Regulatory pressure and income smoothing by banks in response to anticipated changes to the Basel II Accord☆

Chu Yeong Lim,Kevin Ow Yong

aSingapore Institute of Technology,Singapore

bSchool of Accountancy,Singapore Management University,Singapore

Regulatory pressure and income smoothing by banks in response to anticipated changes to the Basel II Accord☆

Chu Yeong Lima,1,Kevin Ow Yongb,*

aSingapore Institute of Technology,Singapore

bSchool of Accountancy,Singapore Management University,Singapore

A R TiClE I NfO

Article history:

Received 3 March 2016

Accepted 25 August 2016

Available online 4 November 2016

JEL classi fications:

M41

M48

Basel Accord

Income smoothing

Loan loss provisions

Corporate banking

Retail banking

We examine the effects of the revised Basel II rules on bank managers’discretionary behavior,specifically income smoothing and loan loss provisioning.As the revised rules exert greater regulatory pressure on corporate than retail banking,we predict corporate bank managers to reduce risk-taking activities or increase income smoothing.Analysis of segmental reports reveals greater (less)income smoothing in the corporate banking segments of low-capital (high-capital)banks during the Basel II period,with their managers recognizing loan loss provisions in a less timely fashion.We find no such effects for retail banking.Although we document an initially negative market reaction to the regulatory announcements,that reaction weakens over time.Overall, the study highlights the unintended consequences of the banking rule changes. ?2016 Sun Yat-sen University.Production and hosting by Elsevier B.V.This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

1.Introduction

The Basel II Accord places greater emphasis on the risk sensitivity of bank assets than the 1988 Basel Accord(i.e.,Basel I).Basel II’s aim was to constrain banks’risk-taking activities by imposing higher capital requirements on banks with riskier assets(Basel,2006).As banks make a trade-offconcerning the returns and risks of various activities,they may engage in more or fewer risk-taking activities in response to the proposed changes in Basel II.In this study,we examine whether those changes are associated with a greater amount of discretionary behavior in bank financial reporting.Our findings suggest that the proposed changes to the banking rules in Basel II may have had unintended consequences.The decision to require banks to improve their capital adequacy placed some banks under increased regulatory pressure to engage in manipulative behavior in the form of income smoothing and less timely loan loss recognition.

Prior banking research shows that bank managers have incentives to engage in three types of discretionary behavior(e.g.,Beatty et al.,1995;Collins et al.,1995;Beaver and Engel,1996;Ahmed et al.,1999; Kanagaretnam et al.,2004;Perez et al.,2008).First,bank managers are prone to managing capital because proper capital management is crucial to determining the effectiveness of bank operations.More specifically, they decrease(increase)loan loss provisions when their banks’capital adequacy ratios are high(low).Second, bank managers have incentives to engage in income smoothing behavior,that is,to decrease(increase)loan loss provisions when current period income is low(high).Third,bank managers may also engage in discretionary behavior to signal future earning performance.Thus,they increase loan loss provisions when they anticipate that future income will be high.

Here,we examine how bank managers react to the proposed regulatory changes to Basel II.Our specific focus is on the effects of these changes on income smoothing and the timeliness of loan loss provisioning. By imposing more stringent capital requirements and the stricter monitoring of risky banks,the aim of the Basel II rules was to remedy a major weakness of the BaseliAccord,that is,its failure to distinguish between the levels of credit risk in commercial and industrial loans(Jacques,2008).Under Basel I,all commercial loans,regardless of credit quality,are assigned a 100%risk weight.The Basel II rules,in contrast,take into account differences in the credit ratings of the loans banks hold(Basel,2006).Thus,Basel II is expected to reduce banks’risk-taking incentives(Elizalde,2007).

Corporate banking is generally viewed as riskier than retail banking(Kohler,2013).2We define retail banking as comprising the following segments:consumer/retail banking,including credit card services,community banking and commercial banking to small-and medium-sized enterprises(SMEs).Consequently,we define corporate banking as comprising the following segments:corporate banking and investment banking,asset/fund management,treasury/global markets,wealth/ private banking and wholesale banking.Hence,for a typical bank,retail and corporate banking activities constitute the entirety of banking operations.Hence,we expect the revised Basel II rules to adversely affect corporate and investment banking to a greater extent than retail banking.The increased regulatory pressure may induce corporate banking managers to either reduce their risky activities or engage in greater income smoothing to reduce earnings volatility and perceived risk.Corporate banking managers in banks with low capital adequacy ratios need to maintain risky activities to sustain their revenue streams.Hence,any reduction in those activities will negatively affect earnings and shrink the bank’s earnings base.Accordingly,we predict the corporate banking managers of low-capital banks to be likelier to engage in greater income smoothing to reduce perceived earnings volatility and risk than their counterparts in banks with high capital adequacy ratios,who have the capacity to curtail their risk-taking activities,and hence may not resort to income smoothing.

We also examine the effects of the rule changes on the timeliness of loan loss recognition in both the corporate and retail banking sectors.The Basel II rules impose a more sophisticated risk assessment structure on banks than the Baselirules.They require banks to assess their capital adequacy and risk positions with greater accuracy.Although the banks in our sample use the incurred loan loss provisioning method specified by either U.S.generally accepted accounting principles(GAAP)or International Financial Reporting Standards(IFRS),they still enjoy substantial discretion in determining their loan loss provisions.One possibility is that the greater risk sensitivity required in regulatory reporting may spill over to banks’financial reporting practices,with the result that they are timelier in recognizing loan loss provisions in their loan portfolios.Another possibility,however,is that the stricter capital requirements exert greater regulatory pressure on banks to delay their loan loss recognition to artificially bolster their reserves.We expect the corporate banking managers in low-capital banks to be more inclined toward imposing less timely loan loss provisions because they are more adversely affected by the Basel II rule changes.

We use a sample of banks from the countries that led the Basel II Accord(i.e.,the U.S.,the U.K.,various European countries,Canada and Australia)to examine the effects of bank regulatory changes on bank managers’discretionary behavior.We obtain data on these banks from the Bankscope database.Our sample period ranges from 1999 to 2007 because the revised Basel II Accord was first conceptualized in 1999,and had been implemented by the majority of banks by 2007.3Unlike many regulatory changes,there is no definite cutoffdate for Basel II implementation.Instead,the Accord allows for phased implementation across different jurisdictions and banks.We end the sample period in 2007 because of the global financial crisis of 2008, which imposed significant changes on banks’operations and discretionary reporting behavior.Including the financial crisis years in our sample would have confounded our results because of the difficulty of disentangling the effects of the crisis on managerial behavior from those of the Basel II regulatory changes.In a sensitivity check,we repeat our analysis with 2007,the year Basel II took effect in the U.S., excluded from the sample period,and the results remain robust.We partition the sample into high-Tier 1 capital banks and low-Tier 1 capital banks.We analyze banks at the segmental reporting level because we are interested in assessing the differential effects of Basel II on the different business segments within a bank.Hence,we handcollect data on the loan loss provisions and profits before those provisions and taxes of corporate banking and retail banking from the segmental reporting section within the footnote disclosures of each bank’s financial statements.

We find evidence of income smoothing by corporate banking managers in low-capital banks from 2003 to 2007(hereafter,the‘Basel II period”).Relative to the pre-Basel II period,these managers are observed to increase(decrease)their loan loss provisions when the level of prior-period pre-tax earnings before those provisions is high(low).Consistent with Kanagaretnam et al.(2004),this evidence indicates the presence of income smoothing.In additional tests,we document a more pronounced income smoothing effect in the 2005–2007 than in the 2003–2004 period.

In a second set of tests,we observe a delay in the timeliness of loan loss provision recognition by corporate banking managers in low-capital banks during the later Basel II period(i.e.,2005–2007).This result indicates that corporate banking managers in weaker banks faced greater regulatory pressure and thus engaged in manipulative behavior in anticipation of the changes imposed by Basel II.In contrast,we document no differences over time in the timeliness of loan loss provisions for retail banking during our sample period.

Finally,we examine how market participants interpreted and reacted to the effects of these rule changes on the banks affected.Consistent with our hypothesis,we find that the market initially reacted negatively to regulatory announcements regarding Basel II implementation across banks.That negative market reaction is also found to be stronger for banks with more corporate banking than retail banking exposure.We further find the initial negative market reaction to have weakened over time as banks became more geared toward implementing the Basel II rule changes.Overall,these findings provide support for the view that Basel II imposes differential market pressure on banks.

This study contributes to the stream of research exploring the interaction between bank manager behavior and regulatory changes.In particular,we examine how bank managers anticipate and respond to the changes to banks’operating environments imposed by the regulatory authorities.Although prior research considers how the revised Basel II guidelines have affected banks in terms of capital management and procyclicality (e.g.,Gordy and Howells,2006;Perez et al.,2008),there is little research examining whether those guidelines induced changes in banks’ financial reporting behavior and financial reporting quality.We show that the greater regulatory pressure and more intense competitive environment arising from the more stringent capital requirements in Basel II induced greater income smoothing and deferred loan loss provisioning by bank managers.Our findings have implications for regulators and accounting standard setters concerned with whether changes to banks’regulatory environment may lead to a deterioration in their financial reporting quality.The findings are particularly timely,as banks are starting to assess and prepare for the likely effects of the proposed Basel III rules on their capital structure and operating pro fitability.

The next section develops our hypotheses and discusses the institutional background surrounding Basel II implementation.Section 3 describes the sample and empirical measures.Section 4 discusses the test results, and Section 5 concludes.

2.Literature review and hypothesis development

2.1.Basel II changes

The Basel II rules have effected substantial changes in the banking regulatory environment.In particular, they impose more refined risk measurement rules that affect both retail banking and corporate banking.As a result of the changes effected by the 1988 BaseliAccord on the existing framework,there are several approaches that banks can take to assess the credit risks in their loan portfolios:(1)the standardized approach,(2)the foundation internal ratings-based(F-IRB)approach and(3)the advanced internal ratings-based(A-IRB)approach(Basel,2006).4All three approaches increase the sensitivity of capital requirements to risk assessments.However,the way in which risk is calculated varies depending on the approach banks adopt.More specifically,the standardized approach uses standard risk buckets and risk weights that vary by product,credit rating and collateral.In contrast,banks that apply the F-IRB or A-IRB approaches calculate credit risks based on their internal risk models.Overall,the risk sensitivity and stringency of capital calculations have increased under the Basel II rules relative to Basel I.Hence,bank operations are now under greater regulatory pressure.

The risk assessment modifications in the Basel II Accord affect the retail and corporate banking sectors differently.Banks’business areas generally comprise housing loans,credit cards,retail loans such as car loans, student loans and personal loans,corporate loans,retail and corporate deposits,wealth and asset management,and such investment banking activities as equity and bond placements and treasury trading (Dermine,2015).These banking activities can be broadly classified by client type.The clients of a bank’s retail banking business are individuals and SMEs,and retail banking thus comprises housing loans,credit cards and retail loans and deposits.The clients of its corporate banking business,in contrast,are large corporations,and corporate banking thus involves corporate loans and deposits,wealth and asset management,investment banking and treasury trading.

The banking literature suggests that the Basel II revisions appear to favor retail banking(Altman and Sabato,2005;Berger,2004).The Basel II Accord stipulates that retail banking exposure(excluding mortgage loans)and loans secured by residential properties using the standardized approach are risk-weighted at 75% and 35%,respectively.Past-due loans are risk-weighted at 150%(100%)when specific provisions are less than (no less than)20%of the outstanding loan amount.Exposure to sovereign states,banks,public sector entities and corporations is risk-weighted on the basis of external credit ratings in the standardized approach.For example,the risk weights on corporate loan exposure range from 20%for borrowers rated AAA/AA-to 150%for borrowers rated below BB-.Under the two IRB approaches,banks must provide estimates of the risk parameters in their risk models for retail loan exposure.5The risk parameters in these risk models are probability of default(PD),loss given default(LGD),and exposure at default(EAD)and maturity(EAM).With regard to corporate banking exposure, the F-IRB approach requires banks to provide their own estimates of the probability of default(PD),but to use supervisory estimates for the other risk parameters,whereas banks using the A-IRB approach must calculate all of the risk components.The different risk weights and risk component estimates specified in Basel II thus lead to differential capital requirements for retail and corporate banking.

