Progress in China’s geological exploration in the first half year of 2018

In the first half year of 2018, there were changes in China’s economic, industrial structure and the changes in government’s policy on land and mineral resources. China’s geological exploration is continued to maintain a trend of the growth. The fund investment in geological exploration declined and the impetus for investment in initial exploration was insufficient. The mining market showed a good development trend and the social investment depicted a slight rise. In the first half of the year, the investments in hydrogeologic exploration, environmental geology exploration and geological disaster investigation increased on the year-onyear basis. According to the needs of ecological construction of civil structures, resources management, urban geology,agricultural geology and ecological geology are shown a new growth trend.

1. Fund investment in geological exploration

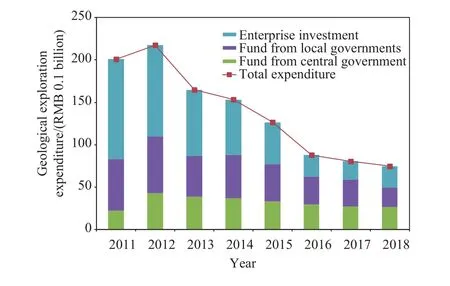

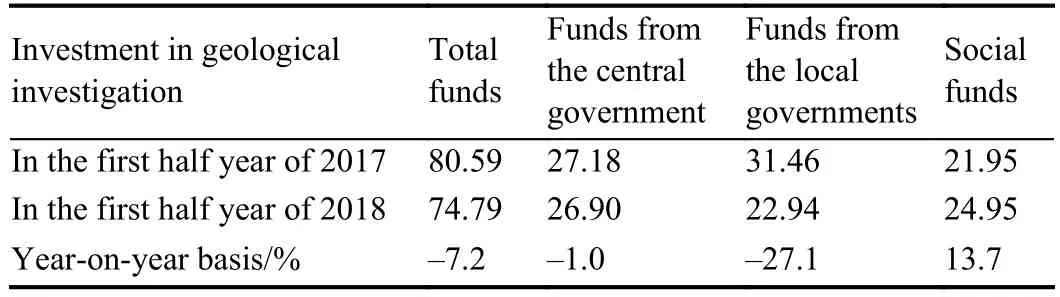

In the first half year of 2018, the funds invested in geological exploration all over China are around RMB 7.479 billion, with a year-on-year decrease of 7.2% (Fig.1). The funds from the central government were RMB 2.69 billion,accounting for 36.0%, with the year-on-year decrease of 1.0%. The funds from the local governments were RMB 2.294 billion, accounting for 30.7%, with the year-on-year decrease of 30.8%; the social funds were RMB 2.495 billion,accounting for 33.3%, with the year-on-year increase of 13.7% (Table 1). Social funds have increased for the first time since 2013, an indication of growth of investors' confidence in the geological exploration market.

