The Coevolutionary Relationship of Technology,Market and Government Regulation in Telecommunications

Xuchen Lin*, Ting-Jie Lv, Xia Chen

School of Economics and Management, Beijing University of Posts and Telecommunications, Beijing 100876, China

Abstract: The telecommunications industry has been undergoing tremendous technological changes, and owning to continuous technological advancement, it has maintained sustained prosperity and development. In this paper, the interplay between technology, market and government in telecommunications is discussed briefly, and then we introduce technology and government into the traditional SCP (Structure– Conduct – Performance) paradigm to develop an industry analysis framework called TGM(SCP) (Technology – Government – Market(Structure – Conduct – Performance)). Based on this framework, we present the spiral coevolution model which elaborates on the interaction mechanism of technological innovation with government regulation and market dynamics from the perspective of industry evolution. Our study indicates that the development of the telecommunications industry is the result of the coevolution of technology, government regulation and market forces, and among the three actors, technology is the fundamental driving force. Relative to the “invisible hand”(market) and “visible hand” (government), we conceptualize technology as the “third hand”,which fundamentally drives the development of telecommunications industry in coordination with the other two hands. We also provide several policy implications regarding thesefindings.

Keywords: technological innovation; government regulation; telecommunications; evolutionary theory

I. INTRODUCTION

Traditional economic studies can easily fall into a dual paradigm; that is, the difference in the viewpoints between the free-market economics school who advocates the “invisible hand” (market) and the new Keynesians who advocate “visible hand” (government).However, the intrinsic attributes of telecom industry, such as the existence of large sunk costs, result in its typical natural monopoly characteristic, and thus determine the competition in real markets is generally an oligopoly rather than a perfect competition. Thus, using the free market competition mechanism to improve market efficiency may lead to market failure in this special industry [1]. Instead, due to the incomplete information about market conditions, there are great limitations if we use the “visible hand” government to dominate the development of the telecom industry, govern-ment failure may also occur [2]. For example,referring to the recent mandatory requirements of the Chinese government urging telecom operators to improve speed and reduce price,not only the consumers have been unsatisfied,but also a serious imbalance was incurred in the current market competition. However, despite the above problems, as we can observe,China’s mobile communications network has changed from 2.5G to 3G and now to 4G during the past decades, and this development process has brought an outstanding price-reducing and speed-lifting effect and achieved continuous improvements in market efficiency. What are the factors on earth leading to the fast growth of this industry in the case where the market and government may fail at the same time? After analyzing the development course and techno-economic characteristics of telecom industry, we argue that relative to the“invisible hand” (market) and “visible hand”(government), there exists a “third hand” in telecom industry: Technology.

Advancements in telecom technology,especially mobile technology, have radically changed people’s lives and contributed to productivity growth [3]. Technological innovation is the most core feature in the telecom industry, and the rate of technological progress in this industry far exceed that in other natural monopoly industries, which is the most significant difference of the telecom industry relative to other industries [4]. In the light of the development history of world telecom industry, the birth and development of analog technology, digital technology, optical fiber technology and other telecom technologies,have played a critical role in the formation offixed-line telephone market, mobile telephone market and broadband market. Each round of significant development of the telecom industry is arguably inseparable from the emergence and application of new technologies. For the telecom industry, technological advancement can bring over two effects: one is to create new opportunities for transitions,such as the transition from telephone voice services to data traffic services; and the other one is to improve the efficiency and quality of services. The essence of such effects lies in the fact that IT technological progress has directly changed the production tool, which is one of the three elements of social productive forces,and therefore enhanced social productivity.Radical technological innovations can change the original techno-economic characteristics of the telecom industry, and then affect market structure, market conduct, market performance and regulatory policy in this industry. That is to say, it is technical change that shaped the industry and changed telecom regulation [2,5]. Since technology is so important in the evolution of the telecom industry, it is instructive and meaningful to discuss the relationship and interaction mechanism of technology with government regulation and market dynamics.

Against this background, the purpose of this study is to highlight technology as the “third hand” to analyze its core role for the evolution of the telecom industry and its relationship with the “invisible hand” (market) and “visible hand” (government), so as to reconstruct the theoretical framework of regulation and public policy. In this study, the problem we need to solve is how to introduce technological innovation and government regulation into the traditional industry analysis framework as elements with economic meanings, so as to discuss the interplay of technology with market and regulation. Specifically, through the analysis of the classic case and industry characteristics of the telecom industry, we briefly discuss the relationship between technology, market and government in telecom.Then, based on the classical SCP (Structure– Conduct – Performance) industry analysis framework built by the Harvard School, we propose a new industry analysis framework which is capable of analyzing the telecom industry —TGM(SCP), that is, Technology –Government – Market (Structure – Conduct –Performance). Traditional industrial organization theory fails to make a specific analysis on the topic that which factors would influence market structure, but just attributes those factors to external conditions or basic conditions[6]. This study discovers and demonstrates the decisive role of industry’s techno-economic characteristics and regulatory factors on the structure of telecom market, thus obtaining a new industry analysis framework. Next, based on the proposed TGM(SCP) framework and the characteristics of the telecom industry,we use the theorizing method of inductive reasoning to present the spiral coevolution framework model which elaborates on the interaction mechanisms of technological innovation with market and regulation in the telecom industry. Finally, we put forward some ideas and policy proposals regarding what role governments should play in promoting technological innovation in telecom.

This study makes contributions to the theoretical and practical policy discussions in two ways. On one hand, at the conceptual level,firstly, we conceptualize technology as the“third hand” in the telecom industry, explicitly emphasizing the critical role of technology in the evolution of the telecom industry;secondly, this study advances our existing understanding of the evolutionary theory of the telecom industry as well as the interaction mechanism between technology, market dynamics and government regulation in the telecom industry. On the other hand, at the practical level, this study aims at sensitizing policy makers to the significant importance of technological innovation in the telecom industry, telecom regulations and public policies have to carefully consider their implications for technological innovation that shapes the future development of the industry.