Prior research examining the effect of the revised Basel II guidelines on banks is primarily concerned with whether the rule changes exacerbate the procyclicality inherent in their lending behavior(e.g.,Gordy and Howells,2006).Gordy and Howells(2006)find that the changes do indeed exacerbate such procyclicality. More specifically,the risk-sensitive capital requirements in the Basel II rules reinforce the procyclicality of bank behavior in the following manner.As bank assets and loans are assigned higher risk weightings during economic downturns,the capital required during those downturns increases.At the same time,capital positions tend to deteriorate as loan losses accelerate.Such a situation induces banks to reduce lending andincrease lending margins,thereby contributing to procyclicality.A recent study in the Australian regulatory setting reports the country’s forward-looking regulatory provisions to prompt managers to use their discretion in setting regulatory provisions to dampen the influence of credit market volatilities on lending activities (Cummings and Durrani,2014).However,what is left unaddressed in this stream of research is whether the revised Basel II rules effect changes in banks’financial reporting behavior and financial reporting quality.

2.2.Hypothesis development

A theoretical reason for banks to engage in income smoothing is to reduce the perceived risk inherent in banking operations because such smoothing reduces earnings variability,which in turn reduces perceived risk (Francis et al.,2004).The revised rules under Basel II exert greater regulatory pressure on bank managers,as the introduction of more re fined risk measurement stipulations imposes greater capital requirements,which can in turn have an adverse in fluence on pro fitability.As a result,we hypothesize that the rules increase the pressure on bank managers to engage in income smoothing.In addition,for the reasons discussed earlier, we expect the increased regulatory pressure arising from the Basel II Accord to exert differential effects on the income smoothing activities of corporate and retail banking managers.

Prior to Basel II implementation,corporate and investment banking had advantages over retail banking,as it faced lower capital requirements.However,regulators and governments have recognized the greater risks posed by corporate and investment banking,particularly in the wake of the 2008 global financial crisis.Hence, greater attention is now paid to the risks associated with corporate banking,with speci fic capital rules imposed on it in Basel II.To mitigate the perceived higher risks resulting from the regulatory changes,corporate banking managers can either reduce risk-taking activities or engage in more income smoothing activities.

The corporate banking managers in weaker banks,i.e.,those with a low capital adequacy ratio,face constraints in reducing their risk-taking activities because such activities tend to generate greater earnings,thereby increasing the shareholder equity that constitutes part of the banks’Tier 1 capital.Hence,these managers may resort to greater income smoothing to mask the extent of their risk-taking activities.Corporate banking managers in stronger banks,i.e.,those with a larger capital base,have more choices:they can either reduce risk-taking activities or engage in income smoothing to mitigate the market pressures arising from the greater Basel II-imposed risk sensitivity.If they reduce their risk-taking activities,their actual earnings variability declines.Consequently,these managers do not need to engage in as much income smoothing as their counterparts in low-capital banks.We thus hypothesize that increased regulatory pressure induces corporate banking managers in weaker banks to increase their degree of income smoothing.Expressed in alternative form,our first hypothesis is as follows.

H1.Corporate banking managers in banks with low capital adequacy ratios engaged in more income smoothing during the Basel II period.

Another important issue is whether there were changes in the timeliness of loan loss provisions during the Basel II period.On the one hand,the Accord’s revised rules impose changes on the risk assessment framework of banks’loan portfolios,allowing them to more accurately assess their capital adequacy and risk positions. As a result,banks may be in a better position to enact timelier loan loss provisions in their loan portfolios.On the other hand,the resulting increase in regulatory pressure may induce banks to delay loan loss recognition. Corporate banking managers,in particular,may be inclined to impose less timely loan loss provisions because they are more adversely affected by the Basel II implementation rule changes than their retail counterparts.Liu and Ryan(1995)hypothesize that the timeliness of loan loss provisions decreases as discretion over those provisions increases.As bank managers tend to have more discretion over larger loans(e.g.,corporate loans)than smaller loans(e.g.,consumer loans),we predict that corporate banking managers use their discretion to engage in less timely loan loss provisioning.More speci fically,we expect a delay in the timeliness of loan loss recognition among corporate banking managers in low-capital banks as a result of the Basel II rule changes. Accordingly,we express our second hypothesis in alternative form as follows.

H2.Corporate banking managers in banks with low capital adequacy ratios engaged in delayed loan loss provision recognition during the Basel II period.

Finally,we also examine the market reaction to a series of Basel II announcements.If the Basel II rules impose greater regulatory pressure on corporate than retail banking,then we expect a negative market reaction to those announcements because the regulatory changes adversely affect the capital adequacy ratios of banks with more corporate banking than retail banking exposure.In contrast,we expect the market to react favorably to the Basel II announcements if it anticipates the revised rules to enhance the competitiveness and capital adequacy of the affected banks.How market participants react to the series of regulatory announcements concerning the Basel II changes is an empirical question.Thus,we express our third hypothesis in null form,as follows.

H3.There is no difference in the market reaction to the Basel II announcements between banks with more corporate banking exposure and those with more retail banking exposure.

3.Research design

Our sample comprises banks from the U.S.,U.K.,Europe,Canada and Australia,with data drawn from the Bankscope database for the 1999–2007 period.For each bank,the loan losses and profits before taxes are disclosed and reported at the business segment level(i.e.,retail and corporate banking)in the footnote disclosures in its annual financial reports(see Appendix A).We hand-collect the segmental information pertaining to retail and corporate banking for each bank in our sample.The data for the other variables(i.e.,nonperforming loans,change in non-performing loans,loan growth and Tier 1 capital ratios)are obtained from Bankscope or,if unavailable,collected manually from the banks’annual reports.

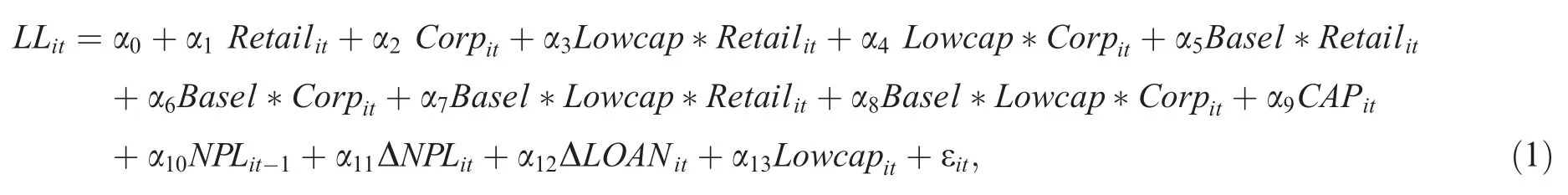

We estimate the following regression to test our first hypothesis.

whereLLis measured asLLcorp,LLretailor the sum of the two;LLcorp(LLretail)is the corporate(retail) banking segment’s provisions for loan losses;Retail(Corporate)is the retail(corporate)banking’s segmental profit before taxes and loan loss provisions;Lowcapis an indicator variable that equals 1 for banks with a below-median Tier 1 capital ratio(i.e.,low-capital banks),and 0 otherwise(i.e.,high-capital banks);andBaselis an indicator variable that equals 1 if the bank-year observation is in the Basel II period,and 0 otherwise. The Basel II period spans from 2003 to 2007,when the third and final consultative paper on Basel II was issued by the Basel Committee and consensus on the Basel II framework was achieved.A reaction to the impending Basel II rules is expected from both the market and banks in this period.

The foregoing regression equation is adapted from those in Kanagaretnam et al.(2004)and Gebhardt and Novotny-Farkas(2011).Similar to their equations,to control for the non-discretionary portion of loan provisions,we includeCAP,which is a bank’s Tier 1 capital ratio;NPL,which is its nonperforming loans at the beginning of the year;ΔNPL,which is the change in nonperforming loans from the prior to current year;and ΔLOAN,which is the change in total loans outstanding from the prior to current year.Thus,our regression specification relates the discretionary portion of corporate(retail)banking loan provisions to corporate(retail) banking segmental profits before taxes and loan provisions.

Model(1)estimates the income smoothing coefficients of each combination ofCorp/Retail,High-/Low-Tiericapital ratios and Basel II/Pre-Basel II periods.In line with prior research(e.g.,Kanagaretnam et al.,2004), the baseline measures of income smoothing are α1and α2.A positive α1(α2)suggests that retail(corporate) banking managers increase their loan loss provisions with an increase in profits before taxes and loan provisions in the pre-Basel II period.We interact our measure of loan smoothing with banks’Tier 1 capital.In these interaction variables,a positive α3(α4)equates to the managers who oversee the retail(corporate)banking business of their banks engaging in more income smoothing activities when their Tier 1 capital is below the median Tier 1 capital ratio in our sample.

To test H1,we examine whether the coefficients onBasel*Lowcap*RetailandBasel*Lowcap*Corpare significant and positive.A positive α7(i.e.,the coefficient onBasel*Lowcap*Retail)means that the retail bankingmanagers in low-capital banks manage loan loss provisions to a greater extent to smooth pre-tax profits during the Basel II period.Similarly,a positive α8(i.e.,the coefficient onBasel*Lowcap*Corp)means that loan loss provisions are used to a greater extent to smooth pre-tax profits by corporate banking managers in low-capital banks during the Basel II period.We thus interpret a statistically significant positive coefficient on α7(α8)as implying that retail(corporate)banking managers in low-capital banks engaged in more income smoothing activities in anticipation of the Basel II rule changes.

