Mutual Prosperity China and its Southeast Asian neighbors need to enhance industrial cooperation

By Zhang Shasha

A worker at the Maxport factory in Hanoi,Vietnam,makes active wear on September 21,2021. (NHAC NGUYEN)

In 2019,TCL,a Chinese consumer electronics company,began to build its new manufacturing base in Vietnam and brought its suppliers with it to the country.The new base has improved TCL’s production capacity with its products selling not only in Vietnam but also to other markets in Southeast Asia and beyond.

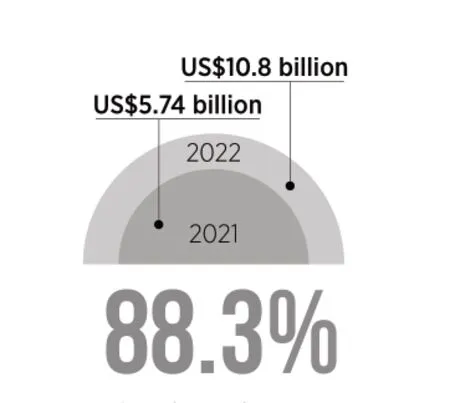

In the first four months of 2022,the total foreign investment in Vietnam surpassed US$10.8 billion,up 88.3 percent year on year,according to its Ministry of Planning and Investment.

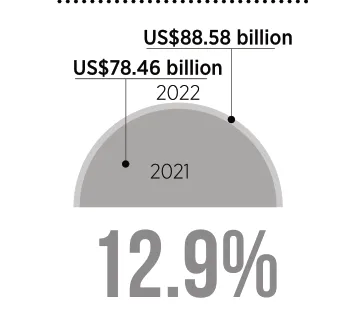

The country’s exports in the first quarter hit US$88.58 billion,up 12.9 percent year on year,data from the Ministry of Industry and Trade showed.

Vietnam’s rising status in the global supply chain has sparked discussion of the possibility that it will take away orders from China.In response,Wang Xiaosong,a research fellow at Renmin University of China’s National Academy of Development and Strategy,pointed out that China should adapt to the trend of some enterprises relocating their businesses to Southeast Asia.

“It is a natural process of industrial upgrading for China,”Wang said,adding that the development of near neighbors will facilitate mutual prosperity.

Behind the Fact

The strategy of relocating labor intensive jobs to countries with competitive local resources that are much closer to target markets,while maintaining core and critical links in China,is motivating increasing numbers of Chinese manufacturers to take their operations overseas.For example,while TV assembly is the core business of TCL’s Vietnamese base,the company’s factories in China produce high value-added products such as display panels.

“The industrial relocation began in 2015,”Wang said.“Economic development has raised the cost of labor-intensive businesses in China,so companies have turned their eyes to Southeast Asian countries with cheaper workforces.”

In addition,emerging markets in the region are also offering preferential policies to attract foreign investors.Taking Vietnam as an example.Firms making new investments in technology-related sectors,footwear,garments,automobiles,goods that are not produced domestically,and investments where the products meet EU quality standards are taxed at 10 percent for 15 years.This period also includes a tax holiday for the first four years and a 50-percent reduction in the corporate income tax rate for nine subsequent years,according to Bloomberg Tax.

“Too many companies moving their operations overseas will cause industrial hollowing-out at home,but the orderly substitution of outdated capacities with sophisticated ones is conducive to China moving up the global value chain,”Xu Qiyuan,deputy head of the Institute of World Economics and Politics at the Chinese Academy of Social Sciences (CASS),toldCaijing,a Beijing-based business journal.

However,that doesn’t mean China’s manufacturing industrial chain has nothing to worry about.Amid the new industrial revolution and current geopolitical instability,vision is required to consolidate existing advantages of local businesses and promote smooth upgrading,he said.

Nevertheless,some companies have transferred due to non-market factors,Su Qingyi,a researcher with the Institute of World Economics and Politics at the CASS,said.