The rest of the paper is structured as follows. Section 2 provides a review of literature related to this study. Section 3 briefly discusses the relationship between technology,market and government in telecom. Section 4 proposes the new TGM(SCP) industry analysis framework, and based on this analysis framework, the spiral coevolution model which elaborates on the interaction mechanisms of technological innovation with market dynamics and regulation in the telecom industry is constructed. Section 5 provides some relevant policy proposals. Section 6 concludes the whole paper and suggests the future lines of research.

II. LITERATURE REVIEW

The interplay of technological innovation,government regulation, and market dynamics in the telecom industry has been a hot topic in telecom research. This section attempts to make a short review on recent theoretical and empirical literature related to this topic.

A group of contributions have studied the effects of regulation on innovation in the telecom industry. Most of the literature studied the specific individual impacts of one or two regulatory instruments (e.g. entry regulation,price regulation, and neutrality regulation)on telecom innovation. Ehrlich et al. (2010)discussed the likely effects of proposals which intended to further regulate the wireless industry business on innovation and product differentiation, the authors concluded that the proposed regulations (e.g. net neutrality regulation) would significantly reduce innovation and consumer choice [7]. Prieger (2002)empirically examined the effects of entry regulation on the innovation in the US telecom market, he found that operators could have introduced 62% more new services from 1987 to 1997 if the FCC regulation had not been in place [8]. The study by Bauer and Shim(2012) also found that access price regulation undermines innovation in the telecom industry [9]. Trubnikov (2017) discussed the case of WiMAX and argued that regulation has an inhibitory role in the disruptive technological innovation and the process could be explained by the dependence on the path of coevolution of regulation and technology [10].

Besides, there is also a great deal of literature which has studied individual and joint effects of regulatory instruments on investment at the network layer. Although such dependent variables (e.g. investment expenditure) are not directly geared to measure innovation, they are influenced by the innovation rate. Studies which emphasize the technological innovation at network layer sometimes treat innovation and investment as equal because in technologically dynamic sectors like telecom, investment will often be in new generations of technology and technological innovations generally need investments in R&D and in the commercialization of new products and services. In this type of literature, much literature shows that more stringent regulation seems to be conductive to incremental forms of service-based investment at the expense of facilities-based investment which is most closely related to technological innovation. Friederiszick et al.(2008) used the data set covering 180 mobile andfixed-line operators in 25 European countries over the period 1990-2006 to examine the relationship between entry regulation and infrastructure investment in the telecom industry, the results show that entry regulation has a significant negative influence on the infrastructure investment by entrants in thefixedline segment and no impact on investment in mobile telephony [11]. Cambini and Jiang(2009) conducted a survey on the older literature about the effects of regulation on broadband investment, and they concluded that most of the literature finds that cost-based access regulation discouraged both incumbents and entrants from investing in infrastructure [12].Bauer (2010) analyzed individual and joint effects of regulatory and other policy instruments on the investment incentives in telecom,and the author concluded that a less stringent regulatory approach will most likely generate a higher level of innovation and investment as well as the associated longer-term social benefits [13]. Grajek and R?ller (2012) empirically examined the strategic interaction between entrants’ and incumbents’ investments, the authors concluded that the pro-entry regulation has a negative impact on incentives to invest in facilities-based competition [14]. Manenti and Scialà (2013) investigated the impact of access regulation on incumbent’s and entrant’s incentives to invest, and they found that access regulation may undermine infrastructure investment, thus inducing a socially inefficient outcome [15]. Bacache et al. (2014) tested the ladder-of-investment (LoI) hypothesis and whether the unbundling policies can stimulate broadband investment by entrants, and they found that access regulation has no effect on the incentive of new entrants’ investment in fixed broadband networks [16]. However, a few studies have also reached opposite conclusions and argued that continued regulation can be conductive to investment [17, 18]. Dkhil(2014) also shows that the regulation-investment relationship is an inverted U-shape in the developed countries, while it takes a U-shape in the developing world [19]. The study by Moshi and Mwakatumbula (2017) indicates that the investments in African mobile telecom industry rely on regulation and liberalization,and their results also show that political stability did not have a significant effect on telecom investments [20].

To summarize, previous theoretical and empirical studies show that the effect of regulation on innovation/investment is ambiguous,but much literature tends to suggest negative or no effect of stringent regulation on innovation incentives in the telecom industry.

The relationship between technological innovation and market structure is also an important subject of debate across economic literature, which was initiated by Schumpeter(1942) and Arrow (1962). The two authors seem to have two opposite views. On one hand, Schumpeter emphasized the strong positive impact of bigfirms and the prospect of monopoly rents on innovation (known as Schumpeterian effect). On the other hand,Arrow pointed out that a firm in a competitive market has more incentive to innovate than a monopoly (known as Arrow effect or escape-competition effect). However, Shapiro(2011) pointed out that the reason why the two views are conflicting is just that the two authors consider different aspects of the innovation process [21]. Afterwards, many scholars have conducted empirical and theoretical studies on this long-standing debate, but thefindings are mixed. Some studies support the view that a high concentration market is beneficial to technological innovation [22], while some held the opinion that competition is conducive to technological innovation [23]. More recently, Aghion et al. (2005) investigated, both theoretically and empirically, the relationship between market competition and technological innovation, and they found an inverted U-shaped relationship between competition and innovation [24]. Several subsequent studies have also confirmed this finding [25,26]. Admittedly, these three viewpoints have theoretical basis and realistic basis to a certain degree, but there are also limitations. The sector-wide analysis may suffer from cross-industry difference in the rate of innovation, thus,the relationship between technological innovation and market structure may vary by industry owing to various techno-economic characteristics and regulatory environment facing each industry. Hence, several attempts have been made to analyze the relationship between technological innovation and competition in the telecom industry. Utilizing data from 24 OECD member countries, Van Cuilenburg and Slaa(1995) conducted an empirical study to verify whether the relationship between innovation and competition in the telecom industry is linear or inverted-U type, while from the perspective of empirical validity, it cannot determine which hypothesis is more accurate[27]. Madden and Savage (1999) conducted an empirical study to test the influence of market scale and market concentration on innovation activities, and the results supported the hypothesis that the market scale of telecom industry has a positive effect on innovation,but did not support the hypothesis that market concentration is conducive to innovation[28].Recent years, Garrone and Zaccagnino (2015)showed that competition intensity and pro-entry regulation in combination have a positive effect on incumbent’s investments in telecom networks [29]. Houngbonon and Jeanjean(2016) used firm-level data to investigate the relationship from a dynamic perspective,they found a robust inverted-U relationship between competition intensity and investment in the wireless industry [30]. Similarly using the firm level data, Briglauer et al. (2016)showed that intermodal competition in terms of fixed-mobile substitution has an inverted U-shape with incumbents’ investment, but the overall effects on aggregate investment rely on the operator type [31]. Utilizing a panel of 50 mobile operators from 17 European countries from 2006 to 2015, Jeanjean and Houngbonon(2017) examined the impact of market structure on investment in the European mobile industry, the results show that both the number of operators and market share asymmetry have significant impacts on investment and the effect of the number of operators on investment strongly depends on asymmetry [32].