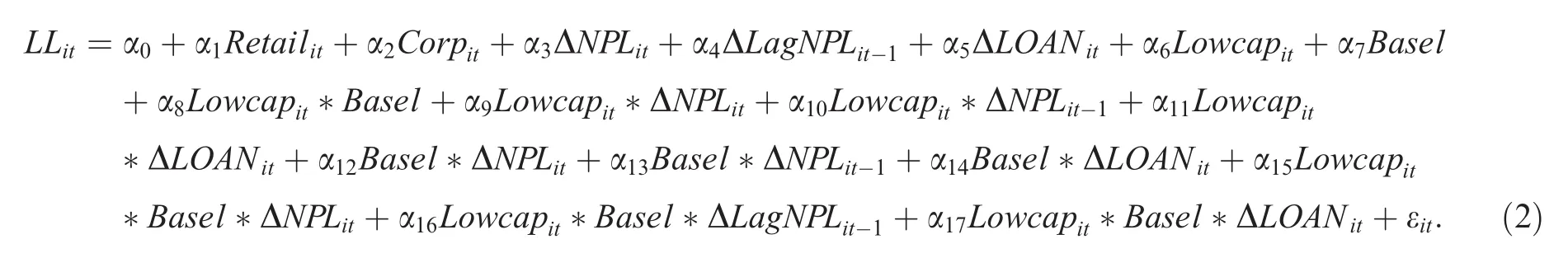

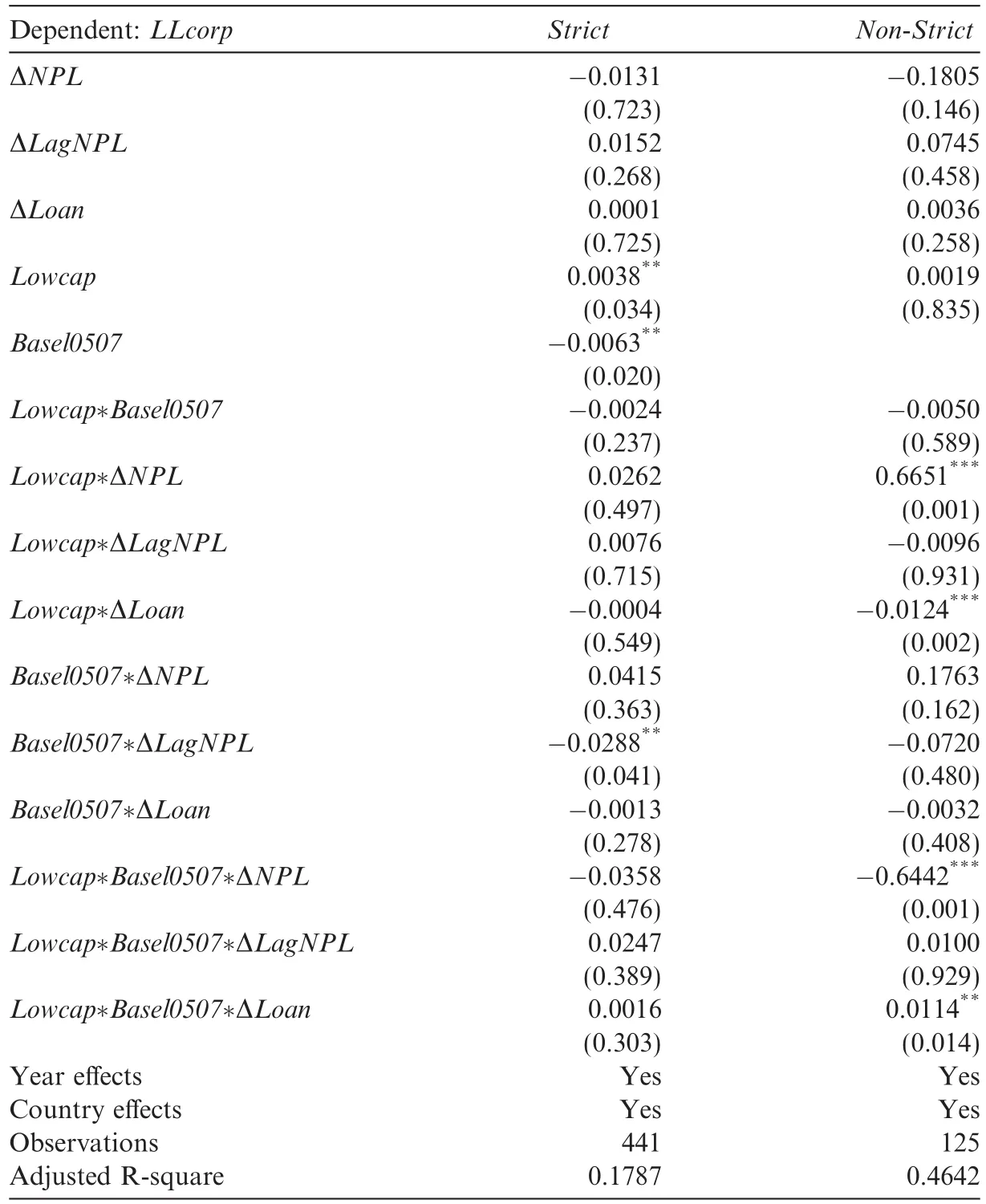

For our second hypothesis,we estimate the following regression model.

Model(2),which is adapted from Beatty and Liao(2011),relates currentLLto current and prior changes inNPLfor each combination ofCorp/Retail,High-/Low-Tiericapital ratios and Basel II/Pre-Basel II periods,whereLLis measured as eitherLLcorporLLretail,as defined in Eq.(1).This model also includes ΔLOANandLowcapas control variables.The coefficients of interest are those on ΔNPLand ΔLagNPL. These coefficients measure the timeliness of loan loss recognition,with a positive coefficient indicating that loan loss provisions reflect the change in non-performing loans in a timelier manner.

H2 posits a delay in the timeliness of loan loss provisioning in the Basel II period for corporate banking managers in low-capital banks.Our baseline measurement variables are α1and α2,which are the coefficients on ΔNPLand ΔLagNPL.These measures of the timeliness of loan loss provisions are based on the measures in Beatty and Liao(2011)and Bushman and Williams(2012).A positive α3and α4demonstrate that these provisions capture the increase in the timeliness of non-performing loan recognition in the pre-Basel period. Because we are interested in the extent of that timeliness in the Basel II period,our variables of interest are α15and α16(i.e.,the coefficients onLowcap*Basel*ΔNPLandLowcap*Basel*ΔLagNPL).Negative values mean that the loan loss provisions capture the change in non-performing loans in the Basel II period in a less timely fashion,indicating that banks delayed loan loss recognition in response to greater regulatory pressure.

