Comparative Study on the Development of Urban Basic Medical Insurance in 14 Cities of Liaoning Province

Zhi Yuanyuan,Wang Shuling

(School of Business Administration,Shenyang Pharmaceutical University,Shenyang 110016,China)

Abstract Objective To put forward some suggestions for the development of urban basic medical insurance of Liaoning by comparing the development situations in 14 cities of Liaoning Province.Methods Relevant data of urban basic medical insurance from 2008 to 2018 in 14 cities were collected to make a comparative analysis,and the 5 why analysis chart was drawn to investigate the development differences in 14 cities.Results and Conclusion The average growth rate of the number of urban residents covered by urban basic medical insurance varied greatly from 2014 to 2018.The range of average growth rate of urban residents' medical insurance is 19.1%,and the range of average growth rate of urban workers' medical insurance is 9.1%.Funding standards are basically the same.It is suggested each municipal government should attach importance to this issue.They can make full use of information technology to coordinate with various authorities and ensure the smooth development of medical insurance.Besides,they must actively adapt to their conditions to better develop the urban basic medical insurance of Liaoning.

Keywords:urban basic medical insurance;development of Liaoning;medical insurance difference

With the continuous improvement of material level,people gradually realize that physical health is the foundation of better life.But how to solve the phenomenon of poverty caused by illness is always a difficult problem faced by China's medical reform.In order to reduce the heavy economic burden caused by personal illness,Liaoning Province actively responded to the national policy.In 1999 and 2007,urban workers' basic medical insurance and urban residents'basic medical insurance were established respectively(hereinafter referred to as“workers' medical insurance”and“residents' medical insurance”),which gradually forms the urban basic medical insurance system.In the past decade(2008-2018),the economic development of Liaoning Province was sluggish.The data fraud incidents from 2011 to 2014 shocked the whole country.The real data showed that the Gross Domestic Product(GDP)of Liaoning Province had a negative growth in 2016[1].Meantime,Liaoning Province's natural population growth rate was also negative,averaging about-0.16‰.Besides,the brain drain and aging phenomenon in Liaoning Province are becoming more and more serious.Under this background,the participation of urban basic medical insurance in Liaoning Province(hereinafter referred to as“urban medical insurance”)has experienced negative growth since 2016.The development of urban medical insurance in 14 cities is uneven and polarized,which means some cities are better but others are worse.From 2018,each municipal Healthcare Security Administration(HAS)has been gradually established.How to speed up the handover work between various departments and HSA and promote the effective development of urban medical insurance is one of the urgent problems in the process of medical reform in Liaoning Province.

This paper consulted theStatistical Yearbookof Liaoning Province,the statistical bulletin of national economic and social development,the official website of the statistics bureau,the governments and the human resources and social security bureau,China economic net,and the daily newspapers of 14 cities.Data related to urban medical insurance in 14 cities of Liaoning Province were collected for comparative analysis.The reasons leading to the differences were found out in the development of urban medical insurance in 14 cities,and some suggestions were given to narrow the gap of medical insurance in 14 cities of Liaoning Province.

