Chinese Investment in CLMV:Before and After the Belt and Road Initiative

By Nisit Panthamit, Hao Nan

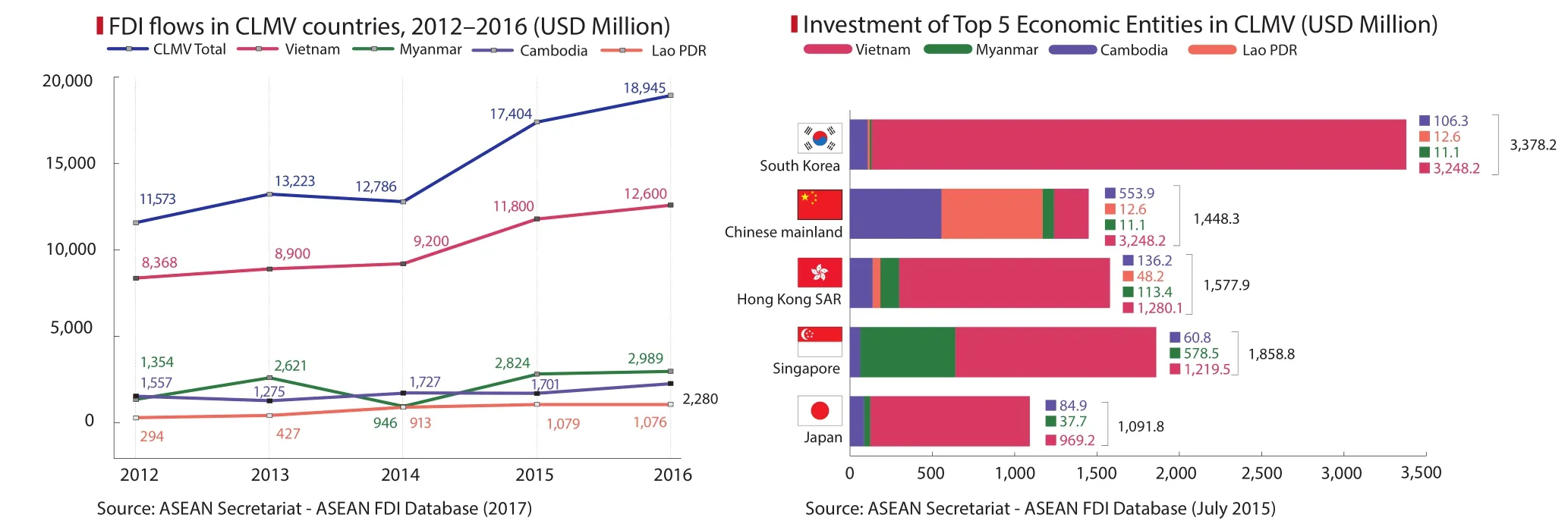

In ASEAN, four late-joining countries—Cambodia,Lao PDR, Myanmar and Vietnam—are frequently grouped together as CLMV due to their many similarities, one of which is a lower development level. However, their great potentials also forecast huge space for development as evidenced by on-going high economic growth. Against the backdrop of these four countries' efforts to promote foreign investment(see Table 1), there has been a competition targeting the above-mentioned potentials that manifest in such aspects as abundant natural resources, large young populations, lower labor costs and growing domestic consumption.

In this investment competition in CLMV, China,South Korea, Japan and Singapore are key players. As the largest investor both in Cambodia and Lao PDR,China takes the overwhelming lead in these two countries. Accelerated by the Belt and Road Initiative(BRI), it is estimated that China will also see its status increasing in the other CLMV countries.

There is no exception for China’s foreign investment—it is governed by the principle of national interest like all the other countries. Since it joined the World Trade Organization, national interest has been increasingly relying on foreign investment.As a result, China has become more and more in fluential in the CLMV as measured by its trade value and investment stock in the region. In addition, the path of economic spill-over effects leading to regional stability and prosperity is also China’s incentive.Chinese border provinces like Guangxi and Yunnan are hugging CLMV.

As illustrated by BRI policy, China is working to connect the Greater Mekong Sub-region, including CLMV countries and Southwest China. The program will go into effect in policy, physical, institutional,financial and psychological aspects. For now, Guangxi and Yunnan have been designated as gateways to ASEAN, which, in fact, is more accurately to CLMV due to both sides’ direct geographical links. A railway from Kunming, capital city of Yunnan, to Singapore is under development.

