Briefing on economic operation of China’s garment industry from January to December 2021

Edited by Zhao Xinhua

In December,China’s garment industry continued to recover,production continued to rebound,domestic sales improved steadily,exports maintained rapid growth,enterprise benefits gradually improved,profitability improved slightly,the overall economic operation of the industry was generally stable.Looking ahead to 2022,the external development environment will remain complex,with unstable and uncertain factors intertwined.However,the fundamentals of recovering international market demand and improving domestic economic recovery will not change.Based on the new dual circulation development pattern,the garment industry will implement the general tone of“stability first,progress in stability”,actively implement the development strategy of digital innovation,green and low-carbon,and strive to promote the stable and healthy operation of the industry.

Economic operation of garment industry

Production continued to rebound

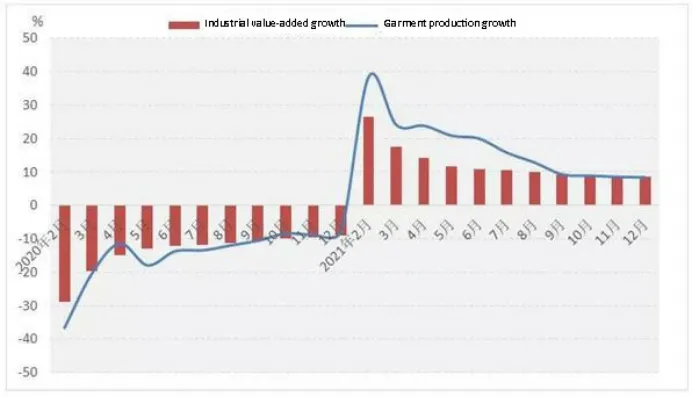

With the strong impetus of positive factors such as the recovery of domestic and foreign market demand and the return of overseas orders,the production growth rate of China’s garment industry gradually stabilized,and the output basically recovered to the pre-pandemic scale.According to the National Bureau of Statistics,from January to December,the industrial value-added of enterprises above designated size in China’s garment industry grew by 8.5 percent year-on-year,17.5 percentage points higher than the same period last year,with a two-year average decline of 0.6 percent (take the same period in 2019 as the base,calculated using the geometric average method,the same below).The garment output of enterprises above designated size reached 23.541 billion pieces,up 8.38 percent year-on-year,16.03 percentage points higher than the same period last year,and a slight increase of 0.04 percent on average in two years.In terms of the output of major garment categories,driven by exports,knitwear production maintained a rapid growth of 10.86 percent,with an average growth of 1.75 percent in two years.While the production of woven garment increased 4.85 percent year-on-year,the two-year average fell 2.34 percent.

Graph 1 Production growth of garment industry in 2021

Graph 2 Sales of garment in domestic market in 2021

Domestic sales improved steadily

In December,driven by the gradual effect of consumption promotion policies,holiday consumption and other factors,China’s garment market sales improved significantly.The decline in retail sales of garment of enterprises above the designated size continued to narrow,and online consumption continued to play a prominent role in driving the domestic market.According to the National Bureau of Statistics,from January to December,China’s retail sales of garment of enterprises above designated size totaled 997.46 billion yuan,up 14.2 percent year-on-year and up 2.4 percent on average in two years,still 0.2 percentage points lower than the growth rate of the same period in 2019.Retail sales of garment of enterprises above designated size fell 1.1 percent year-on-year in December,the decline narrowed by 6.5 percentage points from August.During the same period,online retail sales of garment maintained rapid growth.Online retail sales of wear goods increased by 8.3 percent year-onyear,2.5 percentage points higher than the same period last year,and the two-year average growth was 7.0 percent,still lower than the 8.4 percentage point growth in the same period in 2019.

Exports maintained relatively fast growth

Since 2021,China’s garment export enterprises have overcome many difficulties such as poor logistics,soaring freight costs and rising raw material prices,showing strong resilience in development and maintaining rapid growth in garment export,which has set a record of the highest scale of garment export in the same period since 2016.According to China Customs’data,from January to December,China’s total export of garment and garment accessories reached USD 170.263 billion,up 24 percent year-on-year and up 7.7 percent on average in two years.Driven by increased international market demand and festival promotions,the growth rate of apparel export in December slowed down,but still maintained a double-digit growth rate of 14.5 percent.Of which,the export of knitted garment and garment accessories showed strong growth,with the export of USD 86.472 billion,up 38.96 percent year-on-year,and an average growth of 10.09 percent in two years.The export of woven garment and garment accessories maintained steady growth,with the export of USD 70.115 billion,up 12.59 percent year-on-year and an average growth of 2.56 percent in two years.