1 Development of urban basic medical insurance in Liaoning Province

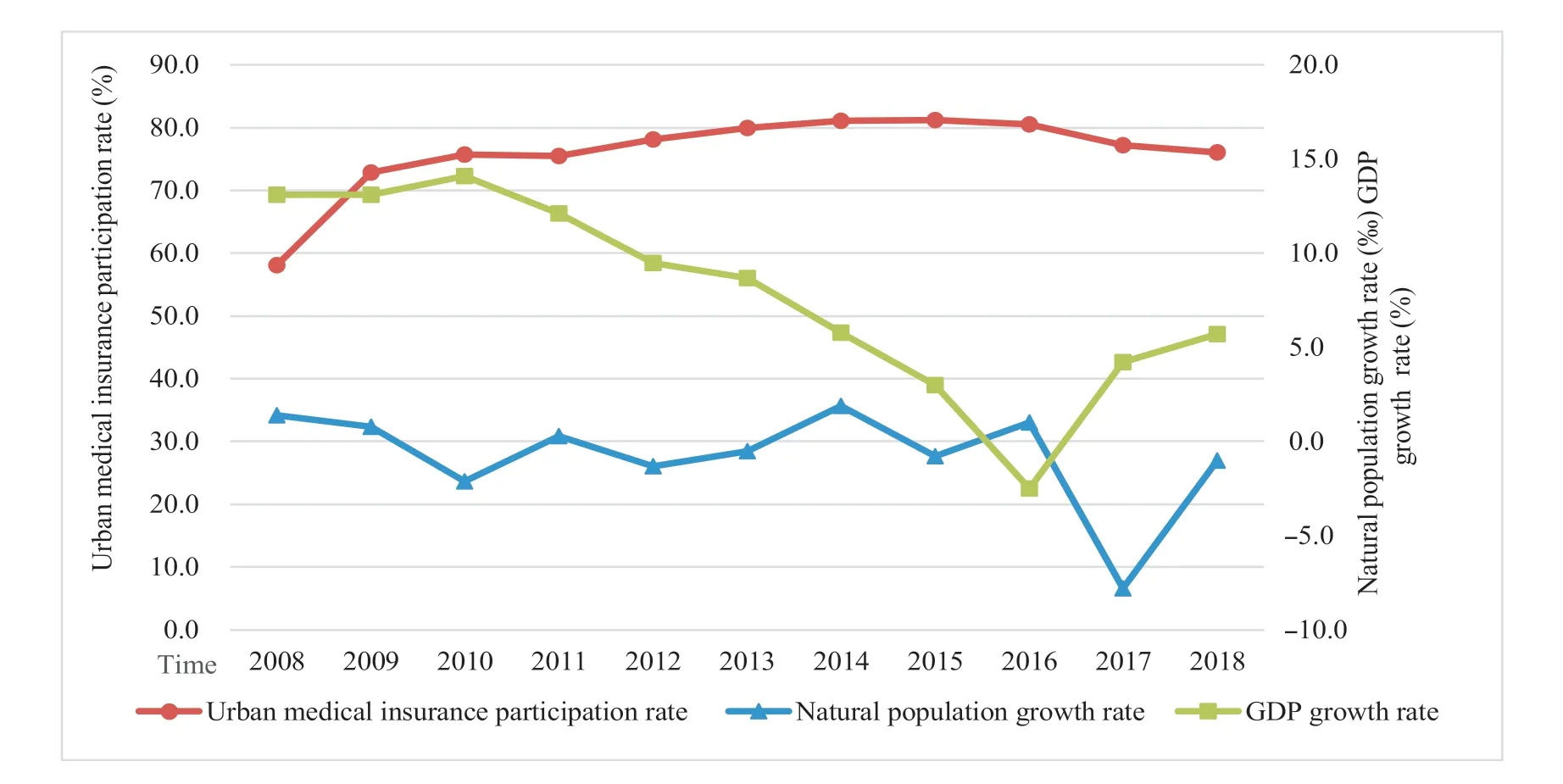

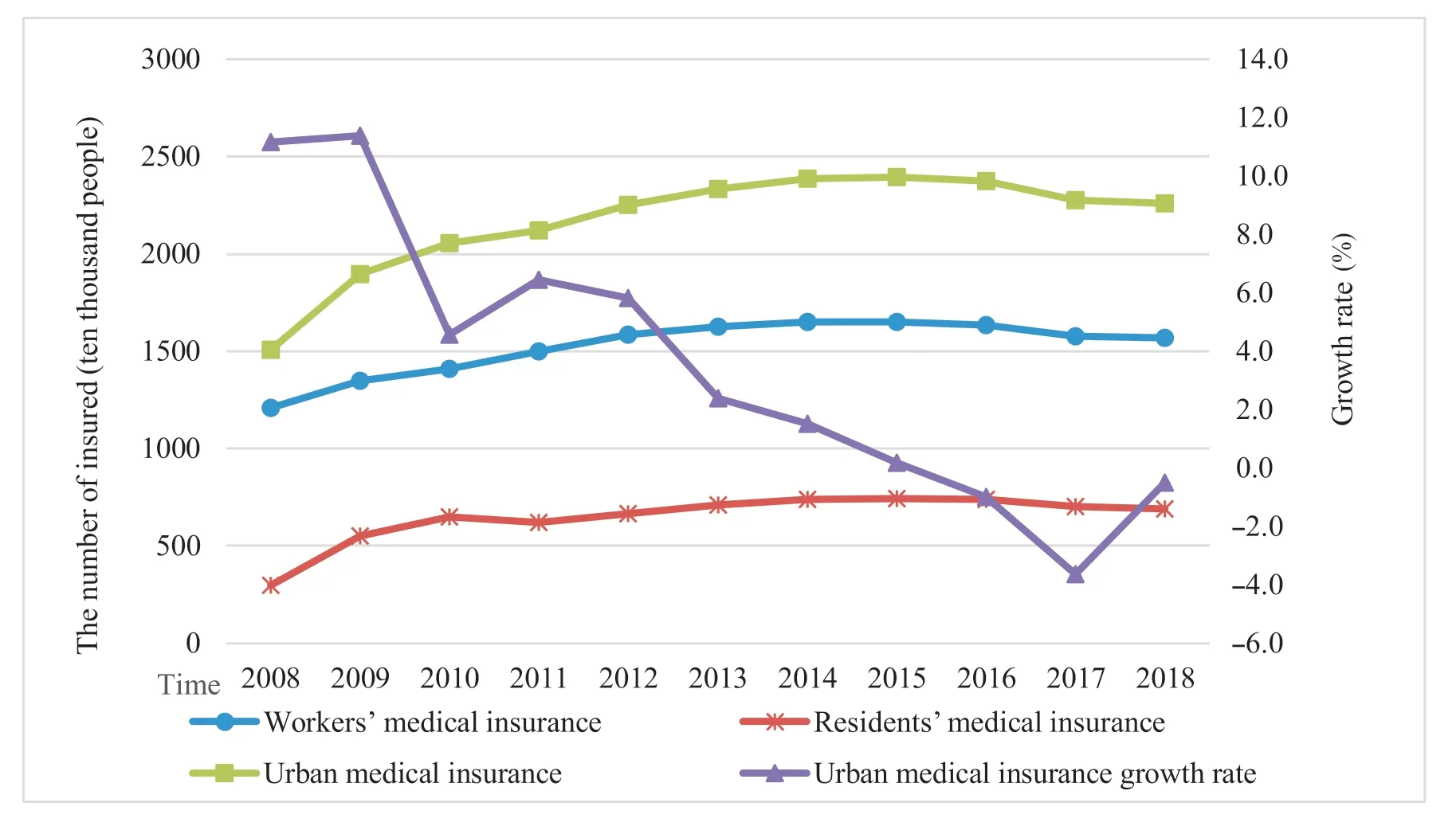

On April 1,1999,the people's government of Liaoning Province issued the Implementation Opinions on the Reform of Workers' Medical Insurance System.In 2007,residents' medical insurance was piloted in Dalian,Shenyang and Huludao.After this,the urban medical insurance system in cities began to take root[2].From 2008 to 2010,the participation rate of medical insurance in Liaoning experienced a rapid growth,and then the number of insured people tended to be stable.Since 2016,negative growth has been seen for three consecutive years,as shown in Fig.1 and Fig.2.This is not only related to the reform and publicity of medical insurance policy,but also closely related to the negative growth of economy,population and talents at the same time.Generally speaking,economy is the fundamental driving force for the development of medical insurance and the improvement of medical and health standards,population base is the necessary guarantee for the growth of medical insurance participation rate,and talents are the catalyst for the overall development of employment rate and medical insurance[3-5].

Fig.1 Comparison chart of urban medical insurance participation rate,natural population growth rate and GDP growth rate in Liaoning Province from 2008 to 2018

Fig.2 The number of workers insured,residents insured and urban medical insurance growth rate in Liaoning Province from 2008 to 2018