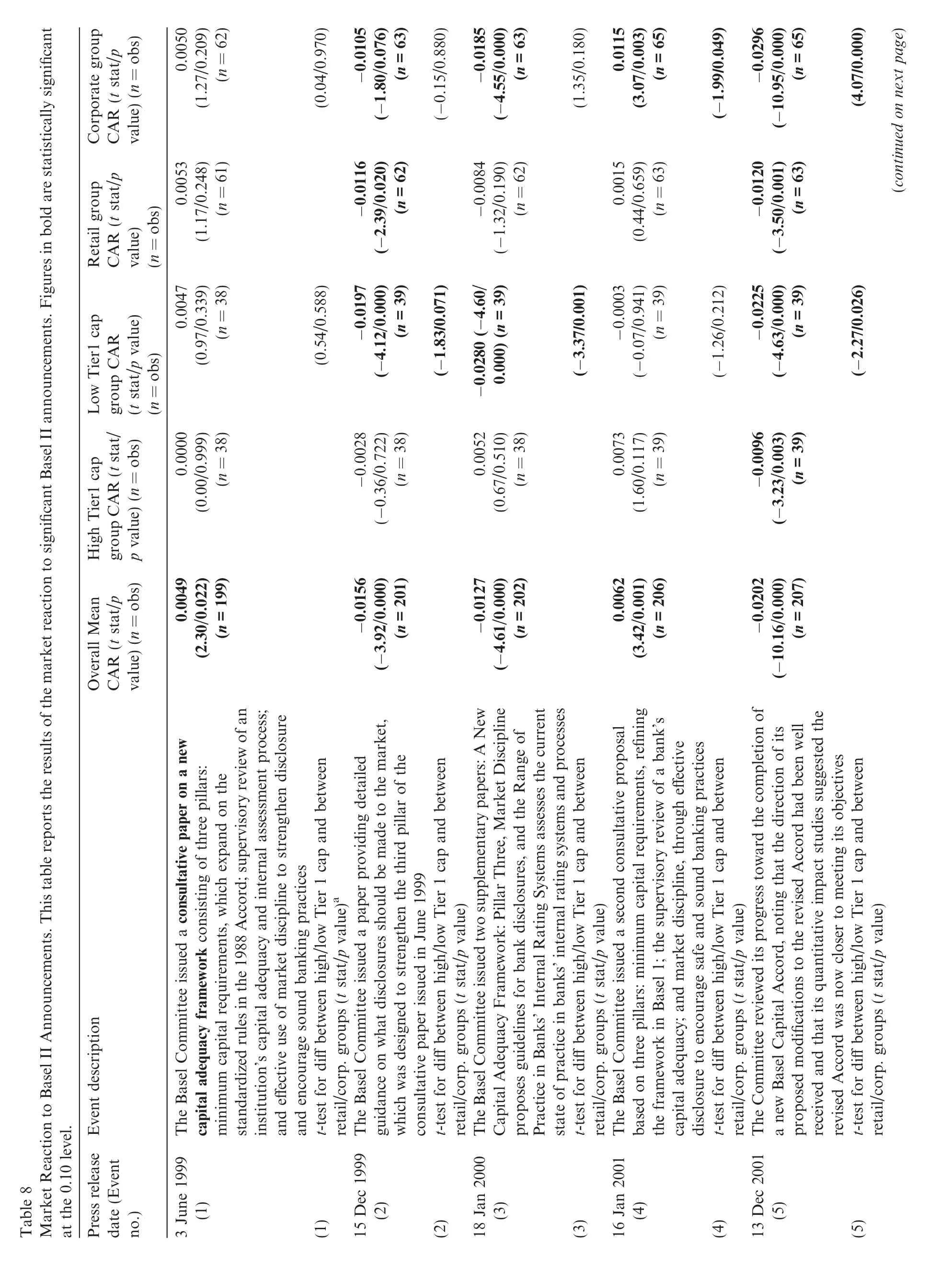

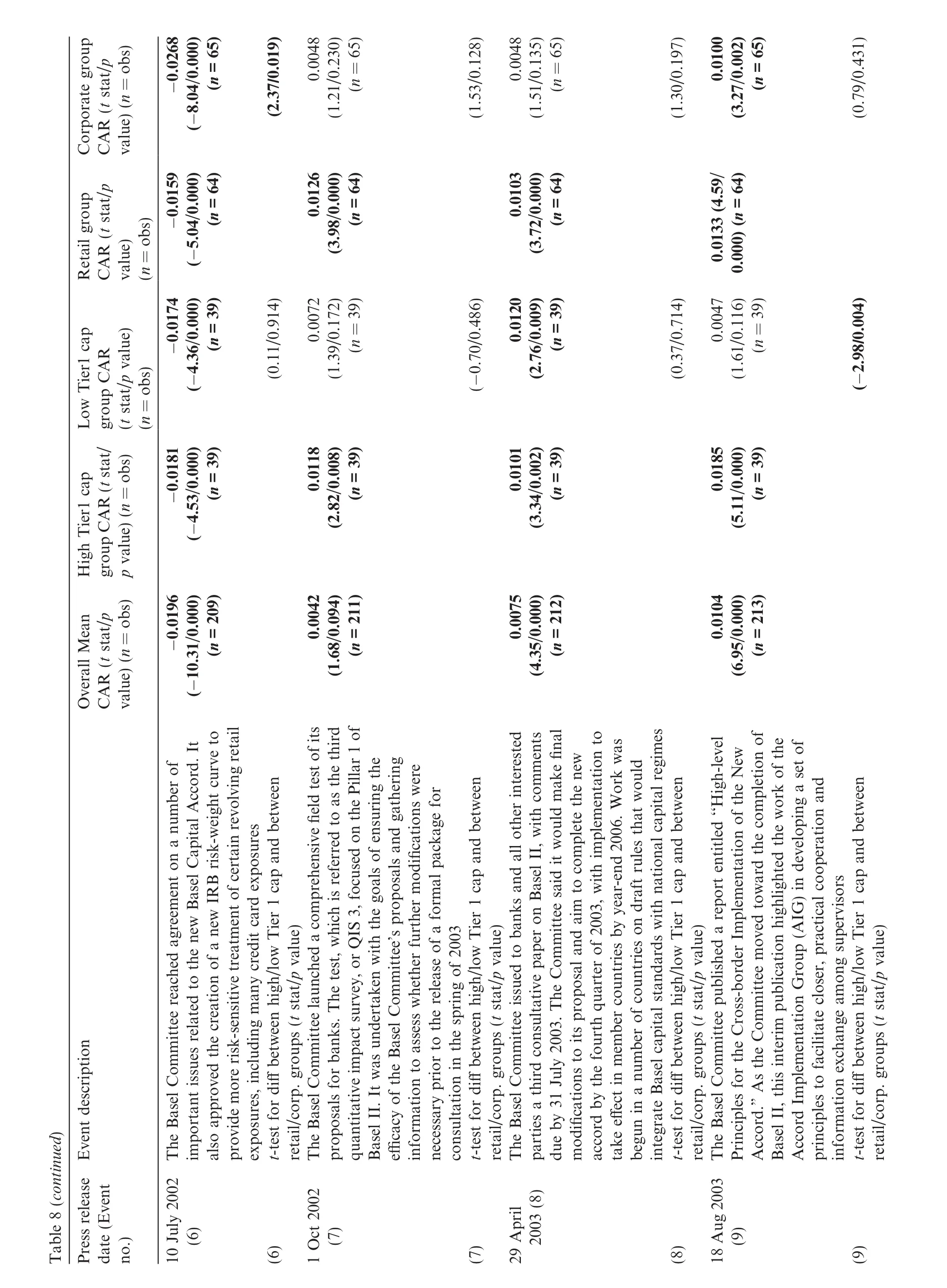

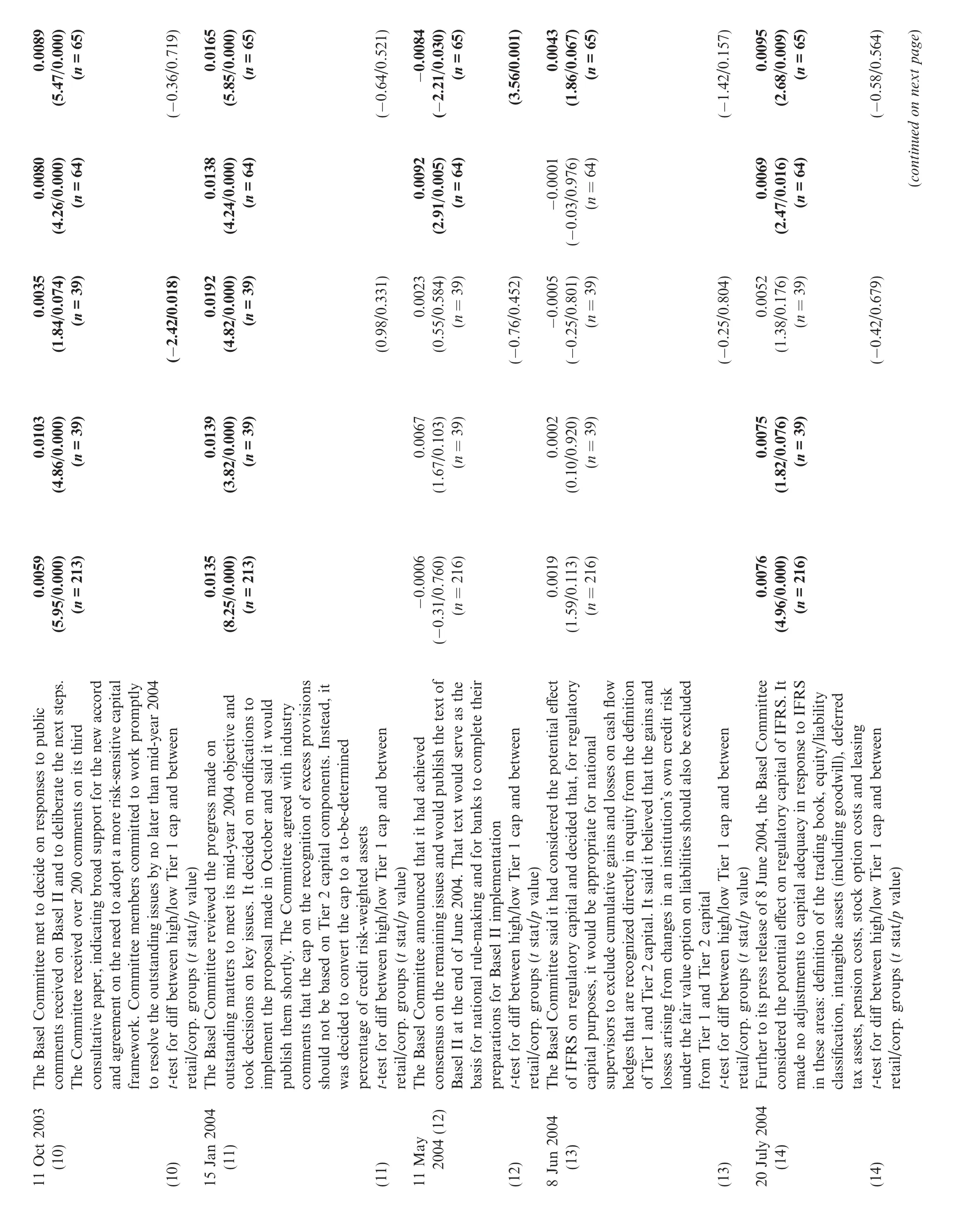

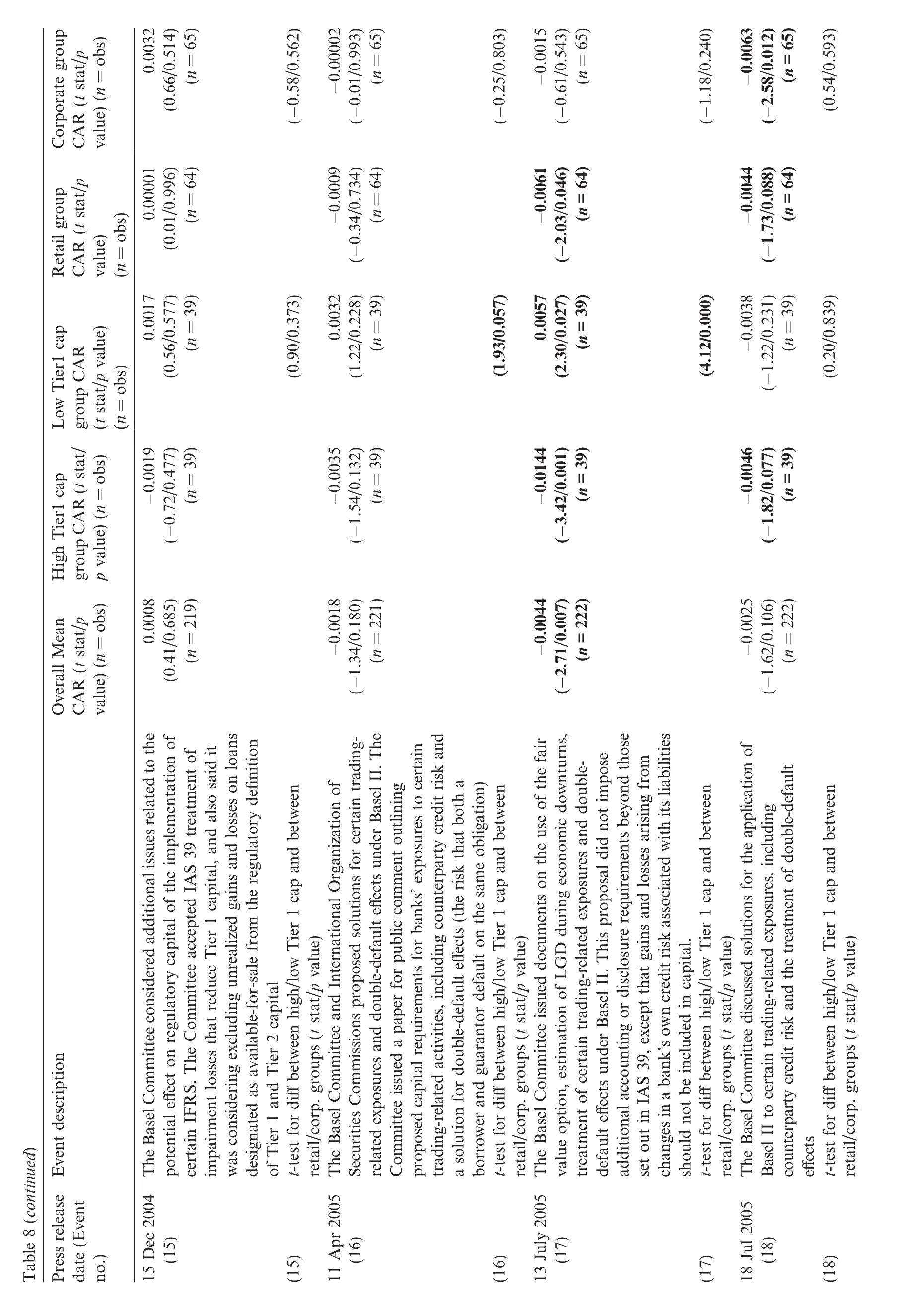

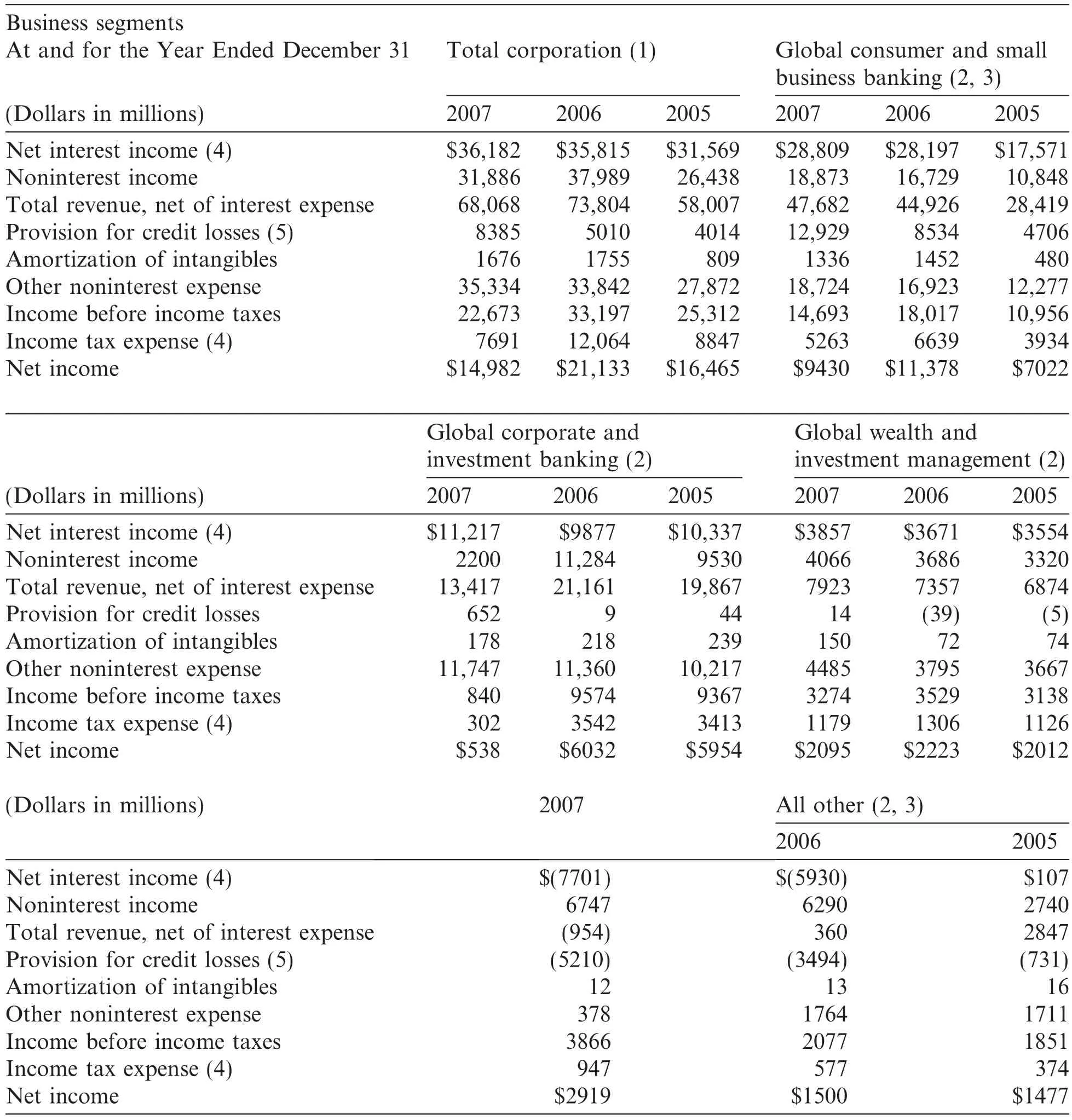

For our third hypothesis,we identify 19 events associated with Basel II implementation.Events 1 to 6 cover the period from 1999 to 2002,which encompasses the conceptualization of the Basel II Accord,release of detailed information on the Basel II rule changes(in the second consultative paper)and achievement of general consensus on the major implementation issues concerning the rules.News articles during this period generally indicate that banks would likely be badly hit by the stringent and restrictive Basel II rules,which would be costly to implement.The revised capital requirements,in particular,were viewed as tougher and thus likely to exert more pressure on certain businesses.For example,it was felt that bank loans to SMEs and derivative activities would be adversely affected.Events 7 to 12 cover the period from October 2002 to May 2004,during which the Basel Committee carried out a comprehensive field test on its proposals,issued and obtained public feedback on a third consultation paper,and took decisions on key issues and achieved consensus on the remaining issues.Finally,Events 13 to 19 took place between June 2004 and May 2006. This period saw further refinements of the trading exposure rules,additional quantitative impact studies and evaluation of the IFRS effects on the capital rules concerning implementation of the standardized approach.

