Benefits of China’s home textile industry increase YoY in H1 of 2023

Edited by Zhao Xinhua

In the first half of this year, the international situation was complex and volatile, and the growth of global trade in goods was lower than expected.The consumption power is insufficient, the market vitality needs to be further developed,and the domestic and foreign trade of China’s home textile industry is generally under pressure.

The overall operation is under pressure

According to the National Bureau of Statistics, in the first half of this year, the operating income of domestic textile enterprises above designated size fell by 4.12%, and the total profit increased by 3.86%.The margin was 3.84%, up 0.3 percentage points from a year earlier.Domestic sales of the industry were relatively stable, and domestic sales of enterprises above designated size fell slightly by 1.79% year-onyear.Exports fell sharply by 5.62%.Enterprise’s orders have decreased, and long-term and large orders are obviously insufficient.

Exports showing a downward trend

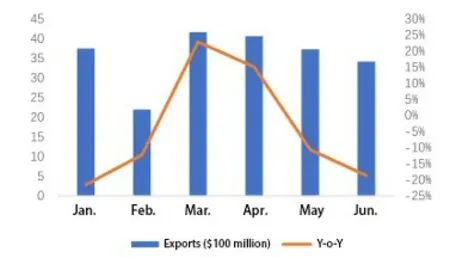

According to China’s Customs, in the first half of this year, China’s exports of home textiles were 21.282 billion US dollars, down 5.62% year-on-year.Compared with the export in the first half of the past year, the exports of China’s home textile still remained at a high level, increasing by 16.59% compared with the same period of 2019 before thepandemic.

Figure 1 China’s home textile exports in Jan.- Jun.2023 and comparison in the same period

All major categories showed a downward trend.According to statistics, in the first half of this year, only exports of carpet and kitchen textiles maintained year-on-year growth,and the rest of the major categories of products have declined to varying degrees, including bedding and cloth products exports fell 7.4% and 9.64% respectively.The export of bedding and towel products has fallen to the pre-pandemic level, and the export of bedding from January to June increased slightly by 0.87% compared with the same period in 2019, while towel products fell by 3.31%, and cloth products,carpets, blankets, and kitchen textiles are still at a historically high level.

Declines deepened in key markets.The United States,ASEAN, the European Union, and Japan are the top four markets for China’s home textile exports, and their exports from January to June were negative compared with the same period last year, including the weak consumption in the US, European and Japanese markets and the more complex trade environment, the decline has been expanding since this year,and the total export of home textiles to the US, European and Japanese markets in January to June was 8.345 billion US dollars, down 12.81% year-on-year.In June, the year-on-year decline was 18.37%, 7.75 percentage points higher than in May.In addition, the ASEAN market turned positive to negative, from January to June, China’s exports of home textiles to the ASEAN market were 4.096 billion US dollars, down 0.86%year-on-year, and fell 26.25% in June.

The export growth of the first three ports is weak, and the export growth of Guangdong ports is prominent.Zhejiang ports, Jiangsu ports and Shandong ports are the top three ports of home textile exports in China, showing a significant decline, and the exports of the three provinces fell by 7.75%,15.46% and 11.4% respectively.From January to June,Guangdong Province exported 2.077 billion US dollars of home textiles, an increase of 12.05%; Hebei Province exported 706 million US dollars, up 10.7% year-on-year; Xinjiang Uygur Autonomous Region exported 382 million US dollars,although the volume is not large, but relying on border trade exports rapid growth, an increase of 135.24%.

Domestic sales are still to be recovered

Since the beginning of this year, the overall vitality of the domestic market has yet to be restored.According to the National Bureau of Statistics, the domestic sales output of enterprises above designated size in the first half of the year fell by 1.79%year-on-year.The domestic sales output value of the 14 industrial clusters tracked by the Association and more than 240 sample enterprises increased slightly by 1.02% and 3.54% respectively.From the perspective of industry, the decline in domestic sales of bedding enterprises is more obvious, and the domestic sales output value of enterprises above designated size decreased by 4.17% year-onyear; the 116 bedding enterprises tracked by the Association also showed the trend, and the domestic sales output value fell by 1.72%year-on-year.

According to the results of the questionnaire survey on the production and operation of home textile enterprises in 2023 (Jan.-Apr.) carried out by the Association, the proportion of domestic sales enterprises with orders basically unchanged compared with the same period last year is the largest, but compared with the same period in 2019 before the pandemic, nearly half of the enterprises have reduced orders, of which 24.49% of the enterprises’domestic trade orders fell by more than 15%.It can be seen that it will take time for home textile enterprises to recover to the level before the pandemic.

From the perspective of the types of orders received, the orders of sample enterprises are mainly short-term and small orders, followed by short-term large orders, and the proportion of long-term large orders and scattered small orders is relatively low.

Business orders in the second quarter were slightly better than in the first.According to the results of the “questionnaire survey on the operation and management of textile enterprises in the second quarter” carried out by the CNTAC, the proportion of domestic trade orders of home textiles enterprises in the second quarter increased and remained flat compared with the first quarter was 38.1%.And the proportion of enterprises predicting the increase of domestic trade orders in the third quarter is 47.6%, and the proportion of enterprises that believe that orders are flat is 42.9%.It can be seen that home textile enterprises are still confident in the domestic market.