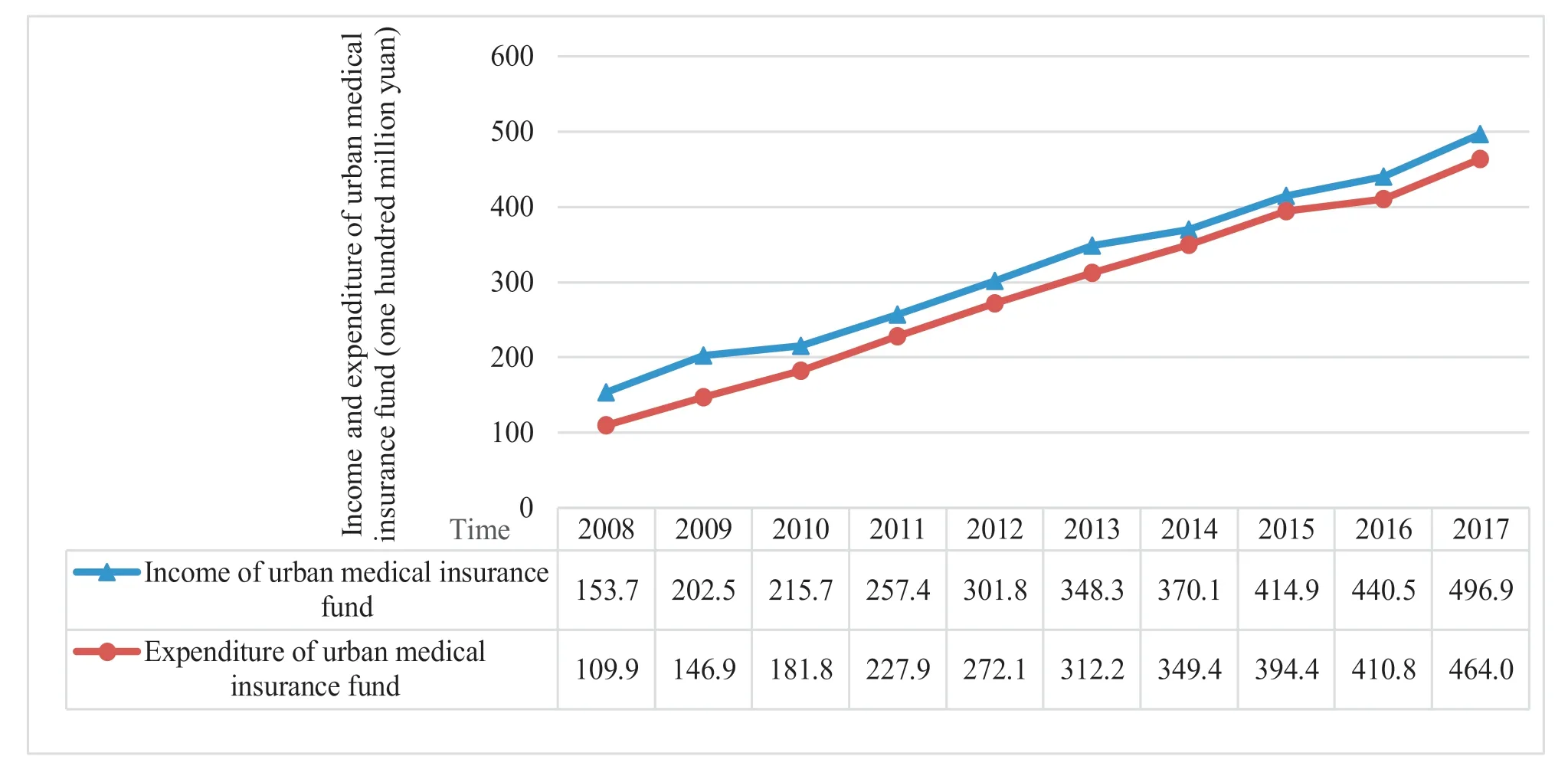

In terms of urban medical insurance fund,from 2008 to 2017,income and expenditure of the fund continued to grow,as shown in Fig.3.By 2017,fund income had more than tripled compared with a decade ago,and the accumulated fund balance reached 45.92 billion yuan,1.6 times than that of 2011.In 2019,government subsidies for residents' medical insurance were increased again,to 520 yuan per person per year,and individual contributions were increased to 250 yuan per person per year.

Fig.3 Income and expenditure of urban medical insurance fund in Liaoning Province from 2008 to 2017

Although the development of urban medical insurance in Liaoning Province has entered a bottleneck period since 2016,the reform has continued.In 2017,Liaoning further deepened the reform of payment methods and medical treatment in other cities.In 2018,HAS of Liaoning,a body directly under the provincial government,was officially established,and the“super HAS”began to make overall coordination in Liaoning Province.In 2019,Shenyang and Dalian,two pilot cities,began to explore the mechanism of centralized drug procurement in response to the Pilot Program of Centralized Drug Procurement and Use Organized by the State.By the end of 2018,Liaoning had 36 002 health institutions,with 315 000 beds,and a total of 200 million medical visits.There were 15.681 5 million workers and 6.904 5 million residents who participated in the medical insurance system,and the participation rate of urban medical insurance was about 76 %[6].