Our tests are based on the banks’three-day cumulative abnormal returns centered on each of the 19 event dates:CARj,e,wherejdenotes firm andedenotes event.The expected stock return for each bank on each event date is the bank’s average stock return one month before the event date.The abnormal return for each bank is its raw stock return less its expected return.The return data from 1999 to 2006 are computed on the basis of total return indices from Datastream.Finally,t-tests are run to compare abnormal returns on each event date for the two bank sub-samples.More specifically,we compare the differences in the market reactions for banks’retail and corporate banking businesses and for low-and high-capital banks.

4.Results

4.1.Main results

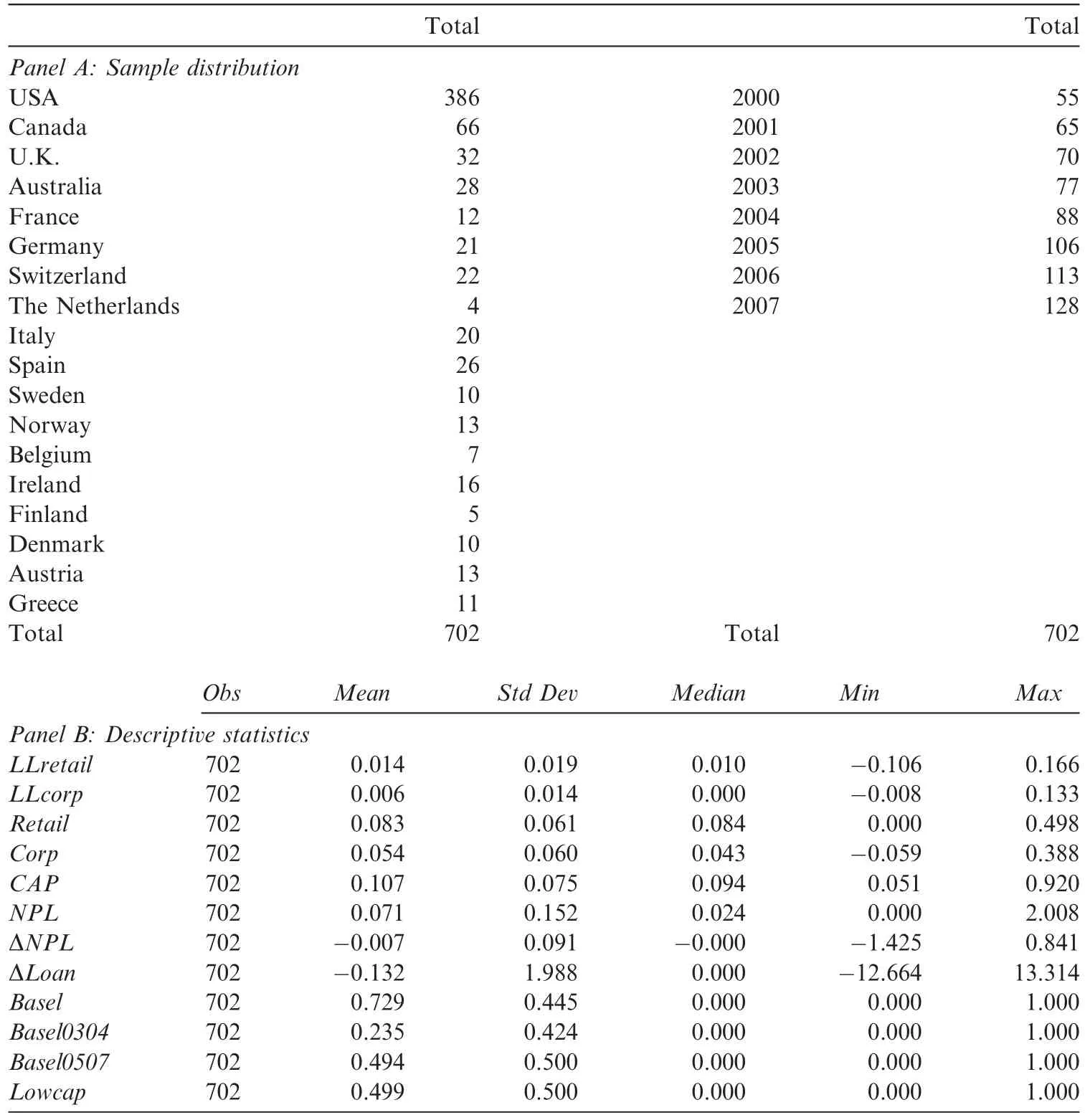

Panel A of Table 1 presents the distribution of our sample firms by year and country,and Panel B the descriptive statistics of our key variables.Three hundred and eighty-six observations are from U.S.banks, and 316 from non-U.S.banks.The sample is evenly distributed across the sample period,with a gradual increase in the number of bank-year observations throughout.As shown in Panel B,loan losses and profits before taxes and loan losses are generally higher in the retail banking segment than in the corporate bankingsegment.More speci fically,the mean(median)value ofLLretailis 0.014(0.010),whereas that ofLLcorpis 0.006(0.000).In terms of pro fitability,the mean(median)value ofRetailis 0.083(0.084),whereas that ofCorpis 0.054(0.043).The percentages of mean retail and corporate banking loan losses and mean non-performing loans are 2%and 7.1%,respectively.These measures are scaled by the beginning market value of equity.

Table 1 Sample composition.This table describes our sample firms.Panel A reports the sample distribution by country and year.Panel B provides the descriptive statistics of the variables used in our regression analyses.LLretail is retail loan losses scaled by prior-year market capitalization;LLcorp is corporate loan losses scaled by prior-year market capitalization;Retail is retail banking segmental profit before taxes and excluding loan losses scaled by prior-year market capitalization;Corp is corporate banking segmental profit before taxes and excluding loan losses scaled by prior-year market capitalization;CAP is Tier 1 capital ratio,as defined by the Basel rules;NPL is non-performing loans in the prior year scaled by market capitalization;ΔNPL is a change in non-performing loans from the prior year to current year scaled by market capitalization;Basel is an indicator variable that is equal to 1 for 2003–2007,and to 0 otherwise; Basel0304 is an indicator variable that is equal to 1 for 2003–2004,and to 0 otherwise;Basel0507 is an indicator variable that is equal to 1 for 2005–2007,and to 0 otherwise;and Lowcap is an indicator variable for bank-year observations with a Tier 1 capital ratio below the median capital ratio,and 0 otherwise.

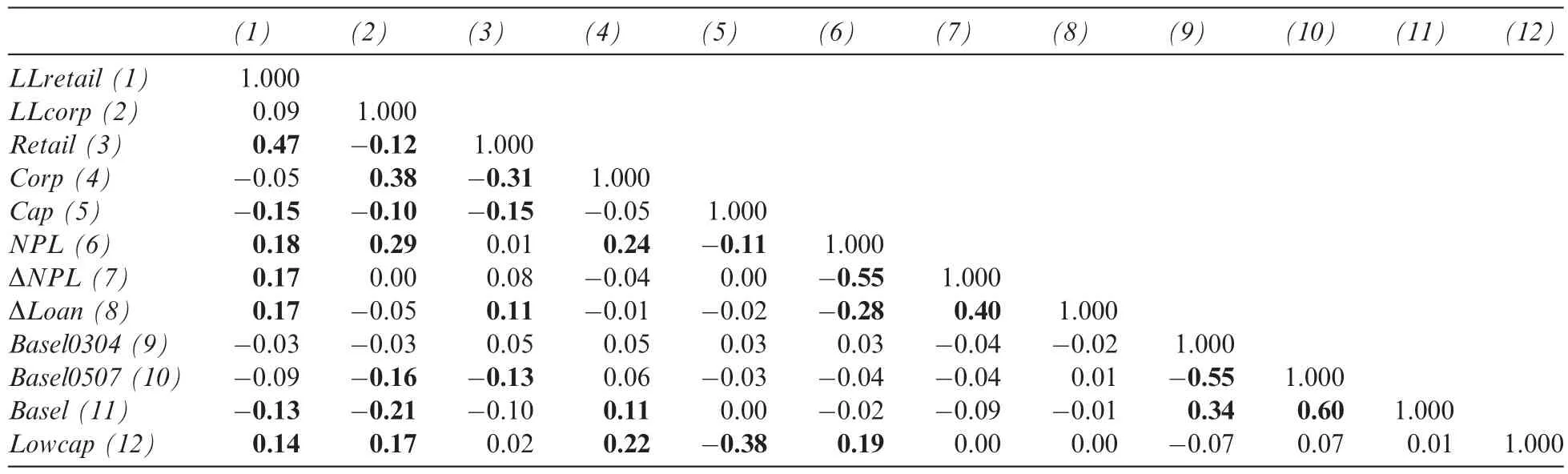

Table 2 shows the Spearman correlation matrix.The negative correlations betweenRetailandLLretail(CorpandLLcorp)provide evidence indicating that banks use retail(corporate)banking loan losses to smooth their retail(corporate)banking segmental income.At the business segment level,the negative correlation betweenRetailandCorpsuggests that banks tend to focus on either retail or corporate banking.That betweenNPLand ΔNPLsuggests that the higher the number of non-performing loans in the prior period,the likelier it is that banks are able to reduce the number of such loans in the subsequent period.Finally,the positive correlation between ΔLoanand ΔNPLshows that greater loan growth leads to an increase in non-performing loans.These results are generally consistent with the empirical evidence in Salas and Saurina(2002).