To summarize, most of the theoretical and empirical literature has suggested that a degree of concentration intermediate between perfect competition and monopoly is best in terms of technological innovation. Yet, further discussion and empirical evidence are needed for each specific industry, such as the telecom industry.

While a great deal of attention has been given to the impacts of regulatory instruments or market structure on innovation, the reverse effects of technological innovation on regulation and market dynamics have received less direct attention, especially considering a specific sector such as the telecom sector. In our knowledge, until this date few papers that have been interested in studying the impacts of technological innovation on the evolution of market structure and regulation. Among the few literature, Antonelli (1995) discussed the interaction between technological change and regulation in telecom, the author concluded that the changing characteristics of technologies strongly affect the evolution of the architecture of telecom networks, and technological change and regulation interact to determine the behaviors of each player in the telecom industry [33]. Geroski and Pomroy (1990) empirically examined the interplay between innovation and the evolution of market structure,their results suggest that innovation reduce the level of concentration in markets and this impact mostly occurs very quickly [34]. In terms of the dynamic impacts of technological inno-vation on market and government regulation,simply relying on econometric analysis can be quite difficult, the theoretical analysis of its internal mechanism can provide new ideas or a new way of thinking for empirical analysis.

In addition, while much literature has used econometric method to discover the relationships between technological innovation and competition/regulation, few recent studies focused directly on the interaction mechanism of the relationships, that is, how the relationship works. As for older literature, Van Cuilenburg and Slaa (1995) provided a simple model to analyze the interplay of competition and telecom innovation, the author pointed out that the interplay is mediated by not only the policy environment but also the socio-economic context [27]. Erakovic and Wilson (2006)utilized the case of Telecom New Zealand to demonstrate the interaction of regulatory environment and market forces with technological forces in the privatization of stateowned enterprise [35]. From a methodological view, this paper is similar with the study by Yu et al. (2004) that constructed a comprehensive framework to analyze the features of basic industry conditions which affect market structure, corporate conduct and market performance in China’s telecom industry. But Yu et al. (2004) mainly focused on the institutional conditions and discussing the relationship between governmental factors and market factors, technical factor was just regarded as basic market conditions [36]. However, in the telecom industry, technical factors not only impact specific corporate behaviors but also have a crucial role in industrial growth, thus,from the perspective of industry evolution,these factors should be viewed as external determinants in a macroscopic sense. Ahokangas et al. (2013) proposed a spectrum sharing framework which covers the regulatory, technical and business domains, and they highlighted the disruptive role of cognitive radio system technology in future cognitive cellular networks [37]. Xia (2017) reviewed the history of China’s telecom industry and argued that the development of the telecom industry is the result of the coevolution of technological, institutional, and market forces [38]. To the best of our knowledge, there is a lack of comprehensive framework for discussing the technology-government-market relationship in telecom. Thus, we attempt to highlight the core role of technology in the evolution of the telecom service industry and provide a framework to examine the general rules and interaction mechanisms of technological innovation with market and regulation from the perspective of industry evolution, andfinally provide several relevant policy implications.

III. TECHNOLOGY, MARKET AND GOVERNMENT IN TELECOMMUNICATIONS

In Robert. M. Solow’s pioneering study in 1957, he indicated that from 1909 to 1949,about 80% of the growth in gross output value for each working hour in the United States were attributed to technological progress [39]. Although later studies yielded a lower estimated value [40], Solow’s conclusions about the importance of technological progress have not been changed. In the monograph wrote by Schumpeter, Business Cycle, the case studies of the emergence and development of new technologies and new industries clearly demonstrate the important role of technological innovation in promoting resource allocation and institutional change.The emergence of the telecom industry is due to the information and communication technology, thus, technological innovation plays an even more critical role in this fast-growing industry. Several empirical results have shown that technological change almost exclusively contributed to productivity improvements in the telecom industry [41, 42]. Relative to the“invisible hand” (market) and “visible hand”(government), we conceptualize technology as the “third hand”, which fundamentally drives the development of telecommunications industry in coordination with the other two hands.In this study, we are going to discuss what relationships between technology, market and government regulation as well as their internal mechanism.

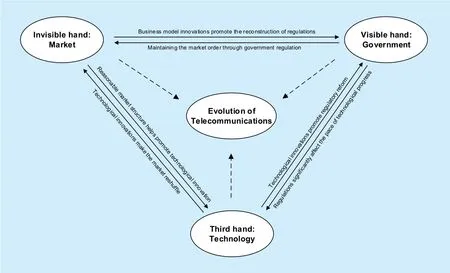

The basic relationships between technology,market and government in telecom are shown in figure 1.

3.1 Technology and market

Technological innovation is the main driving factor of market evolution as well as the direct embodiment of market performance improvement, which means that technological innovation and market are influenced and promoted by each other.