Graph 3 Export of garments and accessories in 2021

China’s garment exports to traditional markets play a major driving role,and exports to countries along the Belt and Road maintain rapid growth.According to China Customs’data,from January to December,China’s garment export to the United States was USD 39.555 billion,up 36.22 percent year-on-year,driving the growth of China’s garment export by 7.66 percentage points.China’s garment export to EU,Japan and ASEAN increased by 21.32 percent,6.31 percent and 27.29 percent year-on-year respectively.Garment exports to the above four countries/regions accounted for 58.89 percent of China’s total garment export,driving the growth of garment export by 14.57 percentage points.During the same period,China’s garment export to countries and regions along the Belt and Road increased by 28.46 percent year-on-year,driving the garment export growth by 6.68 percentage points,of which,the garment export to Kyrgyzstan,Saudi Arabia and the United Arab Emirates increased by 252.33 percent,44.68 percent and 67.27 percent year-on-year respectively.In addition,China’s garment export to South Korea and Australia increased by 22.81 percent and 29.35 percent respectively,and that to Africa and Latin America increased by 26.91 percent and 49.26 percent respectively.

Operation quality and effect gradually improved

Profit growth continued to accelerate,and profitability improved slightly.According to the data of the National Bureau of Statistics,from January to December,there were 12,653 enterprises above designated size (annual main business income of 20 million yuan or more) in China’s garment industry,achieving business revenue of 1,482.336 billion yuan,with a year-on-year growth of 6.51 percent;the total profit was 76.782 billion yuan,up 14.41 percent year-on-year,1.77 percentage points higher than that from January to November;operating income margin was 5.18 percent,0.36 percentage point higher than the same period last year.The quality of industry operation has improved,but the pressure is still large.From January to December,the total assets turnover and the receivable turnover of enterprises above designated size in the garment industry were 1.29 times and 8.08 times per year respectively,3.04 percent and 3.01 percent higher than the same period last year.The operating cost increased by 6.38 percent year-on-year,the ratio of three expenses increased by 0.01 percentage points year-on-year,and the finished products turnover decreased by 2.28 percent year-on-year.

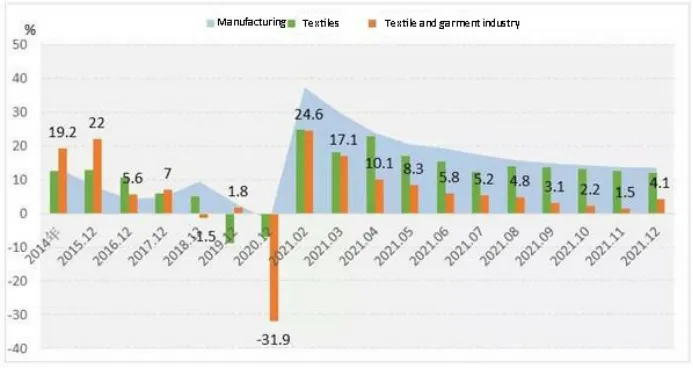

Investment growth picked up slightly

According to the National Bureau of Statistics,from January to December 2021,the completed fixed asset investment in China’s garment industry increased by 4.1 percent year-on-year,36 percentage points higher than the same period last year,and 2.6 percentage points higher than that from January to November,still 7.8 and 9.4 percentage points lower than the overall level of textile industry and manufacturing industry.Compared with 2019,the completed fixed asset investment in the garment industry has declined by 15.8 percent on average over the past two years,and has yet to recover to the pre-pandemic level.

Graph 4 Main benefit indicators of garment industry in 2021

Graph 5 Growth rate of fixed asset investment in garment industry

The main factors affecting the operation of the garment industry

Demand growth in the international market is weakening

Omicron has been a threat to economic trends since the third quarter.The global economic recovery has slowed,inflationary pressures have accelerated monetary tightening in advanced economies,negatively constraining the recovery of the consumption and consumer confidence,the international garment market showed a trend of shrinking consumer demand growth,external demand substantive turned good foundation is still unstable.The consumer confidence index of University of Michigan in December dropped to 70.6 from 85.5 in June.Although the retail sales of garment maintained a substantial growth,the growth rate slowed down significantly.In December,the retail sales of garment and accessories in the United States increased by 29.46 percent year-on-year,down 8.21 percentage points from the previous month.Consumption in the EU has been slow to recover,garment retail is depressed,In December,the European Union consumer confidence index fell to -9.6,in November,the retail sales of textiles,garment and footwear in the European Union fell 1.7 percent from the previous month.The recovery of Japanese garment market is unstable due to the pandemic.From January to November,the retail sales of Japanese textile,garment and accessories increased by 0.78 percent year-on-year,1.33 percentage points lower than the growth rate from January to June.

The pandemic has accelerated the restructuring of global supply chains

With the pandemic under control in Southeast Asian countries and the production capacity of Vietnam,Cambodia and other countries gradually recovering,the phenomenon of overseas orders returning to China is unsustainable,and the layout of the global garment industry chain and supply chain will accelerate the reconstruction in the industrial recovery.From the data of garment import in major markets of the United States,European Union and Japan,China’s market share in the United States and Japan increased slightly,while that in the European Union decreased slightly.Bangladesh,India,Turkey and Malaysia all maintained share growth in major markets.From January to December,ASEAN’s market share in the U.S.decreased by 3.13 percentage points year-on-year,while China’s market share increased by only 0.38 percentage points.The rest of the market share was mainly shared by Bangladesh,India,Honduras,Pakistan and other countries.From January to October,China’s market share in the EU decreased by 0.66 percentage points,while the market share of Bangladesh,Turkey and Malaysia increased by 0.52,0.78 and 2.03 percentage points respectively.From January to December,Vietnam,Indonesia and Myanmar lost a combined 3.32 percentage points of market share in Japan,while Bangladesh,Cambodia and Malaysia gained 0.47,0.2 and 1.19 percentage points,respectively,in addition to China’s 1.71 percentage point increase in market share.