Wu Geming is president of Hanyu Group,a Chinese company producing drainage pumps used in household appliances.Three years ago,Hanyu’s products were included on then U.S.President Donald Trump’s list of Chinese goods to be subject to added tariffs.Wu’s U.S.clients told him he needed to take part of his operations overseas,otherwise they would turn to other suppliers.Wu moved part of his assembly line to Thailand.However,as local supply chains and technical capacity are not as mature as required,he had to keep his most critical manufacturing processes in China.

In addition,the COVID-19 pandemic has triggered concerns about a possible industrial chain exodus from China.

“The COVID-19 flare-ups in major manufacturing hubs in east and south China have negatively affected its industrial and supply chains in this short period,”Bai Ming,deputy director of the International Market Research Department at the Chinese Academy of International Trade and Economic Cooperation,toldChina Newsweekrecently.“But in the long run,the pandemic is only one of the factors that influence global industrial and supply chain restructuring.”

In the first four months of 2022,the total foreign investment in Vietnam surpassed US$10.8 billion,up 88.3 percent year on year.

The country’s exports in the first quarter hit US$88.58 billion,up 12.9 percent year on year,data from the Ministry of Industry and Trade showed.

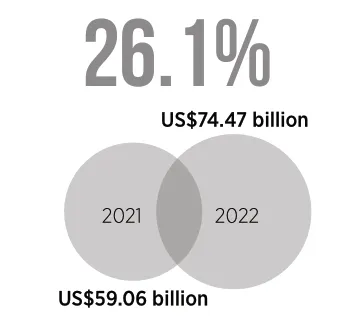

During the same period,paid-in foreign direct investment into the Chinese mainland expanded 26.1 percent year on year to US$74.47 billion,according to China’s Ministry of Commerce.

According to the General Administration of Customs of China,trade between China and Vietnam hit US$230.2 billion in 2021,with a year-on-year growth of 19.7 percent.

Win-win Prospect

“Southeast Asian countries are unlikely to replace China as a destination for foreign investment,”Wang said,citing statistics released by Vietnam’s Ministry of Planning and Investment.

Despite the 88.3-percent rise in foreign investment,Vietnam’s newly registered capital decreased by 56.3 percent in the first four months of the year.It means few companies established new factories in the country and the increasing foreign investment came from companies already present there.

During the same period,paidin foreign direct investment into the Chinese mainland expanded 26.1 percent year on year to US$74.47 billion,according to China’s Ministry of Commerce.The country saw 185 newly added major foreign-funded projects in the January-April period,each with an investment of over US$100 million.

China has complete industrial clusters,technological accumulation,and a huge market that cannot be replicated in the short term.Taking U.S.tech giant Apple as an example.Chinese companies accounted for 57 percent of its Top 200 suppliers,according to a report released by the company in June 2021,which indicates a strong dependency on China’s supply chains.

“The growth of Southeast Asian markets is actually a boon for China,”Wang said.“We have close industrial chain connections with our near neighbors.”

Vietnam,for example,imports upper stream core equipment,raw materials and components,as well as supporting facilities mainly from China,which will create more opportunities for Chinese suppliers,he explained.

According to the General Administration of Customs of China,trade between China and Vietnam hit US$230.2 billion in 2021,with a year-on-year growth of 19.7 percent.China was Vietnam’s biggest trading partner and its second largest export market during the same period.

“As our neighbor,an affluent Vietnam will be more favorable for China than an impoverished one,therefore China should not be too worried about the rise of Vietnamese industries,”said Li Wei,a professor of international relations at Renmin University of China.

Li said China’s biggest advantage lies in its huge market,because industrial revolution starts from innovation but adequate and diverse market demands and application scenarios are essential to the implementation of new technologies.

What China should do is to tap the potential of less developed areas in its central,western and northeastern regions where the labor costs are relatively low and which could be new destinations for industrial shifting,Wang suggested.