Fig. 1. The relationships between technology, market and government in telecommunications.

Technological innovation can reduce the entry barrier of telecom industry and change the competition pattern in telecom market.Due to the uncertainty of innovation activities,the existence of sunk cost and the difference of organizational structure, technology leaders may fail to react to major mutations in technology while the latecomers can carry on leapfrogging development and even surpass former technology leaders [43]. The discontinuity of technology may change the entry barrier of telecom industry and reduce market concentration [44]. Viewing from the development course of telecom industry we can see that telecom industry used to be a part of electronics industry, the emergence of electronic computer tremendously reduced the operation cost of telecom services. In the 1980s, chipbased microprocessors were 30,000 times cheaper than early computers while the computing ability improved by over 200 times; the cost of optical cables has been decreasing over the past few decades from 10$ per meter in 1975 to 1.75$ per meter in 1980, then to 0.1 $per meter in 1990 [45]. As such, the development of telecom technology has immensely reduced the costs of telecom operation. Besides,subversive innovations can threaten the status quo of markets and current actions of players from different layers of telecom, which may lead to the formation of new business models,creation of new leaders, expansion of industrial boundary and even alteration of all of these markets (e.g.fixed-line substituted by mobile,voice traffic substituted by data traffic). Therefore, by dramatically changing the techno-economic characteristics of the telecom industry,subversive technology innovations help reduce the degree of natural monopoly in the telecom industry, making it possible for other potential competitors to enter the industry, as a result of which the competitive relationships in telecom market has been altered over time.

On the other hand, it is obvious that a relatively reasonable market structure helps boost the technological innovation. As reviewed in Section 2, ever since Schumpeter and Arrow proposed their theories, what kind of market structure is conducive to innovation has been discussed with great controversy. Most of the theoretical and empirical studies have suggested that a certain degree of market concentration intermediate between pure monopoly and perfect competition is best in terms of technological innovation. The tension between Schumpeter’s view and Arrow’s view is actually related to incentive and ability to innovate[21]. In terms of the incentive to innovate,on one hand, a large business in concentrated markets can expect greater returns on innovation and protect the competitive advantage associated with its innovation because of its larger market share, the incentive can be positive;on the other hand, a largefirm may have less incentive to investment in technological innovation if it can earn substantial profits without innovation and wants to protect the status quo.As for the ability to innovate, a large business in oligopolistic markets is likely to have more working capital and the ability of combining complementary assets to invest in radical technological innovations that require large-scale and comprehensive R&D [46]. Thus what kind of market structure is conducive to technological innovation can vary with industry, market conditions and characteristics of technology.In the case of telecom industry, unlike other industries, the technological change is so rapid in this industry that incumbents with large market share have increasingly realized the importance of investing in technological innovation [47]. In addition, in the information and communications technology industries where value is created by systems that incorporate multiple components, large firm’s superior abilities of R&D and combining complementary assets make a great difference in radical technological innovation [21, 48]. Excessive market fragmentation could also decrease the capability offirms to respond to new technological opportunities [36]. Therefore, in the telecom industry, it can be said that competition accelerates the pace of technological progress under the premise that there were not many operators participating in the competition, which was basically consistent with the assumption proposed by Schumpeter that large business is conducive to innovation.

3.2 Technology and government regulation

There is also a reciprocal influence between the technical factors and regulatory policies.For one thing, regulatory policies directly affect the innovation incentive of enterprises. In general, regulations affect innovation activities in two ways. Firstly, price regulations, such as regulations on network interconnection fee and retail price, change the profits of enterprises and then influence the incentive to innovation.Secondly, price regulations and market access regulations jointly alter the entering conditions for new entrants, thus affecting the innovation decision-making of incumbents and potential entrants [49]. As many forms of regulation are designed and applied asymmetrically in the telecom industry, the innovation incentives of different players are also influenced differently. Besides, due to the difference in regulatory efficiency, the regulatory regimes (e.g.whether the regulatory bodies are independent or not) also affect the transaction costs and profits of the enterprises, and then indirectly influence enterprises’ incentive to technological innovation [50]. Therefore, government regulatory factors significantly affect the pace of technological progress.

For another, due to the fact that the development of regulatory policy needs to adapt to the characteristics of technology, technological progress will also boost regulatory reform.In the highly regulated telecom industry, there will be an issue when a disruptive technology emerges: because old rules have been developed along the mainstream of the industry and produced a suitable playground for incumbents, while for a new disruptive technology which can alter the functioning way of the field, the old rules can be improper or even hostile [10]. As such, the regulatory regime needs to adapt itself to the new conditions when disruptive technology changes original rules and raises problems in front of policy makers. The development of telecom industry in recent years proved the fact that markets tend to achieve favorable performance when regulatory policies conform to technological development. Instead, failures in regulatory policies often come with policy makers’ being unable to realize the characteristics and development trend of technological progress. For instance, in the early 2000s, as the Chinese government chose to wait until its domestic 3G technologies become mature to launch 3G services, 3G mobile licenses were not issued to operators in time [51, 52]. Fixed-line operators attempted to use the outdated PHS(Personal Handy-phone System) technology to enter the mobile market, which led to the enormous waste of investments. According to Fuxin Xu, who is widely recognized as the father of PHS, the total investment on PHS was nearly 100 billion RMB, all of which caused inefficient repetitive construction. In March 2009, Ministry of Industry and Information Technology (MIIT) commanded China Telecom and China Unicom to withdraw PHS from the market by the end of 2011, which made the two operators pay tremendous exit costs again. In these 10 years, PHS wasfirstly put on and then completely withdrawn from the market, a large number of investments were wasted and the competitive order in mobile communication market was severely deteriorated. To a certain extent, PHS delayed the development of mobile communication technology and telecom market in China.Thus, it can be seen that correct understanding of technological progress is increasingly becoming an important factor which influences the effectiveness of regulatory policies.