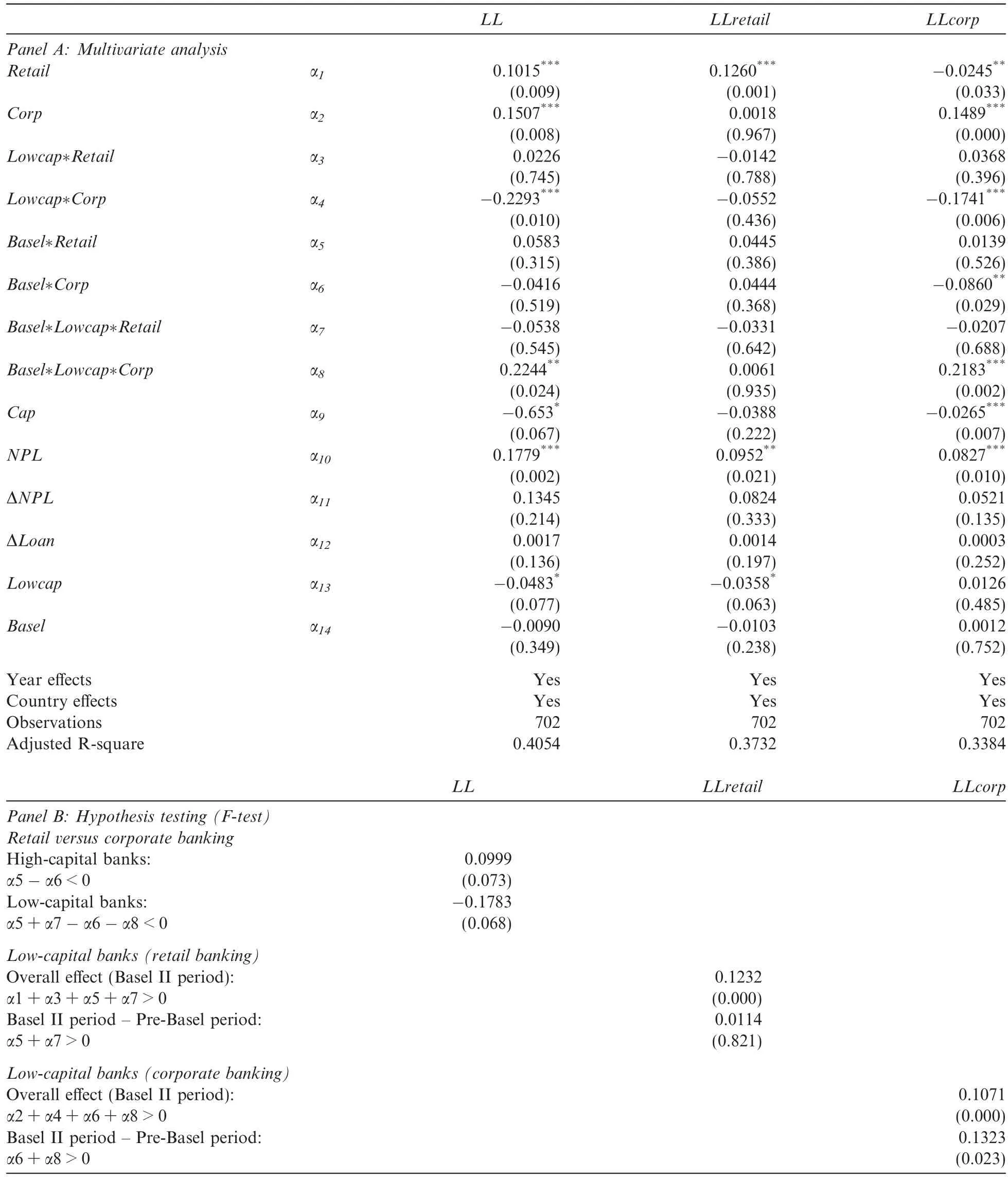

Table 3 reports the results of our regression analyses examining the effects of income smoothing during the Basel II period using retail and corporate loan losses.The first column presents the results of regressingLLon our variables of interest.The coefficient of our key variable,Basel*Lowcap*Corp(0.2244),is positive and statistically signi ficant at the 0.05 level.We interpret this result as suggesting that the extent of income smoothing is greater for corporate banking than for retail banking among weaker banks in the Basel II period.AnF-test comparing the extent of income smoothing in the retail banking segment of weak banks[(α1+α3+α5+α7)-(α1+α3)]against that in the corporate banking segment of weak banks[(α2+α4+α6+α8)-(α2+α4)] suggests a statistically signi ficant difference(α5+α7-α6+α8<0)during the Basel II period relative to the pre-Basel period.The difference(-0.1783,p=0.068)is statistically different at the 0.10 level.

In the second and third columns of Table 3,we regressLLretailandLLcorpseparately.The positive coefficients ofRetail(in the column with dependent variableLLretail)andCorp(in the column with dependent variableLLcorp)show that income smoothing using loan loss provisions occurs in both retail banking and corporate banking.In theLLcorpcolumn,the coefficient ofLowcap*Corpis negative,indicating that corporate banking managers in weaker banks with low capital adequacy ratios smoothed their income to a lesser extent prior to the Basel II period.This result suggests that there was less regulatory pressure on corporate banking before Basel II.The coefficient ofBasel*Corpis also negative,indicating that the corporate banking business of high-capital banks faced less regulatory pressure during the Basel II period.The coefficient of our key variable,Basel*Lowcap*Corp(0.2183),is positive and statistically signi ficant at the 0.01 level.Consistent with our first hypothesis,this result suggests that during the Basel II period,corporate banking managers in weaker banks with low capital adequacy ratios faced more regulatory pressure.Consequently,they smoothed income to a greater extent than their counterparts in stronger banks during that period.AnF-test also shows the extent of income smoothing for the corporate banking segment to have increased(0.1323,p=0.023) among the weaker banks during the Basel II period relative to the pre-Basel period.This result is statistically signi ficant at the 0.05 level.Overall,these results support our first hypothesis that corporate banking managersin low-capital(high-capital)banks engaged in more(less)income smoothing activities during the Basel II period.In contrast,we document no differential effect in relation to income smoothing for the retail banking segment during that period.

Table 2 Correlation Matrix.This table presents the correlations among the variables used in the empirical analyses.Pearson(Spearman) correlations are presented above(below)the diagonal.The variables are defined in Table 1.Correlations in bold are statistically significant at the 0.01 level.

Table 3 Regression Analyses:Basel II(2003–2007)and Income Smoothing.This table reports the results of our regressions examining the effects of income smoothing during the Basel II period using retail and corporate loan losses obtained from the segmental results of banks’footnote disclosures.The variables are defined in Table 1.p-values are reported in parentheses.

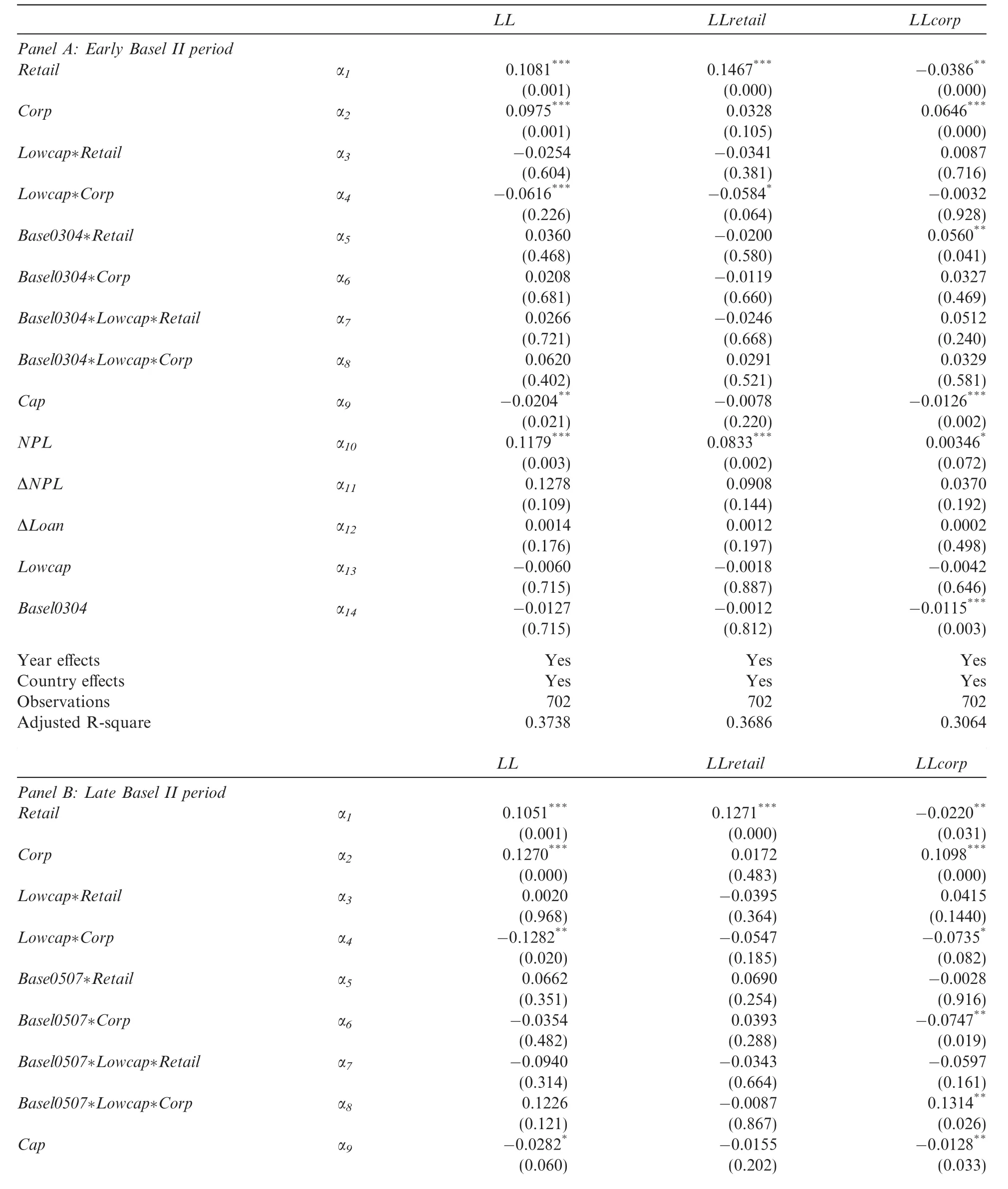

Table 4 reports the results of a regression comparing time-series differences in income smoothing trends during the Basel II period.We partition our sample observations into two periods:the early Basel II period (2003–2004)and late Basel II period(2005–2007).The positive(negative)and statistically significant coefficient of the key variable,Basel0507*Lowcap*Corp(Basel0507*Corp),is present in the late Basel II period (Table 4,Panel B),but not in the early period(Table 4,Panel A),which suggests that corporate banking managers in low-capital(high-capital)banks engaged in more(less)income smoothing in the former period.

We also run severalF-tests to validate our inferences.Consistent with the foregoing result,we find that theF-test difference between retail and corporate banking for low-capital banks during the early Basel II period is not statistically significant(-0.0202,p=0.755),whereas that for low-capital banks is(-0.115,p=0.10). Thus,we document evidence suggesting that corporate banking managers intensified their income smoothing activities in the latter part of our sample period.

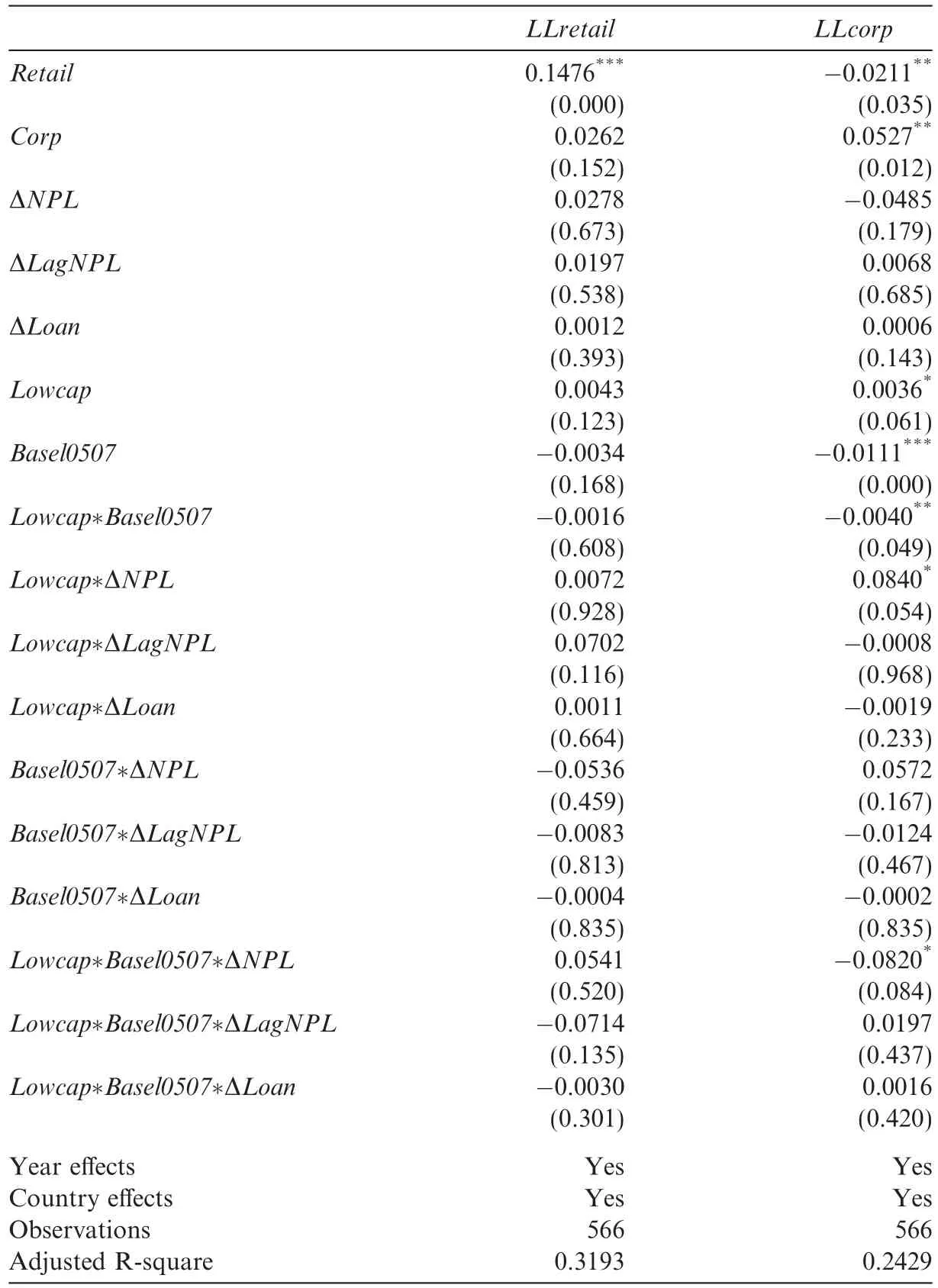

Table 5 reports the results of regressions examining the timeliness of loan loss provisions for corporate and retail banking during the latter part of the Basel II period(i.e.,2005–2007).When the dependent variable isLLcorp,the key coefficient ofLowcap*Basel0507*ΔNPLis negative and statistically significant(-0.082,p=0.084),which suggests that corporate banking loan loss provisions capture the change in nonperforming loans on a less timely basis in the late Basel II period.We document no effect for the timeliness of such provisions for retail banking throughout the sample period.In robustness tests,we remove European banks from the sample,as IFRS came into effect in Europe in 2005,but the key results remain unchanged. Overall,our findings provide some evidence in support of our second hypothesis that corporate banking managers in low-capital banks provided less timely loan loss provisions during the Basel II period.