Further improvement of quality and efficiency

Since the beginning of this year, the overall benefit of the home textile industry has maintained stable growth, the total profit of enterprises above designated size in the first half of the year increased by 3.86%, and the profit margin was 3.84%, higher than the same period last year.The sample enterprises and industrial clusters tracked by the Association also show this characteristic.From the perspective of the main sub-industries, the benefits of the towel and cloth industry have increased year-on-year.Benefiting from the decline in raw material prices, proper cost control of enterprise employment and other reasons, as well as the initial results of digital transformation and cross-border e-commerce and other new business forms, the total profit of towel enterprises above designated size increased by 30.98% year-on-year, and the total profit of cloth enterprises above designated size increased by 17.79% year-on-year, and profit margins improved by 1 percentage point from the same period last year.Although the total profit of bedding enterprises above designated size in the first half of the year fell slightly by 0.19%, the profit margin was still slightly higher than that of the same period last year.The overall quality and efficiency of China’s home textile industry has been further improved.

Operation of each sub-industry

The bedding industry is stable and under pressure

The low base of the previous year led to the high growth of corporate profits.Due to the impact of the pandemic last spring on the normal operation of enterprises in the home textile industry,logistics pressure and high raw material costs and other reasons led to a double-digit decline in profits in the bedding industry.With the full recovery of production and life since this year, raw material prices are basically stable, the profits of the bedding industry in the first quarter showed a high recovery growth.However, after entering the second quarter, the benefits of the bedding industry were slightly lower than the same period last year.

Falling exports put pressure on the bedding industry.According to customs statistics, from January to June this year, China’s exports of bedding totaled 6.126 billion US dollars, down 7.4% yearon-year.Among them, bedding exports to the three traditional markets of the United States, Europe and Japan have declined by 15% or more.Meanwhile, exports to emerging markets still maintained a good growth, the export of bedding to ASEAN was 840 million US dollars, a substantial increase of 35.5% year-on-year.

Cost control is further effective.With the increasing demand of consumers for green, health and comfort, the research and development of new products by industry enterprises, the improvement of process and production and operation management control level,so that the cost reduction and efficiency of the industry are further revealed.According to the National Bureau of Statistics, since the beginning of this year, the decline in operating costs of enterprises above designated size has been greater than the decline in operating income, so as to ensure that corporate profits show better growth.

The towel industry adjustment and transformation

Since the beginning of this year, the price of raw materials such as cotton in the upstream has been stabilized to bring favorable factors to the towel industry, which has largely reduced the raw material cost of towel enterprises.Meanwhile, the construction of cross-border e-commerce and digital transformation platforms in the towel industry has also played a favorable role in promoting industry benefits.The profit margin of towel enterprises above designated size from January to June was 4.09%, an increase of one percentage point over the same period last year.

In recent years, affected by trade protectionism, the export of China’s towel products has declined for two consecutive years, and it has still not recovered to the level before 2019.From January to June, towel exports totaled 1.264 billion US dollars, down 5.21% year-on-year.

The US market has an obvious downward trend; markets in Japan and the European Union recovered slightly.ASEAN is the largest export market of towel products in China, accounting for about 30% of China’s total towel exports, exports from January to June of 350 million US dollars, although exports have declined, but still at a high level.The United States is the second market for China’s towel products exports, affected by trade protectionism,weak consumption in the US market and other factors, the US market fell significantly, down 15.5% from January to June, and the export share accounted for 15.6% of China’s total towel exports.In addition, the Japanese and European markets continued to grow.

Polarization of the cloth industry

Since the beginning of this year, the cloth industry as a whole has declined.The exports of finished curtains and decorations in January-June fell by 5.97% and 5.61%, respectively, to 1.406 billion US dollars and 854 million US dollars.Due to the weakening of consumption in developed economies, and the reduction of orders in ASEAN and other regions, China’s cloth and accessories and other upstream raw materials exports also declined, from January to June, China’s exports to the ASEAN market of cloth and accessories 1.644 billion US dollars, down 15.43%, to a large extent, affecting the ASEAN region’s market performance.

From the perspective of enterprise size, according to the National Bureau of Statistics, the domestic sales output value of textile enterprises above designated size increased by 4.12% year-on-year from January to June this year; the profit margin of the enterprise is as high as 6.97%.According to the results of the questionnaire survey, the orders of small and medium-sized textile enterprises have generally declined, and the operating rate is insufficient and the labor cost has brought pressure to small and medium-sized textile enterprises.

Overall, in the first half of this year, the overall pressure of China’s home textile industry has slowed down, and the power of the domestic and foreign trade market is obviously insufficient.Consumer demand in overseas markets is difficult to recover in the short term, and the foreign trade environment pressure caused by geopolitics will continue to exist, and foreign trade pressure will continue.However, there are still some positive factors.In terms of foreign trade, with the gradual entry into force of trade agreements such as RCEP and the gradual resumption of international flights,the normal operation of foreign trade enterprises and the expansion of customers are guaranteed.Overseas restocking may bring some orders.In terms of domestic trade, with the recovery of domestic tourism, the market demand for hotel textiles has shown explosive growth, so that the efficiency of hotel textiles manufacturing enterprises has been greatly improved.In addition, a series of consumption promotion activities injected impetus into the recovery and expansion of consumption.Industry enterprises should grasp the opportunity to find their own development model in adversity.

- China Textile的其它文章

- ITMF: Business situation remains negative but improves for the first time since November 2021

- Create a digital avatar, everyone is a designer!

- How do top garment manufacturers develop energy-efficient and high-speed processes?

- Turnover of textile and apparel specialized market achieves recovery growth in H1 of 2023

- Demand for industrial textiles in the domestic and abroad markets declines in H1 of 2023

- 33.82 million tons man-made fiber produced in the first half of 2023