3.3 Government regulation and market

One of the main purposes of government regulation is to make the market evolve towards a self-sustaining competitive market structure,where enterprises behave in a competitive manner so that the benefits from competition,in terms of lower prices, better quality and greater variety of product choices, are attained[49]. Therefore, many scholars hold the opinion that the government only needs to intervene when market failures occur. However, deregulation is not an easy choice, especially for some basic industries (e.g. telecom industry,power industry, energy industry, transportation industry and so on) where the state of natural monopoly still remains. For these industries,the infrastructural costs are extremely high,and the social costs would be too high if multiple infrastructures are repeatedly constructed to stimulate competition. That is to say, there will be a continuous need for sector-specific regulation owing to the intrinsic techno-economic characteristics of telecom industry [1].In addition, governments regulate the industry in order to achieve specific social and political objectives, such as promoting universal service and safeguarding national security and so on. Especially for high-tech industries like telecom industry, policy makers are realizing the increasing importance of information technology in national security [53]. Therefore,governments need to regulate the telecom industry and play a vital role in the development of telecom industry. Telecom regulators mainly rely on two control modes to regulate the industry, structural control and behavioral control. Structural control mainly refers to the splitting and restructuring of telecom operators and privatization reforms, which help to produce a desirable market structure and

then influence the competitive relationship of

enterprises in the market. Behavioral control refers to the control of market behaviors, such as price regulation, access regulation, restrictions on advertisements and requirements of the minimum quality standard. At present,telecom regulators in most countries use these two kinds of control alternately. Regulatory policies can influence market structure and business strategy of enterprises, and then affect the action mechanism of market power, all of which lead to different market performance.On the other hand, innovations of market business model also promote the reform of regulatory policy. Business model innovation refers to an unprecedented and more appropriate way to provide customers with products and services, it is the adjustment of existing value chain [54]. When an unprecedented business model appears in the market, the existing regulatory regime may not be able to accommodate the requirement of the ever-changing market, or perhaps there is no corresponding regulatory mechanism available to regulate the new business models, thus regulatory policies should be adjusted to cope with the changes in market.

3.4 Summary of section 3

Based on the analysis above, we can see that technical, market and governmental factors are mutually interacting and promoting, these three factors coordinate with each other and evolve together to promote the development of the telecom industry. We need tofind a proper way to introduce technology and government regulation into the traditional industry analysis framework as elements with economic implications, so as to discuss the interaction mechanisms of technological innovation with market and government regulation in the telecom industry.

IV. A FRAMEWORK MODEL FOR THE TELECOMMUNICATIONS INDUSTRY

4.1 Traditional analysis framework SCP

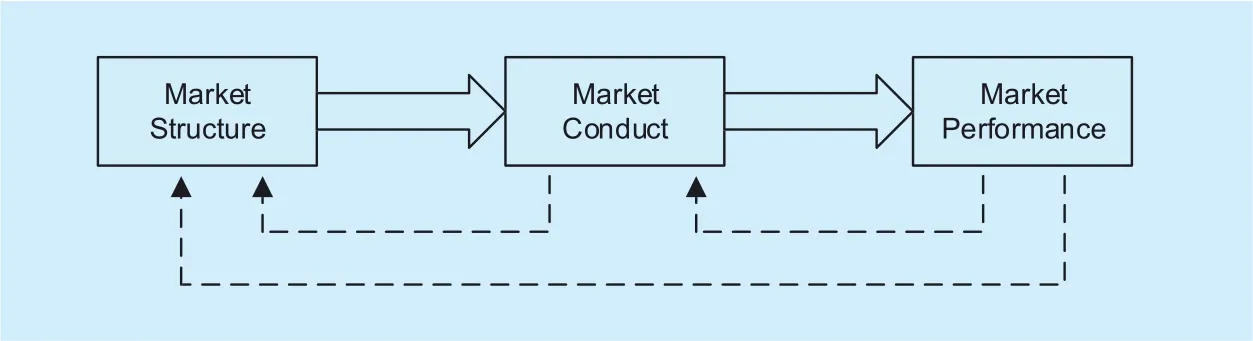

The relationship between market structure,market conduct and market performance is the basic relations of industrial theory. Through analyzing the relationship, the American scholars of Harvard School, Mason, Joe S.Bain, Scherer et al. established the classic industry analysis framework, Structure – Conduct – Performance (SCP). The basic meaning of the SCP paradigm is that in the whole, market structure plays the most basic role in the industry analysis. Market structure determines the conducts of the enterprises in the market,and enterprise conducts determine market performance, while market conduct and market performance react to market structure in turn.The standard representation of the traditional SCP paradigm is shown in figure 2.

The most important significance of the establishment of SCP paradigm is that, for the first time, the industrial organization theory has a complete set of basic concepts and core contents, which have become the most extensive tool for industry analysis. Its basic framework and empirical study method still guide the direction of industrial economics research nowadays. Although the paradigm lacks a rigorous theoretical derivation process in its establishment, it has an irreplaceable role in empirical analysis. Moreover, the paradigm does not depend on detailed assumptions,which makes it owns nice robustness. Therefore, we extend the classical SCP paradigm by introducing technical factors and governmental factors, so as to discuss the relationship between technological innovation, government regulation and market dynamics.

4.2 Extension of SCP analysis paradigm – TGM(SCP)

The SCP paradigm only focuses on the interrelationship of structure, conduct and performance within the market, but fails to analyze the basic conditions outside the market. It is instructive to identify the factors that affect market structure, corporate conduct and market outcomes. Thus, we can introduce the determinants of market structure to extend SCP paradigm. The discussion in Section 3 shows that technical factors and governmental factors play important roles in the development of the telecom market. On one hand, technological innovation can affect the inherent properties of the industry and the operational mode of enterprises; it will also urge policy makers to understand the changes in industrial nature and market demand, thus facilitating the reform of regulatory regime. On the other hand, the telecom industry has its unique characteristics (natural monopoly, economies of scale and network externality), which make it quite different from other industries. Thus,governments in all regime, need to implement sector-specific regulation in this industry [1],and adjust their own regulatory policies to the dynamic changes in industry characteristics.Moreover, since telecom industry belongs to one of the strategically sensitive industries which concern national security, it has remained state-owned so far in some countries.