For the dependent variableLLcorp,the coefficient ofLowcap*ΔNPL(0.084.p=0.054)is positive and statistically significant,which indicates that,prior to the Basel II period,corporate banking managers in low-capital banks exhibited greater timeliness than their counterparts in high-capital banks in recognizing loan loss provisions.However,there are fewer corporate banking loan loss provisions in the Basel II than in pre-Basel II period,particularly for low-capital banks.More specifically,the coefficient ofLowcap*Basel0507(-0.004,p=0.049)is negative and statistically significant at the 0.05 level.Consistent with our prediction that retail banking has been relatively less affected by the regulatory changes,we find the foregoing results to lose their statistical significance when the dependent variable isLLretail.

4.2.Enforcement tests

Tables 6 and 7 report the results of additional cross-sectional tests in which the sample is partitioned between banks located in countries with more and less stringent banking enforcement based on Barth et al. (2013),which reports the results of surveys carried out by the authors with sponsorship from the World Bank. We are specifically interested in the survey responses‘Yes,”‘No”or‘N/A”to three questions:‘If an infraction of any prudential regulation is found in the course of supervision,must it be reported?”‘Are there mandatory actions that the supervisor must take in these cases?”and‘Are supervisors legally liable for their actions?”When the answer to at least two of these questions is‘Yes,”we classify banks located in the countries in question as being located in countries with strict enforcement,with the remaining banks classified as being in countries with less strict enforcement.

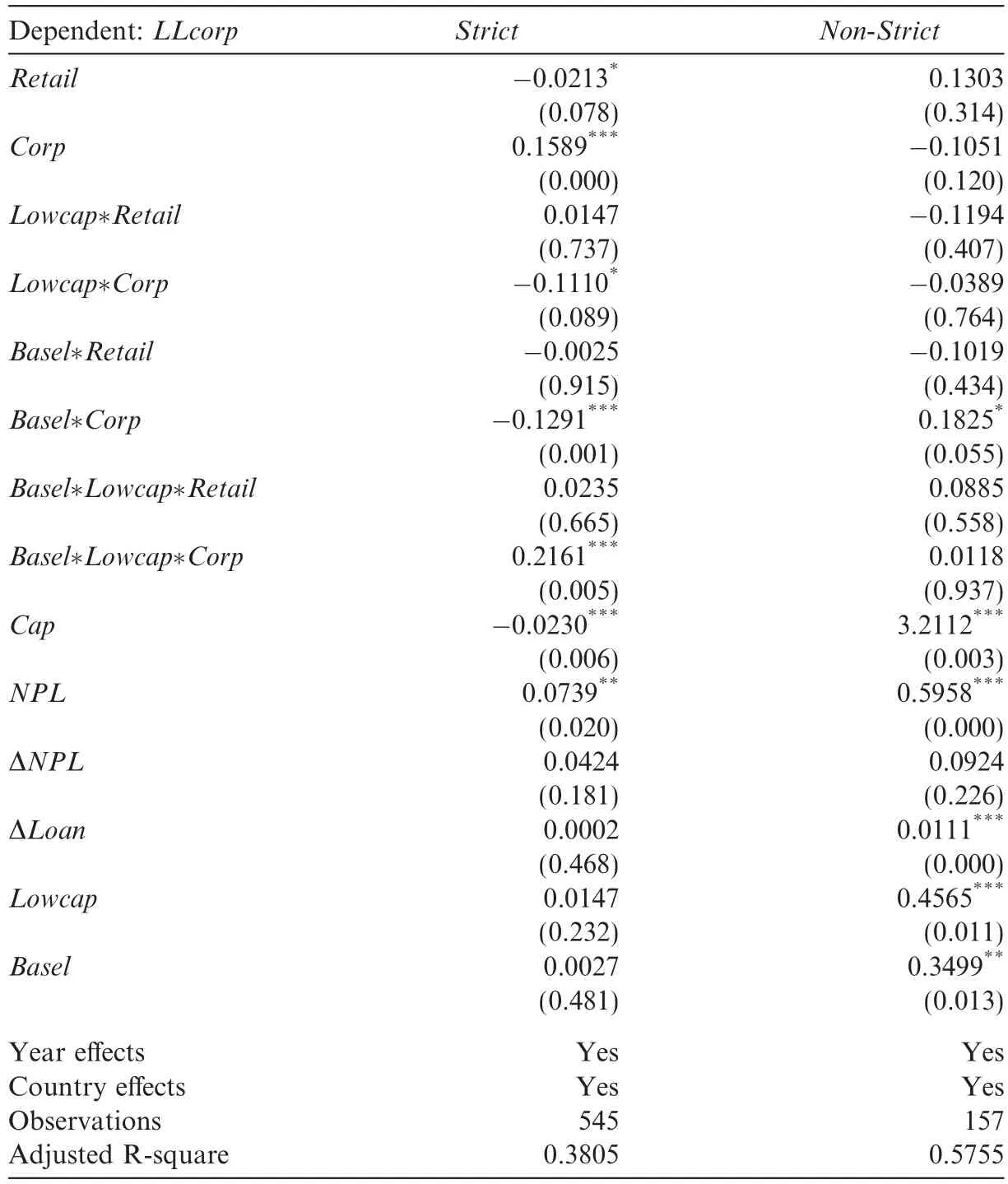

Table 6 reports the results of income smoothing tests on the partitioned sample.The objective of these tests was to determine whether our results vary across the two types of banking enforcement regime.Our expectation is that banks located in countries with strict such enforcement are under greater regulatory pressure than their counterparts in countries with lax banking regulations,and thus the results for the latter should be weaker and less significant.

Consistent with that expectation,we find a statistically significant result at the 0.01 level for the coefficient of our key variable,Basel*Lowcap*Corp(0.2161,p=0.005),among banks subject to strict banking regulations,whereas no such result is found for the other banks(0.0118,p=0.937).Overall,these results suggest that the incentives to smooth income in response to the Basel II rule changes are concentrated amongbanks located in countries with a strong banking enforcement regime.6In countries with strong banking enforcement,increased regulatory pressure can induce bank managers to engage in income smoothing because the bank regulators are primarily interested in ensuring that their banks are well-regulated and well-capitalized.They are less concerned with income smoothing and otherformsofaccounting manipulation,which are underthe purview ofaccounting standard setters.Corporate banking managers in these countries presumably experience greater regulatory pressure than their counterparts in less stringent regimes.

Table 4 Regression Analyses:Early(2003–2004)and Late Periods(2005–2007)of Basel II and Income Smoothing.This table reports the results of our regressions examining the effects of income smoothing in the early and late Basel II period using retail and corporate loan losses.The variables are defined in Table 1.p-values are reported in parentheses.

Table 5 Regression Analyses:Timeliness of Loan Loss Provisions.This table reports the results of our regressions examining the timeliness of loan loss provisions.All variables are defined in Table 1.p-values are reported in parentheses.

Finally,Table 7 reports the test results on the timeliness of corporate loan loss provisions after partitioning the sample by enforcement regime.Only in countries with laxer banking enforcement are low-capital banks less timely in recognizing corporate loan loss provisions in the Basel II period,as reflected in the negative and statistically significant coefficient ofLowcap*Basel0507*ΔNPL(-0.6442,p=0.001).Stricter bank regulators monitor the timeliness of loan loss provisions more closely than their less strict counterparts(Costello et al.,2016).Thus,the managers of low-capital banks in strict enforcement regimes enjoy less discretion to manage such timeliness under the Basel II rules even though they are under considerable pressure to do so. It thus appears that the timeliness of loan loss provision effect is concentrated in less stringent enforcement regimes,where corporate banking managers in low-capital banks have more discretion with respect to the timing of corporate loan loss recognition.

Table 6 Regression Analyses:Income Smoothing and Enforcement.This table reports the results of our regressions examining the effects of income smoothing during the Basel II period between banks located in countries with strict versus less strict enforcement regimes.All variables are defined in Table 1.p-values are reported in parentheses.

4.3.Market reaction tests

Table 8 reports the market reactions to important announcements regarding changes to the Basel II rules.It can be seen that the market reactions to Events 1 to 12 are more negative for banks with greater corporate banking exposure than retail banking exposure,particularly for three of those events:(1)13 December 2001(Event 5:-2.96%)when the Basel Committee’s quantitative impact studies suggested that the revised Basel II Accord would be able to meet the Committee’s objectives;(2)10 July 2002(Event 6:-2.68%)when the Basel Committee reached agreement on a number of important issues related to Basel II implementation; and(3)11 May 2004(Event 12:-0.84%)when the Committee announced that it had achieved consensus on the remaining issues and would publish the text of the Basel II Accord at the end of June 2004.Overall,our test results suggest that in the period spanned by those events the market perceived the effects of the Basel II regulatory changes to have more negative implications for corporate banking than retail banking because the new rules imposed more stringent capital requirements on market risks,which affect corporate and investment banking to a greater extent than retail banking.

Table 7 Regression Analyses:Timeliness of Loan Loss Provisions and Enforcement.This table reports the results of our regressions examining the timeliness of loan loss provisions in banks located in countries with strict versus less strict enforcement regimes.All variables are defined in Table 1.p-values are reported in parentheses.

Conversely,we find that the market reactions to Events 13 to 19 are more positive for banks with more corporate than retail banking exposure.The positive market reaction to these banks is especially large on 24 May 2006(Event 19:2.88%),the date on which the results of a quantitative impact study were released for G10 countries showing that the minimum capital required under Pillar 1 of the Basel II framework would decrease relative to the Baseliframework.The market appears to have been relieved that the consequences for corporate banking of the Basel II rules would be less negative than originally feared.The positive market reaction also corresponds with greater income smoothing using corporate loan losses and more active lobbying by various regulators and industry groups to minimize the adverse effects of the Basel II regulatory changes.7The regulators engaged in lobbying included the Office of the Comptroller of the Currency,the top regulator of national banks in the U.S.,U.S.Senate banking committee members,the U.S.Federal Deposit Insurance Corporation,the U.K.Financial Services Authority and the China Banking Regulatory Commission.The industry groups included the Securities Industry Association,British Bankers Association,European Banking Association,French Banking Federation and banking industry bodies such as the International Swaps and Derivatives Association,Institute of International Finance,European Private Equity and Venture Capital Association.Inresponse to such lobbying,the Basel Committee revised the rules to reduce the capital requirements for mortgage loans and SMEs.The regulations were also watered down for brokerage and securities houses such as Goldman Sachs and Morgan Stanley.Finally,there was also growing awareness that some banks could potentially reduce their capital requirements under Basel II’s advanced IRB approach.

?

?

?

?

?