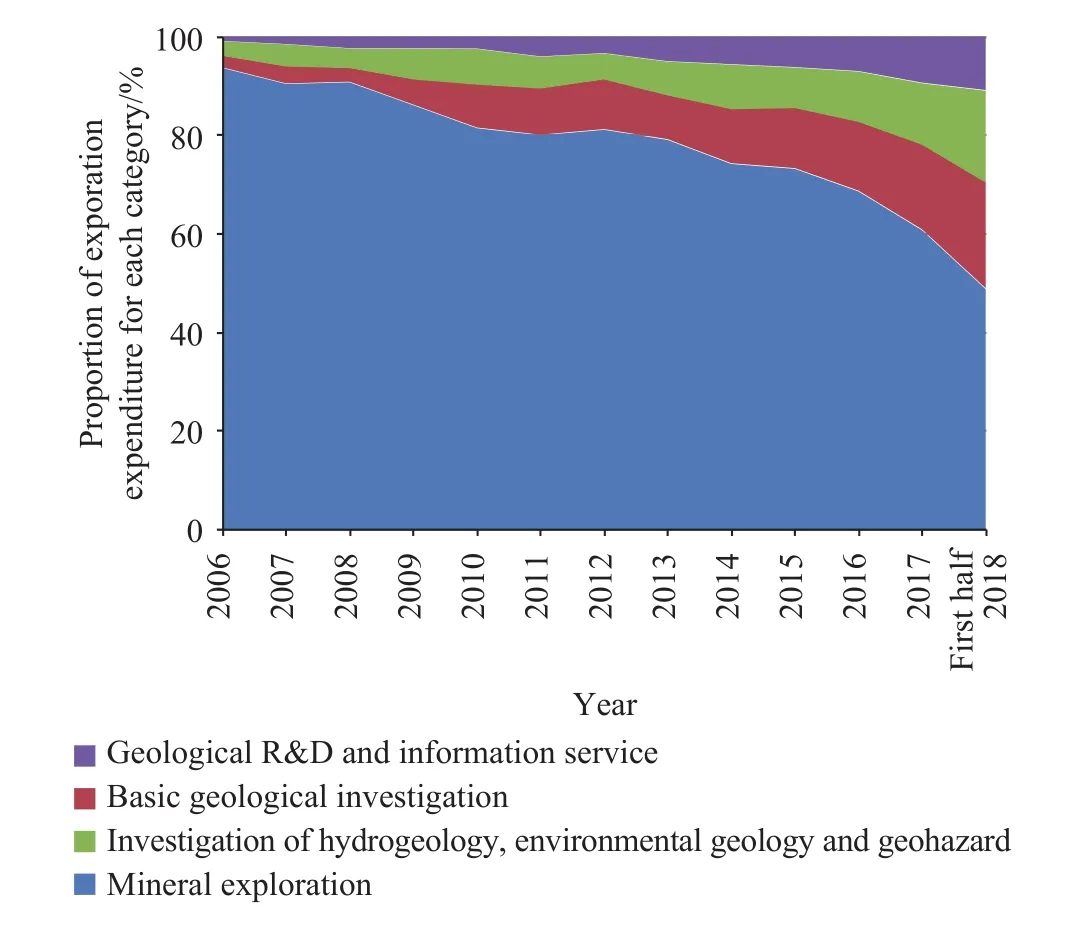

According to the target fields of the funds, funds invested in mineral exploration were RMB 3.706 billion, accounting for 49.5%, with the year-on-year decrease of 13.0%; funds invested in basic geological exploration were RMB 1.602 billion, accounting for 21.4%, with the year-on-year decrease of 5.5%; funds invested in hydrogeologic investigation,environmental geology investigation and geological disaster investigation were RMB 1.364 billion, accounting for 18.2%,with the year-on-year increase of 3.3%; funds invested in geological technology were RMB 0.646 billion, accounting for 8.6%, with the year-on-year increase of 3.5%; funds invested in geological data services and information technology were RMB 0.161 billion, accounting for 2.2%,with the year-on-year increase of 0.4% (Table 2)

1.1. Mineral exploration

Funds invested in mineral exploration were RMB 3.706 billion, of which the central government financed RMB 0.627 billion, accounting for 16.9%, with the year-on-year decrease of 18.3% (Fig.2). Local governments financed RMB 1.085 billion, accounting for 29.3%, with the year-on-year decrease of 32.4%. The social funds were RMB 1.994 billion,accounting for 53.8%, with the year-on-year increase of 5.8%.Local financial investment greatly reduced, and social funds increased slightly.

Fig. 1. National geological exploration investments change in the first half year from 2011 to 2018.

Fig. 2. Proportion change of geological exploration investment in each field in the first half year from 2006 to 2018.

The top five provinces with large funds investment were:Xinjiang (RMB 0.333 billion), Shanxi (RMB 0.309 billion),Qinghai (RMB 0.279 billion), Inner Mongolia (RMB 0.263 billion) Hebei (RMB 0.230 billion).