Implementation of the project is not as easy as it might seem on paper. Booming trends shows that China has strong capacity and great potential to launch economic cooperation. However, cooperation can never be carried out smoothly if either side has any suspicions. The major concern is that China’s programs may have purposes other than economic ones, such as seeking military in fluences in the region.In fact, President Xi Jinping eases these concerns by announcing that implementation of the BRI will never intervene in the internal affairs of other countries, nor pursue hegemony. Economic and political change will still happen, but that is not the purpose. It remains up to CLMV countries to choose how to adapt to such changes.

Chinese FDI in CLMV

The tight investment cooperation between China and Cambodia can be largely attributed to their excellent diplomatic relations. In addition to the political trust,other factors include Cambodia’s low labor costs,abundant natural resources, political stability, good macroeconomic environment, shared Asian values and strategic position in Southeast Asia. A manifestation of the tight cooperation was the adoption of a bilateral investment protection and promotion agreement that entered into force on August 19, 1999.

China’s investment in Cambodia varies in terms of the ownership of assets. China’s state-owned enterprises focus on energy and natural resources. Meanwhile,Chinese private companies are investing in textiles,tourism, agriculture and other light industries, all of which play an important role in local socio-economic development by creating employment opportunities for over half a million Cambodian workers. From 1994 to 2016, investment capital from China totaled about$14.7 billion concentrated in four sectors: agriculture and agro-industry, the industrial sector, physical infrastructure and services and tourism.

Investment cooperation between China and Lao PDR consists of projects in development aid, infrastructure construction, hydroelectric, mining, agriculture and other realms. In development aid, China played an important role in supporting the economy of Lao PDR during and after the Asian financial crisis of 1997. From thefinancial aspect, support has come in the form of cash grants, interest-free loans from the Chinese government and commercial loans from Chinese companies as well. For some Chinese governmental loans to infrastructure construction projects, China canceled loan repayment to make them foreign aid.

FDI in Lao PDR mainly focuses on hydroelectric,mining and the garment industry. China’s FDI in Lao PDR in areas such as food and minerals has risen sharply. China’s FDI also flows to energy,telecommunications and building materials sectors.Most of China’s investment is concentrated in the northern part of Lao PDR along China’s border. China's rapid economic growth has led to increasing demand for mineral resources, agricultural and forestry products that Lao PDR can offer.

Myanmar’s main sources of FDI are Chinese mainland (30.3%), Singapore (27.4%) and Hong Kong(12.2%). Myanmar’s government has set a goal to attract $140 billion by 2030.

After the new government of Myanmar came to power in 2011, reform has opened doors and offered more opportunities for Myanmar and China to cooperate in economic, trade and cultural matters.However, it has also meant uncertainty for economic relations between Myanmar and China. The governments of both sides need to ensure political changes in Myanmar do not threaten bilateral economic ties.

As of March 2017, cumulative Chinese FDI in Vietnam reached $11.19 billion covering 1,616 projects.Chinese investment is primarily found in the processing and manufacturing industry, accounting for 61.4% of total investment capital, followed by production and distribution of electricity, gas, water and air conditioning (18.2%) as well as real estate(5.6%). Binh Thuan Province attracts the most FDI with total registered investment capital of $2.03 billion covering only seven projects which accounts for 18.1% of the total FDI from China.

Conclusion and Suggestion

The expansion of China’s in fluence on CLMV is part of efforts to promote ASEAN economic cooperation. It is proactive diplomacy to seek trade and strategic partnerships with ASEAN by promoting investment. Some suspect that China is trying to leverage in fluence against major powers like the United States. Actually, China has a need to expand its role and in fluence just to maintain its status in Southeast Asia, to which CLMV countries represent a key gateway.

We can see both pushing and pulling forces on China’s entry into these four CLMV countries in which, Lao PDR and Cambodia seem like “brothers”while Myanmar and Vietnam seem more practical and concerned with some obstacles and problems that might arise from historical issues. However,we have to accept that China’s investment makes a bigger impact compared to other foreign countries’investment. The bigger impacts will be to stimulate some countries of CLMV to try to balance economic relations within the ASEAN economy and with players outside the group.

What policy will CLMV countries seek with China?It leaves lots of room for scholars and policy makers from CLMV and the rest of the ASEAN member states to think and act. But one thing that we can share from this paper is that we have to make our own people tangibly benefit from development. Chinese investment is coming. Rejections or reservations are not wise options. We have to face China and find proper ways to welcome Chinese investment to spark our economic development.