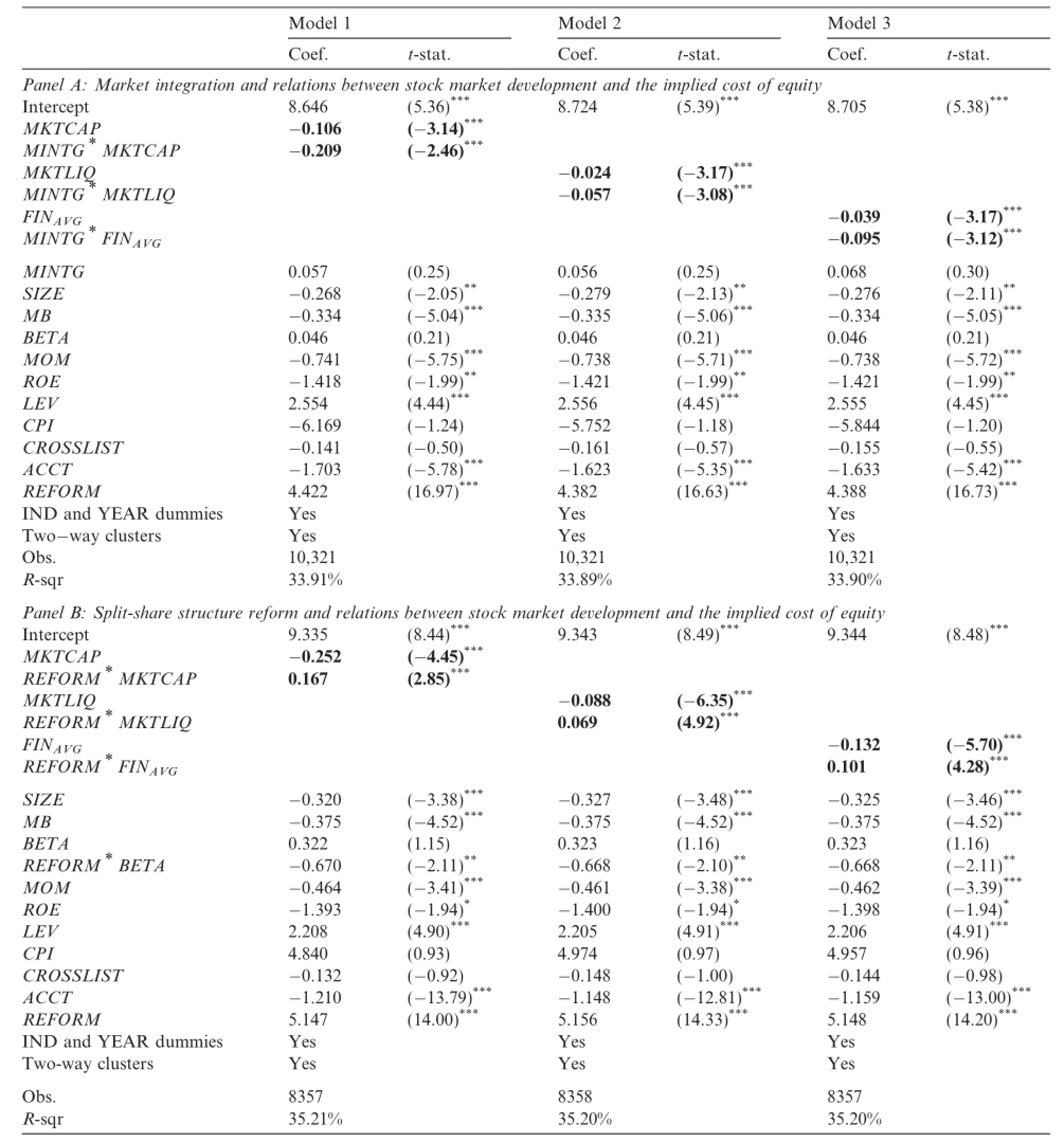

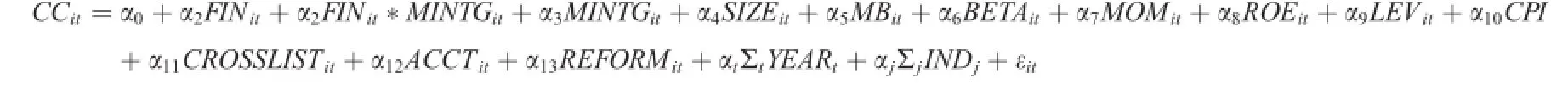

To test the efect of the split-share structure reform,we add to Model(1)the interaction between stock market development and the reform indicatorREFORMfor the post-reform period,as well as the interaction term betweenREFORMand the market betaBETA.We keep only the same frms in the pre-and post-reform periods to control for additional factors or biases not explicitly identifed in the empirical analysis.Panel B, Table 7 reports the estimated results and shows that across all models,the interactions ofREFORMwith stock market development measures are all signifcantly positive.This result suggests that stock marketPanel A of this table presents OLS regression results for the efect of stock market integration on relations between fnancial development and the implied cost of equity capital,using the following model that extends Model(1):