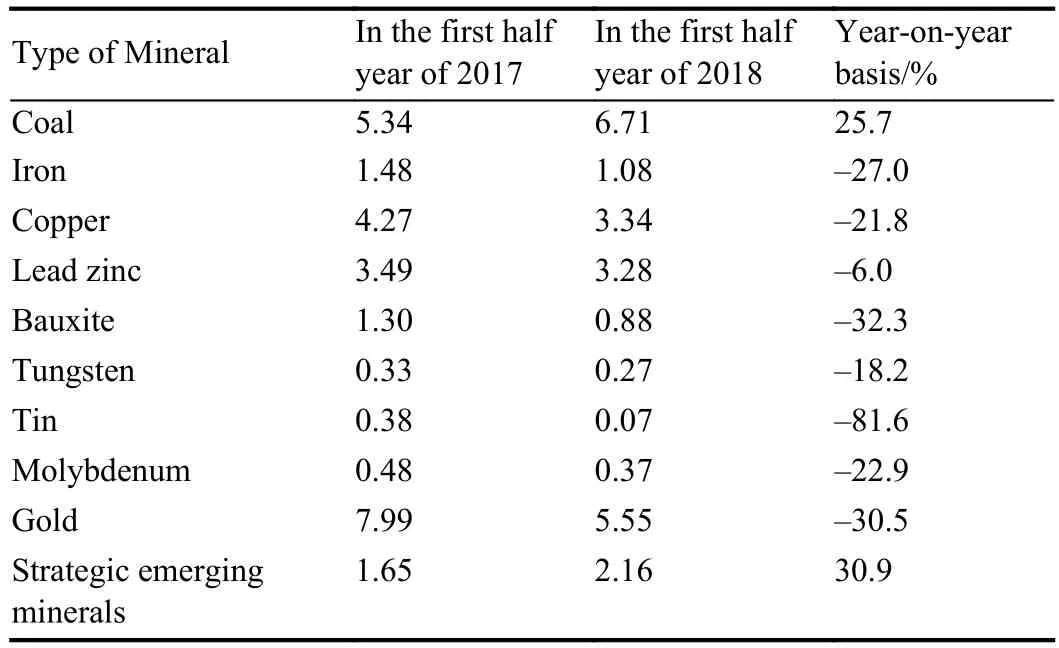

After years of sharp decline, investment in coal exploration rebounded significantly in the first half of this year. Investment in strategic emerging mineral exploration continued to maintain a growth momentum. Investments in other major mineral exploration decreased on year-on-year basis, especially for tin, bauxite and gold (Table 3).

Table 1. National geological exploration fund structure(according to the source of funds, RMB 0.1 billion).

Table 2. National geological exploration fund structure(according to the target fields of the funds).

Table 3. Investment in exploration of major minerals (RMB 0.1 billion).

1.2. Basic geological investigation

Funds invested in basic geological exploration were RMB 1.602 billion, of which the central government financed RMB 1.064 billion, accounting for 66.4%, with the year-on-year decrease of 8.6%. Local governments financed RMB 0.499 billion, accounting for 31.2%, with the year-on-year decrease of 4.2%. The social funds were RMB 0.039 billion,accounting for 2.4%, with the year-on-year increase of 290.0%.

1.3. Hydrogeologic exploration, environmental geology exploration and geological disaster investigation

Funds invested in hydrogeologic exploration, environmental geology exploration and geological disaster investigation were RMB 1.364 billion, of which the central government financed RMB 0.696 billion, accounting for 51.1%, with the year-on-year increase of 48.2%. Local governments financed RMB 0.474 billion, accounting for 34.7%, with the year-onyear decrease of 37.9%; the social funds were RMB 0.194 billion, accounting for 14.2%, with the year-on-year increase of 120.5%.

1.4. Geological technology and comprehensive research

Funds invested in geological technology and comprehensive research were RMB 0.646 billion, of which the central government financed RMB 0.142 billion,accounting for 22.1%, with the year-on-year decrease of 8.7%; local governments financed RMB 0.232 billion,accounting for 36.1%, with the year-on-year decrease of 8.0%; the social funds were RMB 0.269 billion, accounting for 41.4%, with the year-on-year increase of 26.2%.

1.5. Geological data services and informatization

Funds invested in geological data services and information technology were RMB 0.161 billion, mainly from the central government, with the year-on-year increase of 0.4%.

2. Progress in mineral exploration

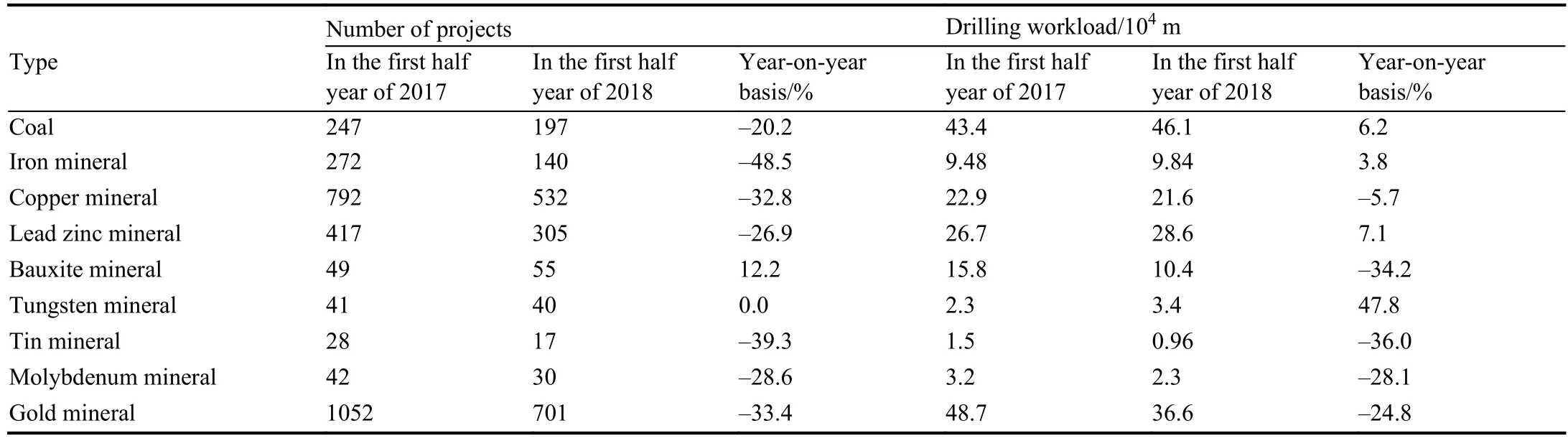

The total number of mineral exploration projects conducted were 2992, with the year-on-year decrease of 25.6%, including a total of 1157 new projects (with year-onyear decrease of 19.7%), 1835 were existing projects. The number of exploration projects of all major minerals is decreased (Table 4).