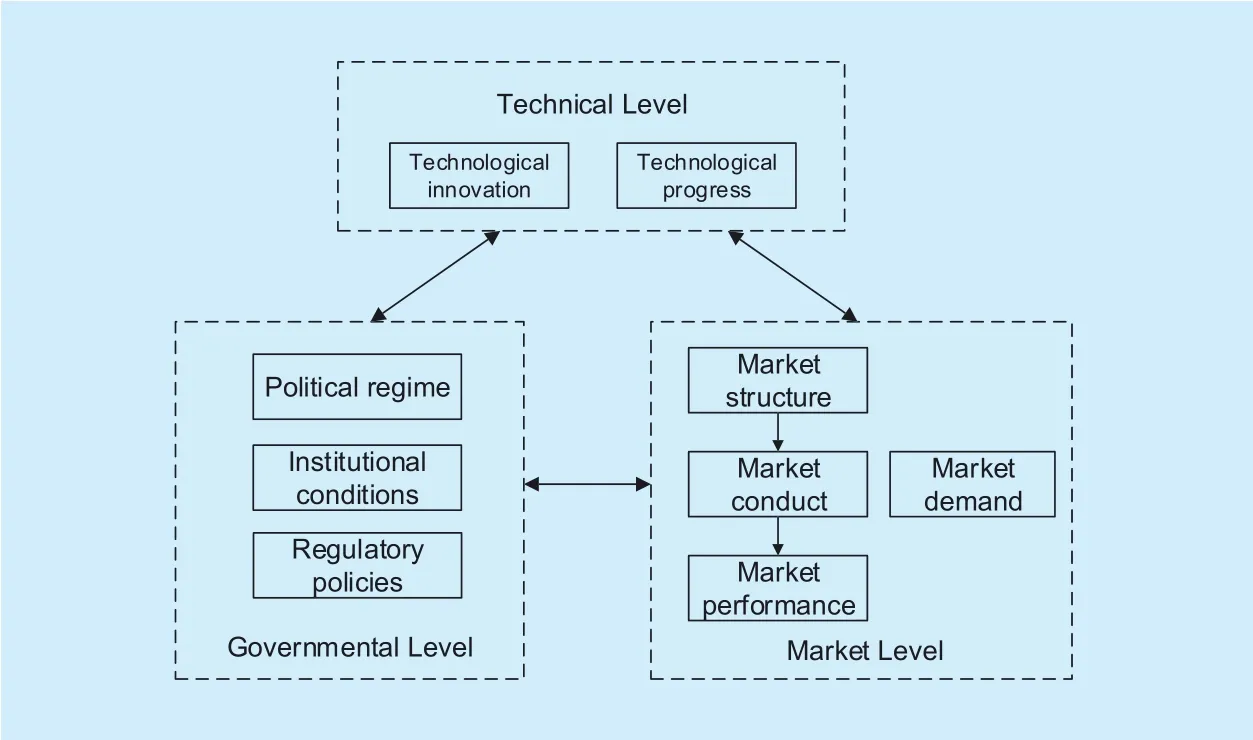

Based on the analysis above, this study introduces the technical and governmental factors into the traditional industry analysis framework to construct a new industry analysis framework called TGM(SCP), that is,Technology – Government – Market (Struc-ture – Conduct – Performance). As is shown in figure 3, we intend to discuss telecom issues in terms of the relationship of three levels,technical level, governmental level and market level.

Fig. 2. The traditional SCP paradigm.

At the technical level, there are two concepts. One is technological innovation, which refers to innovation in production technology,including the emergence of new technologies and application innovation for existing technologies. From the standpoint of promoting industry evolution, here “technological innovation” does not refer to a single technological innovation, but an innovation cluster induced by a radical innovation. Another concept related to technological innovation is technological progress, which refers to the cumulative economic performance and reflection of previous various technological innovations. Technological innovation is arguably the source of technological progress. Economists prefer to use the term of “technological progress”,probably because this term has a meaning of gradualness so that it is easier to be extended into a continuous variable. Instead, scholars who focus on innovation studies prefer to use the term of “technological innovation” to emphasize the process of “destructive creation”proposed by Schumpeter [55].

Fig. 3. TGM(SCP) industry analysis framework.

At the governmental level, regulation and public policy play a major role. However,not all policies are fully applicable across regions and nations, as those policies’ success or failure may depend on specific institutional conditions. Each country has its own political regime and unique characteristics, which play a critical role in the formation of institutional conditions in each country. Institutional conditions1Institutional conditions should also contain the informal norms related with social culture and customs, but institutional conditions at the governmental level mainly refer to the formal institutions which play a major role in the telecom industry compared to informal norms.of a nation include its judicial capabilities, impartiality and enforceability of the powers of regulatory agencies, and the balance between legislative and executive bodies [56].Also, different political regime and institution conditions in individual countries lead to different regulatory system and corresponding policies [57]. For example, policies aimed at promoting competition have been much stronger in the US than in China. The main reason lies in the complete difference in the political and economic regime between the two countries. The US has a strong antitrust regime and tradition which can provide an institutional and legal basis for restricting the exercise of market power and predatory behaviors; while in China, although the market-orientated economic reform has been implemented, the antimonopoly enforcement may not achieve effectively in terms of China’s regulatory and economic context [58].

At the market level, the supply side mainly conforms to the traditional SCP paradigm which indicates that market structure determines corporate conduct, and corporate conduct determines market performance. Market structure in a broad sense refers to the integrated state of a market regarding the number and size distribution of firms, the degree of difficulty for new competitors to enter the market and the degree of product differentiation, it also can be viewed as the internal relations between different participants and their characteristics in a given market. Market conduct refers to the decision-making behaviors of market participants for the pursuit of profit maximization as well as the conducts to implement the decisions. Market performance means the extent of social benefits provided by a given market structure, and it can be measured by indicators such as profitability of firms, improvements in price, the range and quality of services available to end users. In highly regulated industries like the telecom industry, market performance also embodies in the achievement of some political and social goals (e.g. universal service). On the demand side, changes in market demand may derive from the great improvements in the form and service quality of telecom services, or just come from the changes in the size of the population, preferences, demographics, and income. In a general market, market supply and market demand can be coordinated by the price mechanism. In this study, we mainly focus on the supply side of the market.