2 Comparison of the development of urban basic medical insurance in 14 cities of Liaoning Province

2.1 Development of economy and population in 14 cities of Liaoning Province

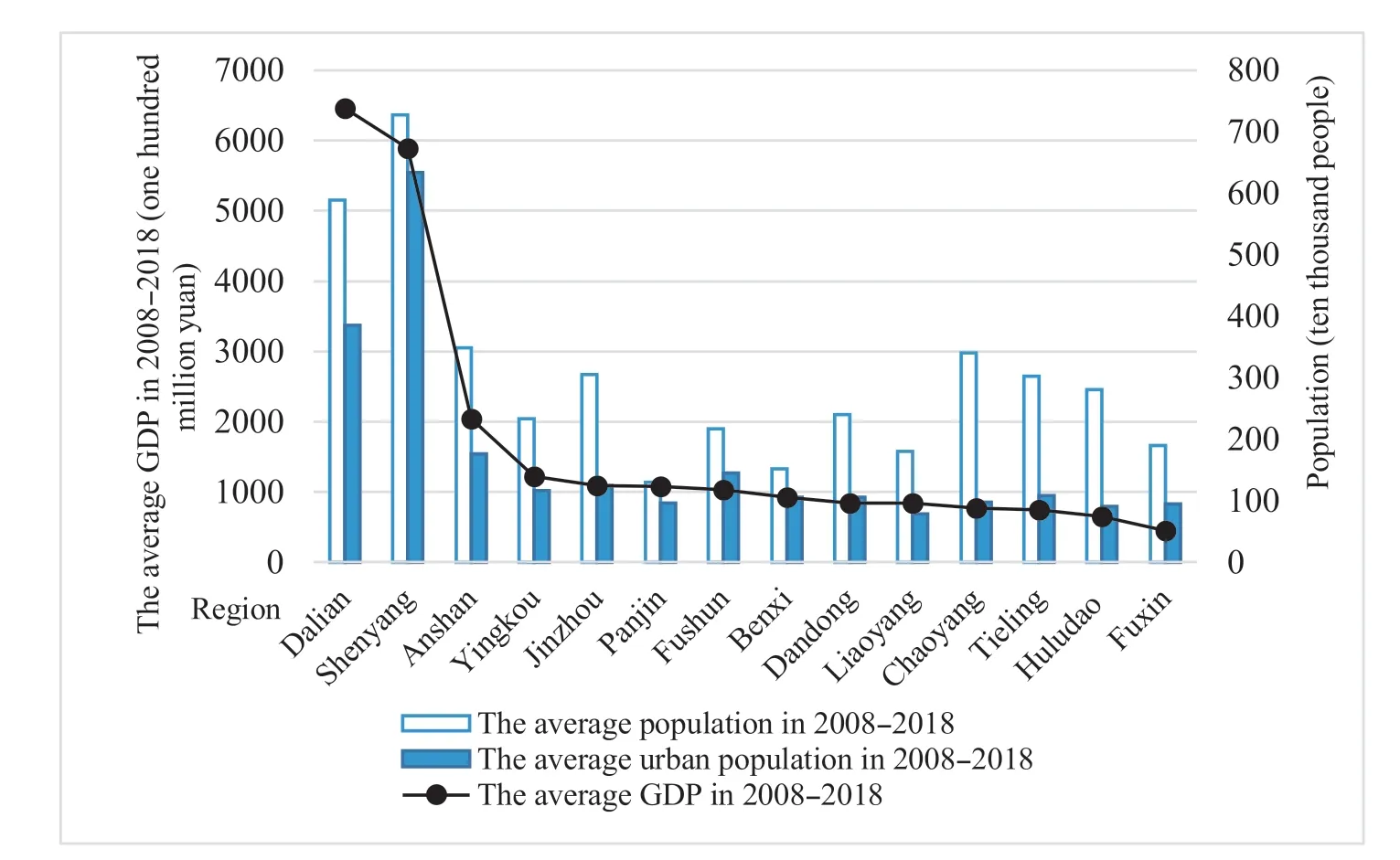

Liaoning has a total of 14 cities,with great differences in economy,population,medical care,personnel training,and urbanization.It has formed a situation of“one super city,one strong city,one average city and other weak cities”.One super city means Dalian,one strong city means Shenyang and one average city means Anshan.According to statistics of Liaoning Provincial Bureau,in terms of economy,from 2008 to 2018,one super city and one strong city contributed more than 50% to Liaoning's GDP on average,Anshan's GDP was basically in line with the provincial average,and Fuxin and Huludao ranked the last two.In terms of urbanization,the percentage of urban population in Shenyang and Panjin(hereinafter referred to as“U/T”)has been the top two for ten years.By 2018,Shenyang,Dalian,Panjin and Benxi's U/T are over 70%,as shown in Fig.4.In terms of population,the natural population growth rate of Fushun,Jinzhou,Fuxin,Tieling and Huludao exceeded-12% in 2017.Except for Chaoyang,the aging population in other cities exceeded 20%,and Jinzhou,Fushun and Dalian were the most serious(over 25%).

Fig.4 Comparison chart of economic and population development in 14 cities of Liaoning Province from 2008 to 2018

It can be seen that 14 cities in Liaoning Province have great differences in the development of economy and population.Therefore,the discussion cannot be measured by the same fixed standard,and the evaluation should be made after combining the basic situation of each city.

2.2 Development of urban basic medical insurance in 14 cities of Liaoning Province

As to the urban medical insurance fund income and expenditure,Shenyang and Dalian have developed rapidly.In 2017,the income of urban medical insurance fund in Shenyang was about 4 times that of 2008,and the fund expenditure was about 5 times that of 2008.The development of Benxi and Anshan is the slowest.The fund income of the two cities in 2017 was about 2.2 times that of 2008,and the fund expenditure was about 2.8 times that of 2008,as shown in Fig.5.

Fig.5 Income and expenditure of urban medical insurance fund in 14 cities of Liaoning Province in 2008 and 2017