We also compare the market reaction to low-and high-capital banks.During the early part of our sample period(Events 1–12),that reaction was more negative for low-than high-capital banks,most likely because the market was concerned that the Basel II rules would have a greater adverse effect on the former.However, during the later part of the period(Events 13–19),the market was more receptive to low-capital banks than to their high-capital counterparts,possibly because subsequent refinements and political lobbying mitigated Basel II’s effects on the former.

Considering all 19 events together,we find that the overall market abnormal returns to the full sample, banks with low-Tier 1 capital adequacy ratios and banks with more corporate banking exposure are not statistically significantly different from 0.It seems that the market recovered fairly quickly from the initial negative shock of the Basel II announcement.However,for banks with high-Tier 1 capital adequacy ratios and those with more retail banking exposure,we find the overall market abnormal reaction to the 19 Basel II events to be positive.Overall,the evidence suggests that the implementation of Basel II benefitted strongly capitalized banks and those with greater retail banking exposure because the regulatory changes allowed these banks to gain a competitive advantage over weakly capitalized banks and those with greater corporate banking exposure.

5.Conclusion

This study examines the interaction between a major banking regulatory policy change(i.e.,the Basel II rule changes)and its effects on bank managers’discretionary behavior.We find evidence to suggest that corporate banking managers in weaker banks with low capital adequacy ratios engaged in income smoothing to a greater extent in the Basel II period than their counterparts in stronger banks,most likely because of the more stringent capital requirements imposed on corporate and investment banking by the regulatory changes.We also find such smoothing to be more prevalent in the latter part of the Basel II period,being non-existent in the early part.

Similarly,we find corporate banking managers in weaker banks with low capital adequacy ratios to have reduced the timeliness of their loan loss provisions in the latter part of the Basel II period.In additional crosssectional tests,we demonstrate that income smoothing and the timeliness of loan loss provisions vary depending on the strictness of the bank enforcement regime under which banks operate.Finally,we find that the market reacted more negatively to banks with more corporate banking exposure than to those with more retail banking exposure in the Basel II period.However,the negative market reaction to the former was negligible toward the end of that period.

The study offers important input to policymakers,showing that banks that are affected by capital regulations may engage in such discretionary behavior as income smoothing and the delayed recognition of loan losses.The corporate banking sector faces increased regulatory risks as a result of Basel II implementation. To mitigate those risks,it appears that the managers who oversee the corporate banking business of weaker banks engage in income smoothing activities and delayed loan loss recognition.

Appendix A

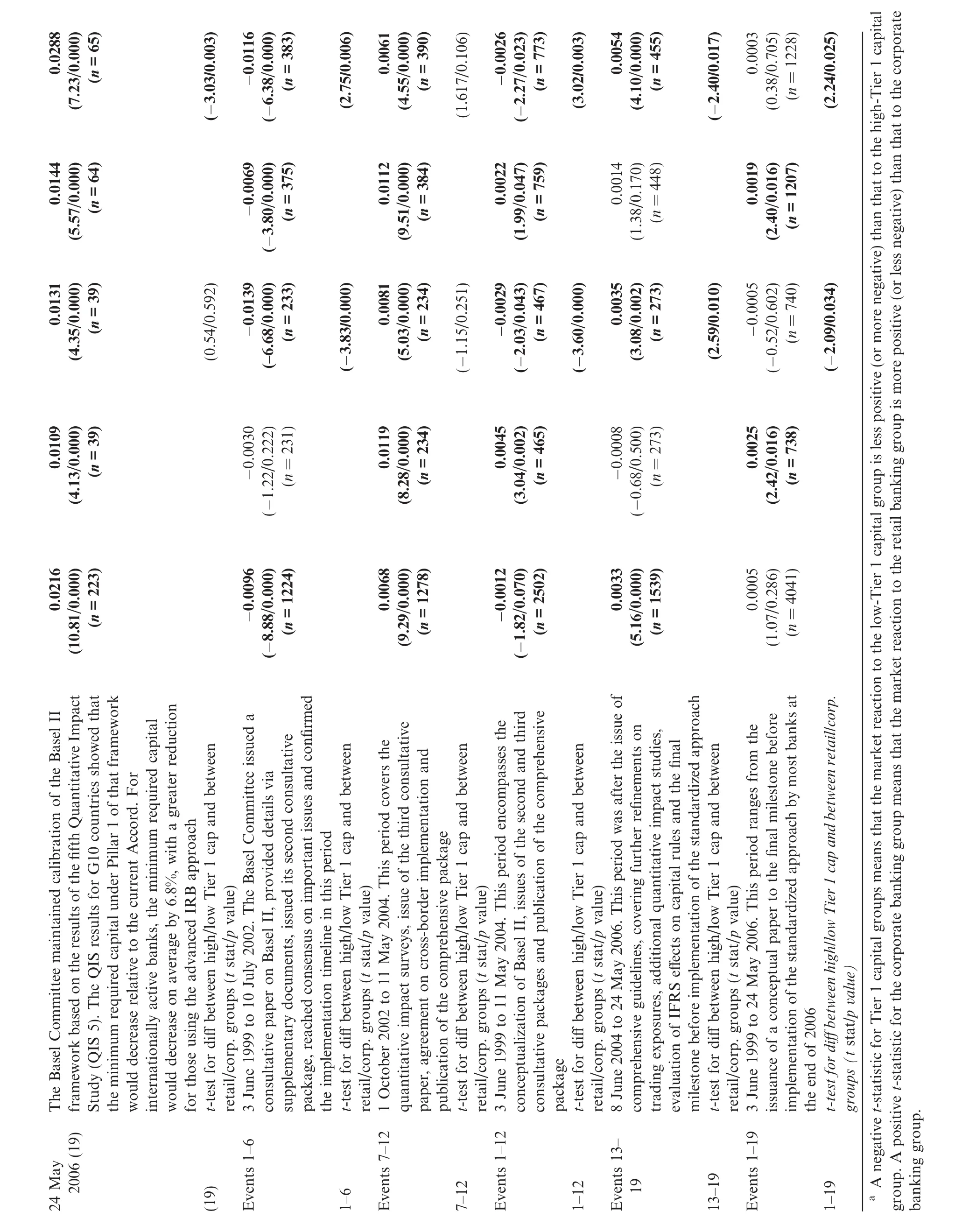

Source:Bank of America 2007 Annual Report Note 22

The following tables present total revenue,net of interest expenses,on an FTE basis and net income for 2007,2006 and 2005,total assets as of 31 December in 2007 and 2006 for each business segment and all other items

(1)There were no material intersegment revenues among the segments.(2)Total assets include asset allocations to match liabilities(i.e.,deposits).(3)GCSBB is presented on a managed basis with a corresponding offset recorded in All Other.(4)FTE basis.(5)Provision for credit losses represents:For GCSBB–Provision for credit losses on held loans combined with realized credit losses associated with the securitized loan portfolio and for All Other–Provision for credit losses combined with the GCSBB securitization offset.

Ahmed,A.S.,Takeda,C.,Thomas,S.,1999.Bank loan loss provisions:a re-examination of capital management,earnings management and signaling effects.J.Account.Econ.28,1–25.

Altman,E.I.,Sabato,G.,2005.Effects of the new Basel Capital Accord on bank capital requirements for SMEs.J.Financial Services Res. 28(1/2/3),15–42.

Barth,J.R.,Caprio,G.,Levine,J.R.,2013.Bank Regulation and Supervision in 180 Countries From 1999 to 2011.Working Paper, Auburn University.

Basel Committee on Banking Supervision(Basel),2006.International Convergence of Capital Measurement and Capital Standards.Bank for International Settlements,Basel.

Beatty,A.,Chamberlain,S.L.,Magliolo,J.,1995.Managing financial reports of commercial banks:the influence of taxes,regulatory capital and earnings.J.Account.Res.33,231–261.

Beatty,A.,Liao,S.,2011.Do delays in expected loss recognition affect banks’willingness to lend?.J.Account.Econ.52 1–20.

Beaver,W.H.,Engel,E.E.,1996.Discretionary behavior with respect to allowances for loan losses and the behavior of security prices.J. Account.Econ.22,177–206.

Berger,A.N.,2004.Potential Competitive Effects of Basel II on Banks in SME Credit Markets in the United States.Federal Reserve System Working Paper.

Bushman,R.M.,Williams,C.D.,2012.Accounting discretion,loan loss provisioning,and discipline of banks’risk-taking.J.Account. Econ.54,1–18.

Collins,J.H.,Shackelford,D.A.,Wahlen,J.M.,1995.Bank differences in the coordination of regulatory capital,earnings and taxes.J. Account.Res.33,263–291.

Costello,A.,Granja,J.,Weber,J.,2016.Do strict regulators increase the transparency of the banking system?Working Paper,Sloan School of Management.

Cummings,J.R.,Durrani,K.J.,2014.Effect of the Basel Accord Capital Requirements on the Loan-Loss Provisioning Practices of Australian Banks.Working Paper,Macquarie University.

Dermine,J.,2015.Bank Valuation.Value-based Management,second ed.McGraw Hill Education,New York.

Elizalde,A.,2007.From Baselito Basel II:an Analysis of the Three Pillars.CEMfiWorking Paper No.0704.

Francis,J.,LaFond,R.,Olsson,P.M.,Schipper,K.,2004.Costs of equity and earnings attributes.Account.Rev.79,967–1010.

Gebhardt,G.,Novotny-Farkas,Z.,2011.Mandatory IFRS adoption and accounting quality of European banks.J.Bank.Finance 38(3–4),289–333.

Gordy,M.B.,Howells,B.,2006.Procyclicality in Basel II:can we treat the disease without killing the patient?J.Financial Intermed.15, 395–417.

Jacques,K.T.,2008.Capital shocks,bank asset allocation,and the revised Basel Accord.Rev.Financial Econ.17,79–91.

Kanagaretnam,K.,Lobo,G.J.,Yang,D.,2004.Joint tests of signalling and income smoothing through bank loan loss provisions. Contemporary Account.Res.21,843–884.

Kohler,M.,2013.Does Non-Interest Income make Banks More Risky?Retail-Versus Investment-Oriented Banks.Deutsche Bundesbank Discussion Paper,No.17/2013.

Liu,C.,Ryan,S.G.,1995.The effect of bank loan portfolio composition on the market reaction to and anticipation of loan loss provisions. J.Account.Res.33,77–94.

Perez,D.,Salas-Fumas,V.,Saurina,J.,2008.Earnings and capital management in alternative loan loss provision regulatory regimes.Eur. Account.Rev.17,423–445.

Salas,V.,Saurina,J.,2002.Credit risk in two institutional regimes:Spanish commercial and savings banks.J.Financial Services Res.22, 203–224.

*Corresponding author at:60 Stamford Road,Singapore 178900,Singapore.Fax:+65 6828 0600.

E-mail addresses:chuyeong.lim@singaporetech.edu.sg(C.Y.Lim),kevinowyong@smu.edu.sg(K.O.Yong).

1Fax:+65 6592 1190.

☆We wish to thank Sophia Liu,Gerald Lobo,Chew Ng,Cong Wang,Li Zhang and workshop participants at the 2016 American Accounting Association Annual Meeting,the 2016 Accounting&Finance Association of Australia and New Zealand Annual Conference, the 2016 Annual Conference on Pacific Basin Finance,Economics,Accounting,and Management and the 2016 China Journal of Accounting Research Symposium on Bank Deregulation and Corporate Finance for helpful comments and suggestions.We also thank the School of Accountancy Research Center at Singapore Management University for financial support.This paper won the Best Paper Award at the 2016 China Journal of Accounting Research Symposium.

http://dx.doi.org/10.1016/j.cjar.2016.08.003

1755-3091/?2016 Sun Yat-sen University.Production and hosting by Elsevier B.V.

This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

China Journal of Accounting Research2017年1期

China Journal of Accounting Research2017年1期

- China Journal of Accounting Research的其它文章

- Are academic independent directors punished more severely when they engage in violations?☆

- Employee quality,monitoring environment and internal control

- Economic policy uncertainty,credit risks and banks’lending decisions:Evidence from Chinese commercial banks

- Accounting research in banking–A review