The drilling workload completed was 2.24×106m, with a year-on-year decrease of 2.2%. Except for coal, iron, leadzinc mineral and tungsten mineral, the drilling workload of all major minerals is decreased (Table 4).

Table 4. Number of projects and drilling workload of main minerals.

The top five provinces (autonomous regions) with largedrilling workload completed were: Guizhou (2.424×105m),Shanxi (2.298×105m), Shandong (2.15×105m), Inner Mongolia (1.675×105m), and Xinjiang (1.497×105m).

There were thirty-nine new discovered mineral deposits(thirty-three in the first half year of 2017). Among them, there were thirteen large-sized mineral deposits (one bauxite mineral deposit, one vanadium mineral deposit, three graphite mineral deposits, and eight chemical and building materials mineral deposits), fifteen medium-sized mineral deposits and eleven small-sized mineral deposits.

3. Analysis about China’s geological exploration

China’s geological exploration work is in the transition period. The emerging industries, such as natural resources management, ecological protection and restoration, new urban construction etc. of geological exploration services will continue to expand. It is estimated that the annual geological exploration investment will drop by about 10% on year-onyear basis and exploration of minerals such as strategic emerging minerals will increase. Urban geology, agricultural geology, ecological geology and so on, will continue to expand.

3.1. Mineral consumption and mining will transfer from the rapid growth period, to a high-position fluctuation and differentiation period when investments in explorations of different minerals continue to differentiate

In recent years, China’s total mineral resources consumption has slowed significantly. The consumption of bulk mineral products may reach the peak and later decline slightly when the consumption reaching 1×109t. The consumption of most non-ferrous metals and precious metals has slowed, but the consumption has still maintained a steadily high position.The consumption of the oil/gas minerals and the emerging minerals with a consumption of less than 104t continued to grow. Since 2012, the growth rate of total mineral resources mining quantities has slowed significantly. The total mineral resources mining quantities reached a peak of 11.082×109t in 2014 and decreased to 10.147×109t in 2016, with a decrease of 8.4% from the peak. From 2017 to the first half year of 2018, the total mineral resources mining quantities has been maintained, which indicates the fluctuating trends of the previous years.

3.2. Due to the good trend of the global mineral explorations and the increasing price of mineral products, China’s mineral exploration market may rebound

In 2017, the global investments in metal mineral explorations were USD 7.95 billion, with the year-on-year increase of 14%. In June 2018, SNL predicted that except for silver and iron ore, the average price of other metals in 2018 will be higher than that in 2017.

In the first half year of 2018, the investments in China’s mineral exploration increased by 5.8% on the year-on-year basis, reflecting that the confidence of social investors in the mineral exploration market was growing. However, due to the significant reduction in funds from local governments, the annual mineral exploration investment may continue to decline.

3.3. According to the needs of ecological civil construction and natural resources management, new growth of geological explorations (e.g. urban geology exploration, agricultural geology exploration, ecological geology) will continue to expand

Supporting the ecological civil construction and the natural resources management will be the future direction of sustainable development in the geological exploration work.The first is to serve urban construction, and to promote the rapid development of urban geological work. The second is to serve the national land space planning and ecological protection and restoration, and to promote the development of environmental geology and ecological geology work. The third is to serve the people’s livelihood and rural revitalization, and to promote the development of agricultural geology and tourism geology work. The fourth is to serve the unified management of natural resources, and to promote the coordinated operation of the geological environment monitoring network and other monitoring networks, the diversified geological exploration and evaluation work such as "Geological Big Data +".

(Authors: Teng Ma, Jian-feng Yang, Yao Wang and Cui-guang Zhang, fromDevelopment and Research Center,China Geological Survey,Beijing,China.)

- China Geology的其它文章

- Deep Continental Scientific Drilling Engineering Project in Songliao Basin: progress in Earth Science research

- Main technical innovations of Songke Well No.2 Drilling Project

- Preliminary results of environmental monitoring of the natural gas hydrate production test in the South China Sea

- Episodic crustal growth in the Tanzania Craton: evidence from Nd isotope compositions

- Origin of natural sulfur-metal chimney in the Tangyin hydrothermal field, Okinawa Trough: constraints from rare earth element and sulfur isotopic compositions

- Exploration and research progress of shale gas in China