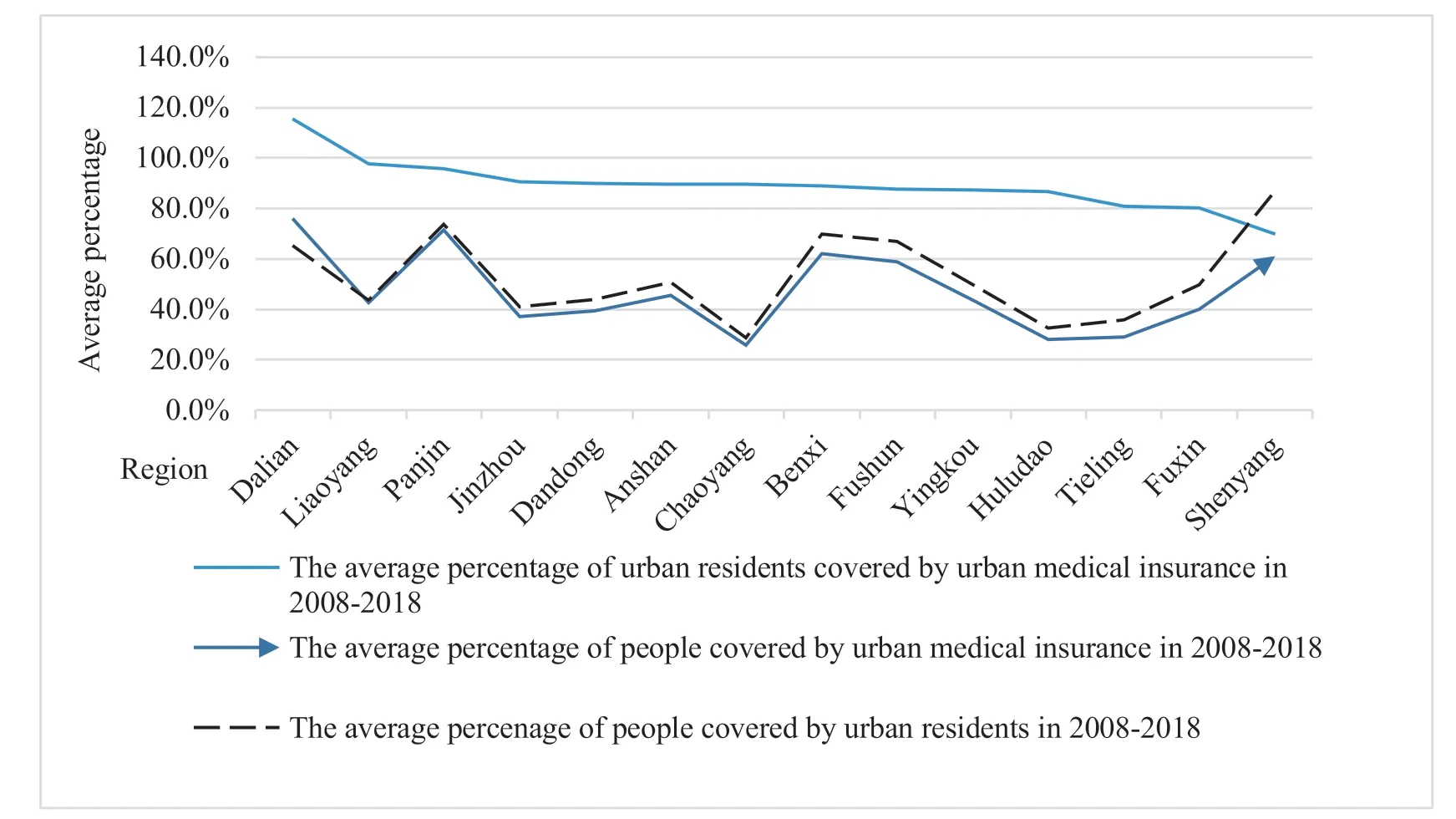

In terms of the number of insured people,Dalian and Shenyang have the largest number,but they also have the largest number of total population and urban population.Therefore,the average percentage of urban population covered by urban medical insurance(hereinafter referred to as“P/U”)and the average percentage of total population covered by urban medical insurance(hereinafter referred to as“P/T”)were counted in the ten years from 2008 to 2018,as shown in Fig.6.

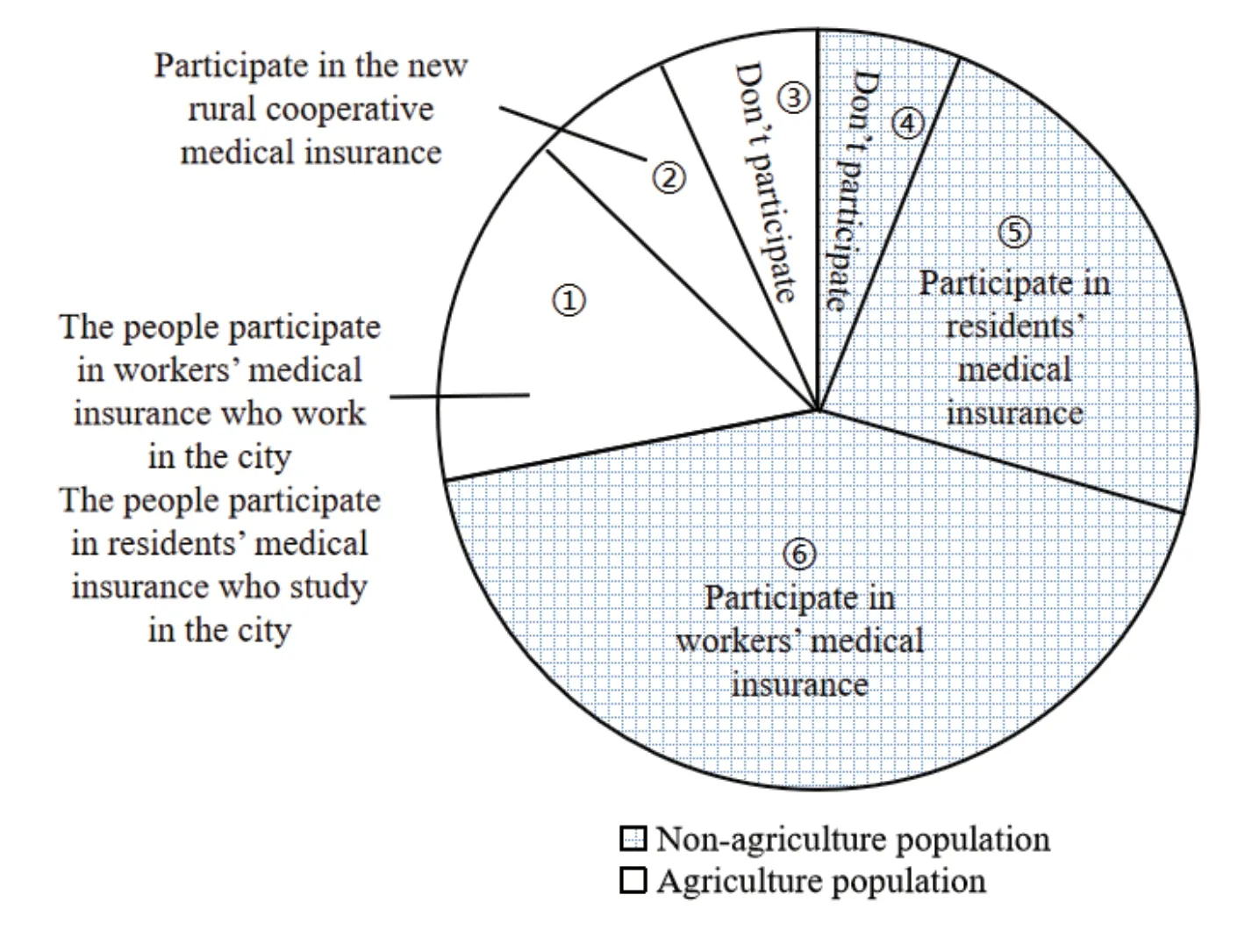

It can be seen from Fig.6 that U/T and P/T have the same trend basically,except for Shenyang and Dalian.Besides,Dalian's average P/U is more than 100%.By 2018,P/U in Dalian,Liaoyang and Chaoyang all exceeded 100%.This phenomenon is actually determined by the participants of urban medical insurance,as shown in Fig.7.Normally the medical insurance participation rate should be based on the region's resident population.Because the permanent population data is the urban registered population(unless specified in the text,the statistics of the regional population are registered population).That's P/U.According to Fig.7,Participation rate=The number of people covered by urban medical insurance(①+⑤+⑥)/(①+④+⑤+⑥)The number of people who should be covered by urban health insurance.While P/U=The number of people covered by urban medical insurance(①+⑤+⑥)/(④+⑤+⑥)Urban population.