The recovery of domestic consumption lacks endogenous impetus

The recovery of the domestic consumer market has been affected to some extent by the recurrence of the pandemic and extreme weather in China.The growth of sales and investment has slowed down,showing a weak recovery on the whole.China’s retail sales of consumer goods grew by only 1.7 percent in December,according to the National Bureau of Statistics.From January to December,retail sales of consumer goods grew by 12.5 percent year-on-year,with a two-year average growth rate of 3.9 percent,4.1 percentage points lower than in the same period of 2019.In the same period,fixed asset investment (excluding rural households) grew by 4.9 percent year-on-year,with a two-year average growth rate of 3.9 percent,1.5 percentage points lower than in the same period of 2019.The new orders index of the manufacturing Purchasing Managers’ Index (PMI) has been in contraction territory for five consecutive months in December,reflecting overall weak demand.China’s per capita personal income and per capita consumer spending rose 8.1 percent and 12.6 percent year-onyear in the fourth quarter,3.9 and 4.8 percentage points slower than in the first half of the year,respectively.In the fourth quarter,per capita expenditure on garment consumption was 1,419 yuan,up 14.6 percent year-onyear,6.8 percentage points slower than the first half of the year.

Pressure on enterprises continued to increase

Under the influence of multiple factors such as the spread of the global pandemic,complex and grim international situation,poor circulation of industrial and supply chains,and rising commodity prices,China’s garment enterprises are under increasing operating pressure,especially the rising manufacturing costs and export costs of small and medium-sized enterprises.On the one hand,the tight energy supply and rising raw material prices have pushed up the prices of intermediate products.The gap between the purchasing price index of textile raw materials and the producer price index of garment has been widening,rising to 9.2 percentage points in December.On the other hand,due to the pandemic,port congestion and poor collection and distribution system have led to multiple increases in international freight prices.In addition,the RMB exchange rate and the USDX have strengthened simultaneously,and garment export enterprises are faced with exchange losses,logistics difficulties and extended payment settlement cycle,which have brought great risks to normal production and operation of enterprises.According to the National Bureau of Statistics,the PMI index for small manufacturing enterprises in December was 46.5 percent,down 2 percentage points from the previous month,and has been in the contraction zone for eight consecutive months.

Forecast of development trend of garment industry in 2022

In 2022,the global economic recovery and the recovery of international market demand will slow down,and China’s economy will face considerable downward pressure.However,the fundamentals of strong resilience and long-term sound macroeconomic performance will remain unchanged.With this development background,the economic operation of China’s garment industry has the stable conditions and good foundation.Based on the high base effect of the industry’s recovery growth in 2021 and the weakening of the market recovery,it is expected that the overall economy of the garment industry will run at a low speed in 2022 and gradually return to the track of normal recovery.

From the perspective of the domestic market,with the increase of last year’s base,the macro-economicenvironment becomes more complex,and the network channel passes through the period of concentrated release of dividends brought by the pandemic,the domestic market of garment will continue to maintain recovery growth,but the growth rate will show a slowdown.Firmly implement the strategy of expanding domestic demand in China,will be effective to boost public consumption,foster new consumption and expanding urban consumption,expedite rural consumption and a series of policies and measures,continue to promote the vigorous development of new forms,new scenes and new products,new brand,support the domestic garment market to present a high-quality development trend of product innovation,quality improvement and brand upgrade.From the perspective of the international market,supported by a number of positive factors such as the introduction of foreign trade stabilization policies,overseas demand recovery,implementation of regional trade agreements and industrial chain advantages,China’s garment export in 2022 is expected to maintain a stable operation on a high base.However,it will still face many downward risks and challenges,such as increased uncertainty in the recovery of consumer demand in the international market,the backflow of overseas orders may gradually fade,and the international logistics difficulties,freight increases,geopolitics,Xinjiang-related issues,and RMB exchange rate fluctuations.

Facing the complicated and changeable internal and external development environment,garment industry will continue to deepen the supply-side structural reform in accordance with the task direction proposed in the “Fourteenth Five-Year Development Advice for the Garment Industry”,vigorously promote the transformation,upgrading and innovative development of enterprises,and fully demonstrate the resilience and development potential of the industry,and strive to promote the stable and healthy operation of the industry economy.

- China Textile的其它文章

- Global Textile in Action ? Asia

- India:Measures to boost exports,production,and job opportunities

- Pakistan:The 2022 investment will up to USD 3.5 billion

- Bangladesh:Reasons to promote the growth of textile industry

- Dear readers:

- Japan:Occupy an important position in the high-end textiles field