Table 7 Market integration,split-share structure reform and the relations between stock market development and the implied cost of equity proxied byRGLS.

whereCCrefers to the implied cost of equity capital measureRGLS.FINrefers to the stock market development measureMKTCAPin Model 1,the stock market development measureMKTLIQin Model 2,and their averageFINAVGin Model 3.MINTGis an indicator for low market integration between the provincial stock market and the national stock market.Other control variables are the same as described in Model(1).

Panel B of this table presents OLS regression results for the efects of the split-share structure reform on relations between fnancial development and the implied cost of equity capital using the following model that extends Model(1):

whereCCrefers to the implied cost of equity capital measureRGLS.FINrefers to the stock market development measuresMKTCAPin Model 1 andMKTLIQin Model 2 and to their averageFINAVGin Model 3.REFORMis an indicator for the period after the split-share reform in 2005 in China.Other variables are the same as described in Model(1).Variable defnitions are provided in Appendix A.t-statistics are adjusted for frm-specifc and year-specifc clusters.

*Coefcient is signifcant at the 10%level.

**Coefcient is signifcant at the 5%level.

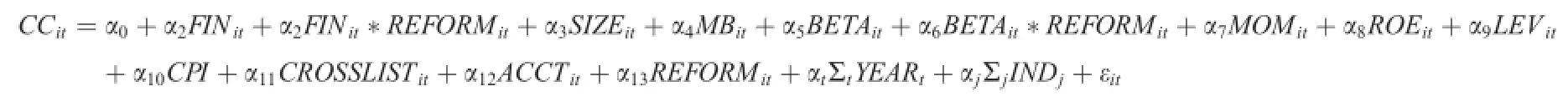

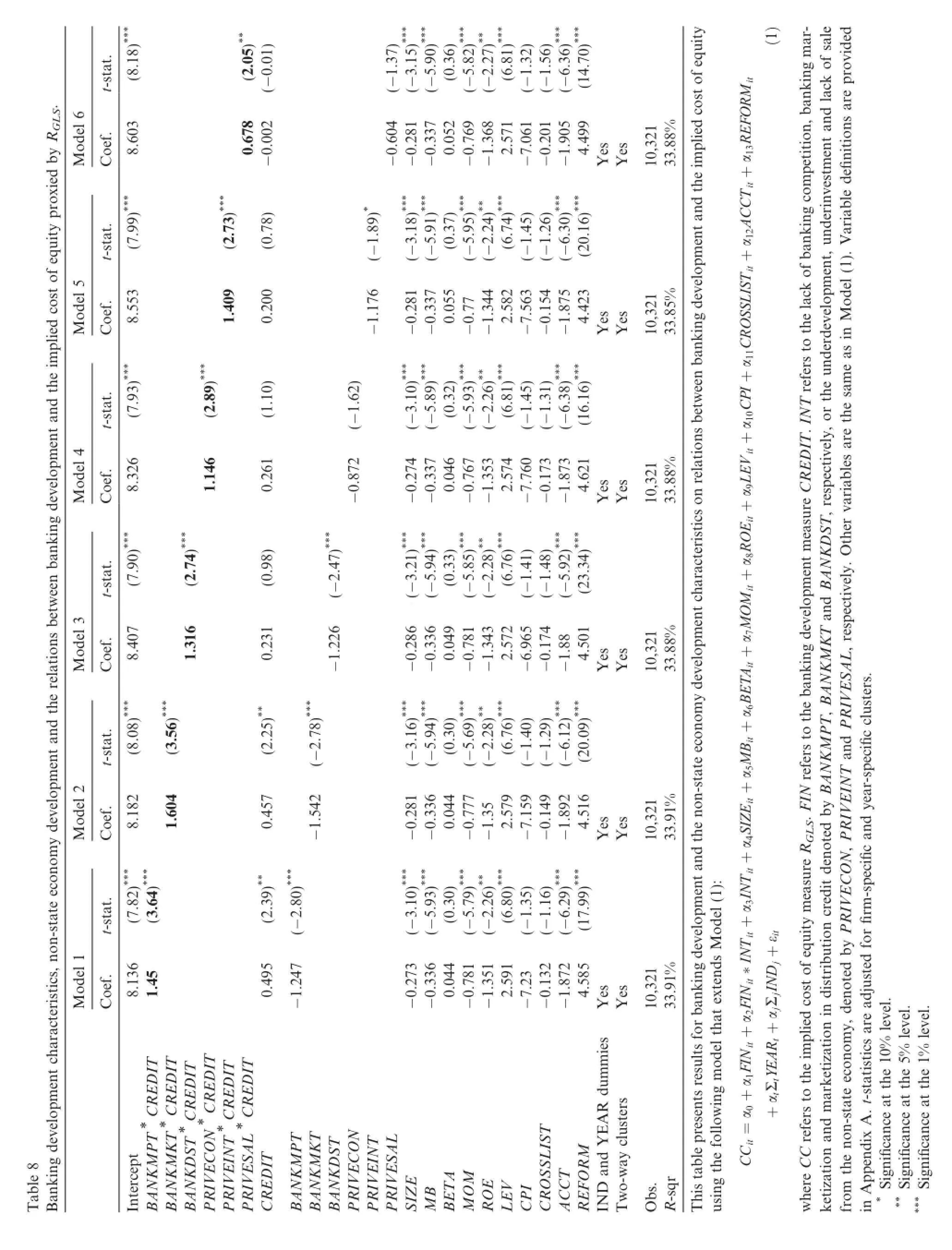

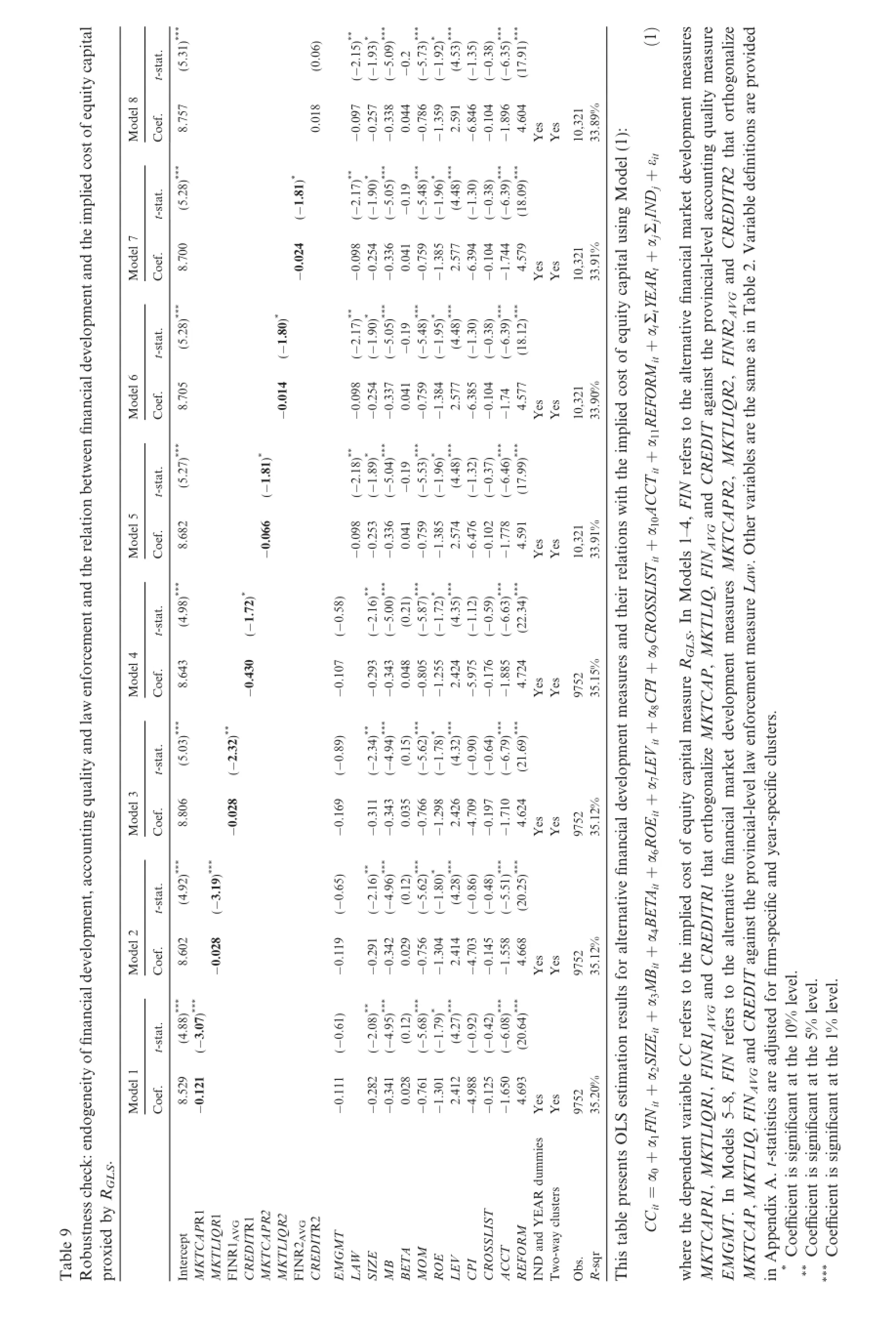

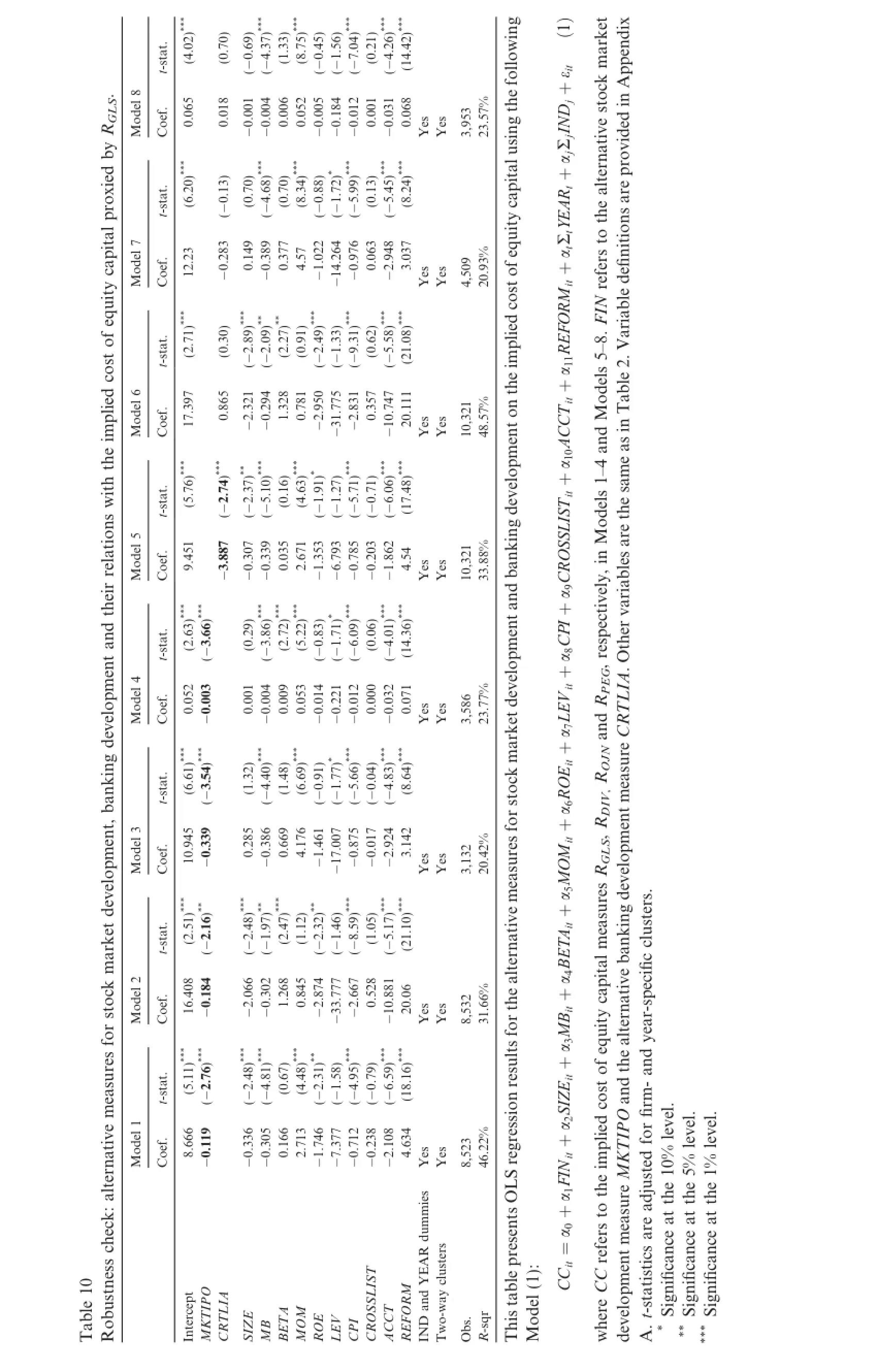

***Coefcient is signifcant at the 1%level.