Fig.6 Urban medical insurance coverage in 14 cities of Liaoning Province from 2008 to 2018

Fig.7 Relation chart of insured people and registered population

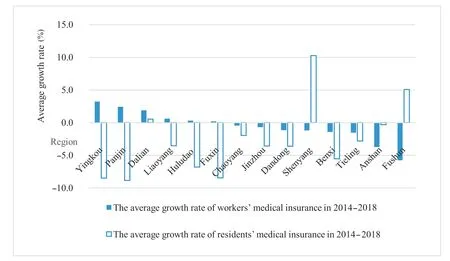

It is not difficult to explain many of the phenomena in Fig.6.First of all,P/U is more than 100%(or P/U is high in less developed areas,such as Liaoyang),though most people have agricultural household registration in this region,a large number of them with agricultural household registration work or study in cities and participate in urban medical insurance,which makes the numerator of P/U in this region grow.Second,although Shenyang ranks the top in the number of people participating in urban medical insurance,P/U has dropped below 70%.This is because,compared with other regions,Shenyang has the highest U/T,with a large urban population,and many people do not participate in the urban medical insurance.While the number of people with agricultural household registration is small,and fewer of them work or study in other cities and participate in the urban medical insurance.This leads to the lowest P/U.Finally,through the above analysis,it is found that P/U and P/T are largely related to the urbanization level,urban-rural integration and communication of a region.So it is not possible to evaluate the advantages and disadvantages of the development of urban medical insurance in a region directly.The average growth rate of urban medical insurance was studied in 14 cities during the five years from 2014 to 2018,as shown in Fig.8.The data of insurance participation in Dalian,Benxi and Tieling in 2018 was not released,so the growth rate in 2018 is estimated according to the five-year average.Over the past five years,the average growth rate of the number of workers'medical insurance has been negative in more than half of the cities,among which Yingkou has the highest annual growth rate of 3.3% and Fushun has the lowest(-5.8%).In the past five years,except for Shenyang and Fushun,the average growth rate of residents'medical insurance in other cities was negative.Shenyang has the largest growth rate(10.3%),Fushun followed closely(5.1%),and Panjin had the lowest(-8.8%).

Fig.8 The average growth rate of urban medical insurance in 14 cities from 2014 to 2018

2.3 Comparison of fund-raising standards of urban basic medical insurance in 14 cities of Liaoning Province

According to the above data,we make a comparative analysis of“one good city,one average city and one bad city”.Yingkou,a city with relatively rapid development of workers' medical insurance;Fuxin,a city with an average growth rate of about 0;and Fushun,a city with relatively slow development,were randomly selected.Then,we compare and analyze the three cities.Similarly,Shenyang,Anshan and Panjin were selected for the comparative analysis of residents' medical insurance.

2.3.1 Taking Yingkou,Fuxin and Fushun as examples to compare and analyze the Fund-raising standards of workers' medical insurance

Firstly,the economic level of Yingkou and Fushun is similar,and Fuxin is relatively backward.Secondly,according to the above analysis,the development of Yingkou workers' medical insurance is good.In 2018,the growth rate of the number of workers covered by medical insurance in Yingkou was 8.9%,and the average growth rate from 2014 to 2018 was the highest in Liaoning Province.On the contrary,in 2018,the growth rate of the number of workers covered by medical insurance in Fushun was-8.7%,and the average growth rate from 2014 to 2018 was the lowest in Liaoning Province.We collected data on financing standards and compensation methods of the three cities for a comparison,as shown in Table 1.

Table 1 Financing standard and compensation method of urban workers' medical insurance in Yingkou,Fuxin and Fushun

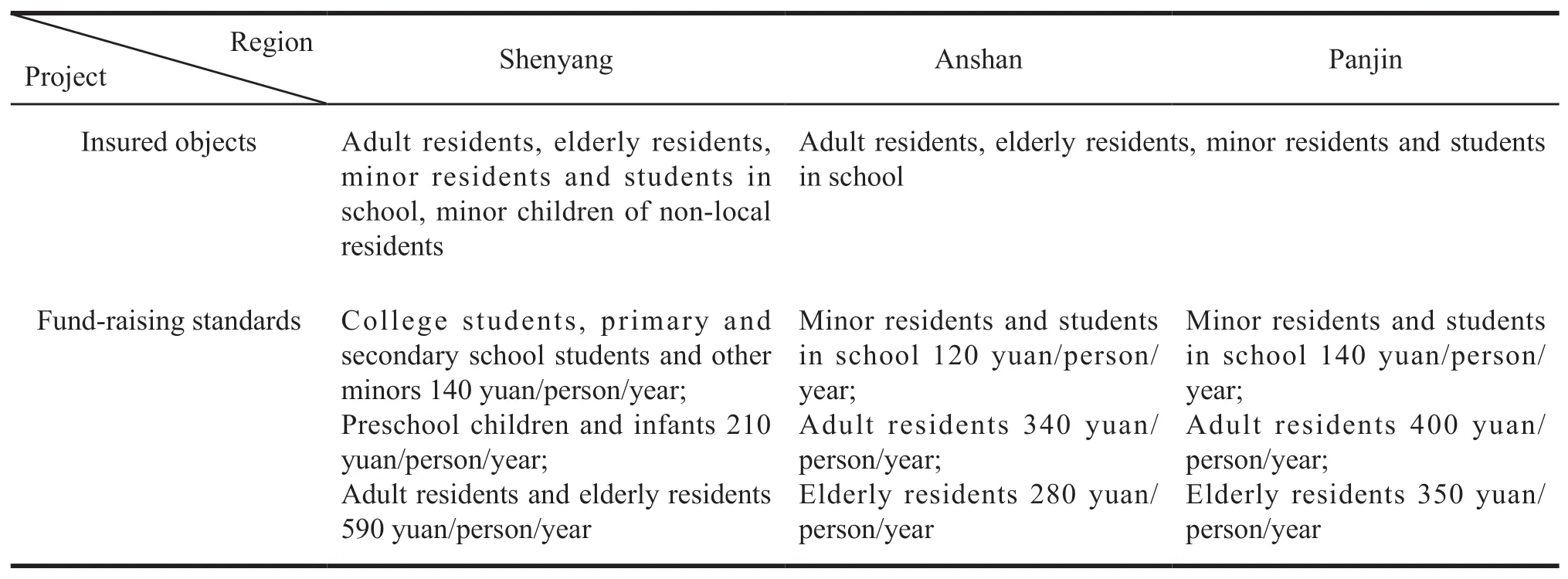

2.3.2 Taking Shenyang,Anshan and Panjin as examples to compare and analyze the Fund-raising standards of residents' medical insurance

From 2014 to 2018,the number of residents covered by medical insurance was positive,with an average growth rate of 10.3%.Although workers'medical insurance work was outstanding in Panjin,the number of residents covered by medical insurance was negative,and the negative growth rate increased year by year,reaching-20.3% in 2018.In addition,minor children of nonlocal residents are included in the insurance coverage in Shenyang,and the payment standards for preschool children and infants are more detailed,as shown in Table 2.