Previous theoretical frameworks in telecom generally view technology as one of the basic conditions or regard technological innovation as enterprise’s strategic behavior to obtain competitive advantage (e.g. see [36, 59]).However, we argue that technical factors, at least for the telecom industry, not only impact specific corporate behaviors but also play a crucial role in industrial growth and industry evolution, such factors should be viewed as external determinants in a macroscopic sense.Thus, we develop the TGM(SCP) framework in order to show the viewpoint that the evolution of telecom industry is the result of the interaction of technological, institutional and market forces, the coordination and complementation of the three actors can help improve market performance. Our consequent task lies in examining the dynamic relationship between these three levels in the telecom industry, which will be theoretically explored in the following section.

4.3 Spiral coevolution model for the telecommunications industry

According to the development course of telecom industry, the emergence of this industry is due to the development of contemporary information technology. And telecom regulation is kind of an institutional arrangement that emerged at a time when the telecom industry developed to a certain stage. Hence, technological innovation is the logical starting point in the evolution of telecom industry.

The traditional telecom industry is a typical natural monopoly industry [60, 61]. However,due to the technical factors, the natural monopoly of the telecom industry has the characteristics of hierarchy and dynamism. Hierarchy mainly refers that there are services that have different degrees of natural monopoly in this industry; that is, there are strong natural monopoly services, weak natural monopoly services, and even competitive services existing in the telecom industry at the same time.For example, in the traditional telecom, localfixed-line services are often considered to be strong natural monopoly, while long-distance telephone markets are considered relatively weak natural monopoly[2]. Dynamism refers to the fact that the boundary of the telecom industry is evolving dynamically, natural monopoly characteristics of the industry can change with the emergence of new technologies. The natural monopoly characteristics of the telecom industry are essentially determined by the techno-economic characteristics of the telecom industry [33]. During the divestiture of AT&T in the 1980s, telecom experts expected to utilize the microwave technology,a technology that exhibits only moderate returns to scale, to pave the road for the opening of the American long-distance market to competition. However, in a short time, this technology was replaced byfiber optics technology which has high fixed costs and low marginal costs, thus, experts emphasized that it was necessary to regard long-distance market as a natural monopoly, suggesting that the buildup of multiple full-scale fiber-optic networks was technologically wasteful. In addition, the reason why the natural monopoly of the localfixed-line market is considered to be stronger than that of the long-distance fixedline market is also essentially due to technical reason –– class-4 tandem switches dealt with inter-city traffic and class-5 local switches served end-user customers. Improvements in digital switching technology and the advent of optical-fiber transport eliminated cost differences between local and long-distance calls[2]. Therefore, if the economic characteristics of newly adopted technology are significantly different from the prior one, the techno-economic characteristics and cost structure of the telecom industry will change [33], and accordingly the industrial nature (the degree of natural monopoly) will also change.

Changes in natural monopoly of the telecom industry will change the structural entry barriers in the market, which provides the possibility for the entry of new enterprises and creates the preconditions for the adjustment of industrial boundary. Firstly, technological innovations significantly reduce the sunk costs and production costs of telecom enterprises and optimize the cost structure. For example,fiber, wireless, satellite and other large-capacity transmission technologies significantly reduce the unit cost of long-distance voice,high-definition video, and large-capacity data transmission. Secondly, new product market resulting from technological innovations will also change the market structure of old product market. For example, the emergence of cellular mobile technology has significantly changed the market structure of the traditionalfixed-line market. As of 2015, 96.6% of U.S.households had telephone services. Among them, households that only had wireless service accounted for about 47%, far exceeding the number of wireline-only households (8%).The traditional telephone companies’ local-access market share has fallen from about 97 percent in the past to about 29 percent of U.S.households in 2015 [2].

Once technological progress has changed the intrinsic properties of the industry and business forms of enterprises, the existing telecom regulation will no longer contribute to the efficient development of the industry, lagging regulation can cause the increase of transaction costs [62]. As such, in order to maximize the social welfare under the new industrial nature, regulators should adjust the regulatory system according to the changes in industrial nature and market demand [63]. Reformed regulation and public policy will also affect market structure (through entry regulation or restructuring by administrative practices) and regulate the behaviors of market participants[36]. In terms of the influence on market structure, on one hand, entry regulations which determine the erection or reduction of entry barriers affect the entry decision of potential competitors. On the other hand, regulatory agencies can examine whether the current market structure is reasonable or not by analyzing the current market conditions and techno-economic characteristics of services. If the market structure is considered unfavorable,telecom enterprises would be split and restructured through administrative procedures in order to adjust the market structure and promote competition. In 1982, the issue of “Modified Final Judgment”(MFJ) led to the divestiture of AT&T, regulated local telephone companies were separated from AT&T to reorganize into seven Bell Operating Companies (BOCs), US administrative departments expected to create a competitive long-distance market by means of divestitures and reforms [2]. China’s regulatory agencies also carried out three largescale acquisitions and divestitures reforms in its telecom industry in 1999, 2002 and 2008,respectively. Besides, price regulations and interconnection policies, which aim to prevent dominant enterprises from using their market powers to create unfair competition, can regulate the conducts of telecom operators. To maintain significant market power, dominant operators may have strong anticompetitive incentives [64]. Anticompetitive behaviors by incumbents, such as predatory actions and interconnection delay, seriously harm other competitors and ultimately impair consumer welfare. International and cross-industry experiences suggest anticompetitive behaviors must be monitored by the regulatory body or antitrust agency [65]. Based on the analysis above, we can find that the techno-economic characteristics and regulatory factors interact with each other, jointly determining the market structure and the scope of action of each player in the telecom industry [33]. However, the implementation of regulatory reforms depends on the regulator’s perception for the change in industrial nature, which is brought by technological innovation. Hence, technological innovation plays a key role in propelling the evolution of market structure and affecting corporate conduct in the long run.