Table 2 Insured people and financing standards of urban residents' medical insurance in Shenyang,Fushun and Panjin

3 Analyzing the reasons that affect the differences of urban basic medical insurance in 14 cities by 5 why analysis chart

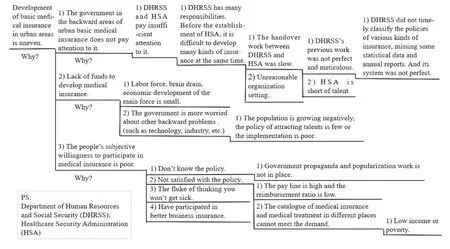

Through the above comparative analysis of one good city,one average city and one bad city it is found that,except for the higher residents' medical insurance fund-raising standards in Shenyang,the fund-raising standards and reimbursement ratio in other cities with rapid or slow development of urban medical insurance are not significantly different.Fushun and Panjin had the phenomenon of unbalanced development.Fushun residents' medical insurance performance is excellent,but the workers' medical insurance is not good.Panjin is just the opposite.Why does development vary so widely despite similar fund-raising standards?Fig.9 is drawn for the analysis by using 5 why analysis chart.

Fig.9 Five why analysis chart of differences in urban basic medical insurance in 14 cities

3.1 Government's resolution

As a macro-regulator,the government's resolution to urban medical insurance is one of the key factors for its smooth development.If the government does not take it seriously,the enthusiasm of subordinate departments will be greatly weakened.Meanwhile,in 2018,the state reformed medical insurance institutions,and super HSA was set up in various cities.This brings new challenges to the transformation of medical insurance.Whether the urban medical insurance can be separated from Department of Human Resources and Social Security(DHRSS)and the handover work can be done well is not only a test for the DHRSS and HSA,but also an inspection of the previous work of DHRSS.Taking the official websites of the six municipal HSA and DHRSS as examples,we collected the policies and regulations from 2008 to 2018.There are 95 policies and regulations in Shenyang,75 in Yingkou,72 in Panjin,30 in Anshan(from December 2015 to December 2018),and 11 in Fushun.There are no documents related to medical insurance policies on the official website of Fuxin DHRSS(the above information comes from“policies and regulations”and“social insurance”columns of Shenyang HSA and municipal DHRSS).We can see that there is a huge gap.Shenyang is the only city that has established the official website of HSA in Liaoning Province.What's more,its website is more perfect than the website of the Liaoning HSA.In the official website of Shenyang HSA,the detailed classification of various policies,guidelines for handling affairs,medical insurance lecture hall,interactive platform,information consultation and so on are available,which is very convenient for the public.The urban medical insurance information of the other five cities is still published on the official websites of DHRSS,and the construction of the official website of the municipal DHRSS varies greatly.(1)From the official website homepage,the content of the official website homepage of the municipal DHRSS is rich,covering a comprehensive subject.The main tone is blue,more official.Fushun's official website is colorful and more user-friendly.There are few columns on Yingkou's official website.(2)From the perspective of policies and regulations,although Panjin and Yingkou have more policies,they are not timely updated and involved all aspects.Besides,they have not classified the policies clearly,which means that they mix endowment insurance,industrial injury insurance and others together.(3)From the perspective of convenience,Yingkou has established the“8890”service platform,which can respond to people's complaints 24 hours a day,but the online service of the official website is worse than other cities.Besides the entrance of individuals and units,the entrance of designated medical institutions and collaborative office are also added on the official website of Fushun.(4)According to the statistical data,Shenyang DHRSS released the annual work summary and quarterly insurance coverage on time,while the other five cities did not release it.Compare with other cities in Liaoning Province,Dalian did a better job in statistics.

From the construction of official websites of municipal DHRSS and HSA,it can be seen how much a region attaches great importance to urban medical insurance.The frequency of policy updates,the aspects involved in the policy and the convenience of online services reflect the overall development level of urban medical insurance in this region.Therefore,to develop urban medical insurance,the government must have resolution first.

3.2 Medical insurance funds are used differently

As the superstructure of urban medical insurance,the medical insurance fund and government appropriation are undoubtedly the material basis.Therefore,according to P/T,14 cities are divided into three grades(>60%,40%-60%,<40% three grades).Three representative cities are selected from each grade and they are Dalian,Anshan and Chaoyang.Then their social security,employment,medical and health budget expenditure,medical insurance fund income and participation in 2017 were compared.The medical insurance fund income of Dalian,Anshan and Chaoyang was 25.8 billion yuan,11 billion yuan and 8.9 billion yuan respectively.Their budgetary expenditures for social security,employment,and medical and health care were 13.3 billion yuan,2.4 billion yuan and 1.4 billion yuan respectively.It can be found that the insurance participation in these three cities is positively correlated with the government budget expenditure and the income of medical insurance funds.Moreover,the disposable income and urbanization rate of urban residents in these three cities also declined successively.

The importance attached to talents and the priority to develop medical security system is the key factors affecting medical insurance funds.The shortage of talent can cause local economic development to lag behind.A shortage of medical and social security professionals can slow down the pace of reform and innovation in local cities.When the whole city does not have vitality,the government usually chooses industry,agriculture,and science and technology as the priority objects of development.While medical insurance is in a passive position.This is more obvious in the current economic background of Liaoning Province.That is why there is the situation of good becomes better,bad will be worse.

3.3 People's willingness to participate in medical insurance varies

The willingness of the masses to participate in medical insurance depends not only on their economic ability,education and their trust in the government,but also on the propaganda intensity and the method of the government.With the rapid development of information technology,it is necessary to make full use of network.At present,only Shenyang has established mobile phone software application about medical insurance in Liaoning Province.Shenyang smart medical insurance application includes medical insurance card management,account inquiry,insurance payment,long-distance filing and other convenient services such as online drug purchase and appointment for medical treatment.Liaoyang launched the first electronic medical insurance card in Liaoning Province in December 2018,which mainly includes such functions as medical insurance settlement,selfservice inquiry and payment[7].By the end of 2018,DHRSS APP was available in all cities except Anshan and Jinzhou.The publicity and convenient services of urban medical insurance are reflected in the APP,which places more emphasis on industrial and commercial insurance and endowment insurance.However,most of them only provide the installation package of android system.In some areas,the DHRSS APP cannot be opened at all,and the system update is slow too.

4 Suggestions on narrowing the gap in the development of urban basic medical insurance in 14 cities

4.1 Increasing the resolution of the government

Liaoning local municipal governments should pay more attention to the development of urban medical insurance.In addition to increasing medical insurance subsidies within the disposable scope,they should also implement policies to improve the coordination.The policy should focus on the settlement of urban medical insurance funds in different cities,the integration of medical insurance for urban and rural residents,and the reform of compound payment mode,etc.When the policy is issued,the policy interpretation should be released to avoid too many obscure professional words.The policy should be explained to the public with easyto-understand language and pictures after sorting out the key points such as the purpose of the policy,the content of improvement,the way of implementation,the relevant departments involved and the people benefiting from it.At the same time,all regions should actively learn from the cities with rapid development of urban medical insurance nationwide.We should set up pilot projects to carry out reform in line with our own conditions.We should abandon the mentality that we will not start the reform until we are notified.

4.2 Making full use of information technology

Each local city should make good use of the Internet technology to establish the official websites of DHRSS and HSA.The official websites of HSA should contain such basic contents as policies and regulations,policy interpretation,guidelines for handling affairs,openness of government affairs,information inquiry,long-distance medical treatment,and designated medical institutions of medical insurance,etc.Policies and regulations should cover documents issued by the State,provinces and local cities.And then they should be classified according to the types of medical insurance,which can be further classified according to insurance and treatment.This can help the public and other departments to timely understand the development of urban medical insurance and superior instructions.We should continue to enrich the information of object and classification guidelines for residents and medical institutions to have information inquiry.Mobile application can be released in time,and WeChat official account can be established in combination with existing platforms(such as Alipay)to carry out policies.The maintenance of the online service platform and the new media medical insurance platform should be enhanced.Meanwhile,opinions from various parties must be collected actively to improve the platform.Besides,the hot issues concerned by the masses should be responded in time.These methods will facilitate the popularization of medical insurance policies among the masses.

4.3 Coordinating with all departments

In 2018,HSA was established in different local cities.In terms of urban medical insurance,the handover between DHRSS and HSA should be completed as soon as possible.To some extent,the more complete the DHRSS's work is,the easier it will be for HSA to carry out the reform.Before the handover is completed,DHRSS should still share the burden of medical insurance with HSA.At present,relevant contents of urban medical insurance have been completely excluded from the Statistical Bulletin on the Development of Human Resources and Social Security in 2018 released by Liaoning DHRSS in July 2019.On the website of Liaoning HSA,the Statistical Bulletin on the Development of Medical Insurance in 2018 and the Budget and Final Accounts of Medical Insurance Fund in 2018 have not been published.The information of urban medical insurance in 14 cities is mixed in the websites of various government departments,and there are also great differences in the processing methods of information disclosure.Besides DHRSS,the Financial Bureau,Health Commission and other relevant departments should also actively carry out the handover work.Otherwise it will greatly slow down the development of HSA and urban medical insurance.

4.4 Guaranteeing the service of urban medical insurance

All related departments should work together to guarantee the urban medical insurance and.Just as a rising tide raises all boats,all the efforts from the society should not be ignored.At the same time,publicity work is important as well.If the publicity content is simple and comprehensive,and the publicity mode is easy to spread,more people will know about urban medical insurance and participate in it.For the residents' medical insurance,the publicity of communities,schools and hospitals is vital.Regular lectures on urban medical insurance popularization and posters can be selected for publicity.It is worth mentioning that at present,the medical insurance financing mode,reimbursement ratio and guidelines of college students in Liaoning need to be refined.To a certain degree,health policy details,such as the reimbursement ratio can affect the medication of college students.The subtle influence of medical treatment and college students' evaluation of the development of a city ultimately affect the talents'choice for employment.It will also determine the loss of talents in Liaoning.Therefore,student medical insurance policy should be improved.

4.5 Actively adapt to Liaoning's development environment

The recession in the Northeast has been worse in recent years.In September 2018,President Xi Jinping paid another visit to northeast China and put forward six proposals for revitalizing the region.The first five aspects are related to economy,science and technology,coordinated development,natural environment and free trade.For urban medical insurance,these are exactly the foundation mentioned above.The sixth proposal points to the shortcomings of the people's livelihood,emphasizing that the people should share the results of the reform[8].Liaoning must firmly grasp the opportunities to deepen reform and revitalize its economy comprehensively.Urban medical insurance in Liaoning must adapt to the development pace of the whole province.The use of funds should be balanced and attention should be paid to the new development trend of the whole province in real time.Urban medical insurance is an important part of people's livelihood.If we can solve the problem of medical insurance,people will enjoy their life better.

Liaoning is in an era of revival.Although the reform is like rolling stone gathering up the hill,the enthusiasm for development cannot be held back.Liaoning urban medical insurance is one of the most important reforms.Though 14 cities are experiencing mixed development,they must have the confidence.There are some developed cities in China such as Beijing,Shanghai and Nanjing.There are also some good cities in Liaoning such as Shenyang,Dalian and Panjin.Only all the underdeveloped cities learn from these excellent ones,we can develop urban medical insurance in Liaoning Province better.

Asian Journal of Pharmacentical Sciences2020年1期

Asian Journal of Pharmacentical Sciences2020年1期

- Asian Journal of Pharmacentical Sciences的其它文章

- Information for Authors

- The Analysis of Marketing Strategy of Plendil

- Research on the Transformation of Mapping Method for Cancer Patients' Health Utility in the Asia-Pacific Region

- Pharmacoeconomic Evaluation of Rituximab(Hanlikang)for Patients with Rheumatoid Arthritis

- Application Research of Earned Value Management in New Drug Research and Development Projects

- Compulsory Licensing of Pharmaceutical Patents System from the Perspective of Public Interest-Public Health in China