Next, reformed regulatory regime also constitutes the institutional environment for a new round of technological innovation. The motivation for enterprises carrying on technological innovations lies in recognizing the existence of potential profits. Price regulation and access regulation can affect the potential profits of enterprises, thus having an influence on the innovation incentives for enterprises[49]. Besides, governments in all regimes,have some power to shape telecom innovation and implementation outcomes to suit policy objectives [66]. On the other hand, under the joint actions of industrial techno-economic characteristics and government regulation, the telecom industry evolve into a certain market structure, which determines the conducts of enterprises and market performance. Improvements in market performance will generate incentives for the next round of innovation investment decision and have a positive impact on enterprises’ development and application ability of technological innovation, thus affecting the effect of the next round of technological innovation. As such, the reformed regulatory system and market performance work together to affect the next round of technological innovation.

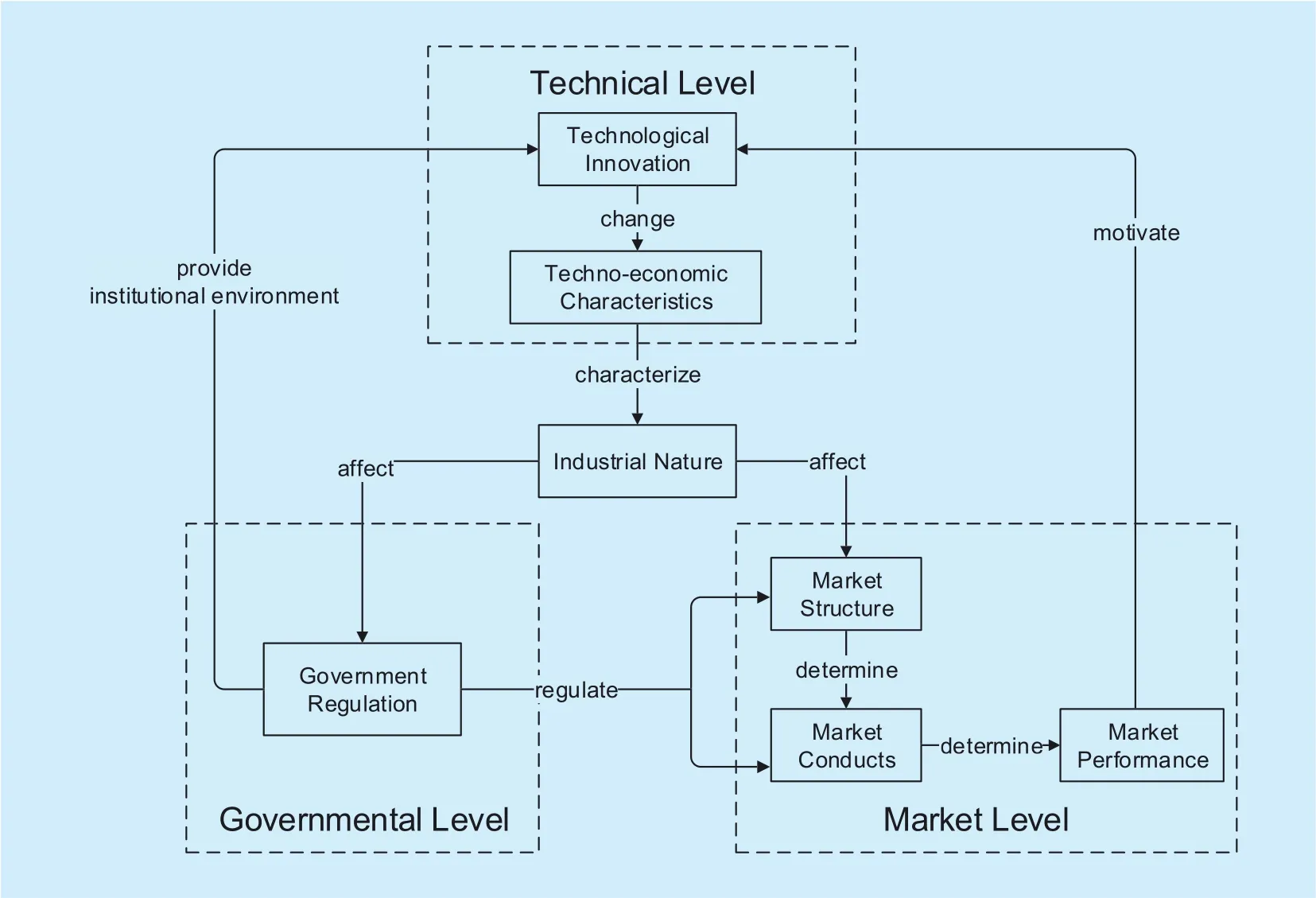

Based on the discussion above and the TGM(SCP) industry analysis framework proposed in Section 3,finally we are able to come up with the spiral coevolution model which reveals the interaction mechanisms of technological innovation with market and government regulation in the telecom industry, as is shown in figure 4.

Fig. 4. Spiral coevolution model for telecommunications based on TGM(SCP).

As is shown in figure 4, technological innovation is the logical starting point in the evolution of telecom industry, it can alter the original techno-economic characteristics of the telecom industry, which characterize the natural monopoly, economy of scale and network externality of the industry. Significant changes in the characteristics of the telecom industry can catch regulator’s attention, thus promote the reform of telecom regulatory regime. In other words, government regulations dynamically adjust themselves to react to the changes in industrial characteristics (normally lagging behind). In turn, the new telecom regulatory regime provides the institutional environment for the next round of technological innovation. Changes in industrial nature(e.g. cost structure) also change the structural entry barriers in the market and influence the competition relations among incumbents and entrants. Regulatory policies can affect market structure through entry regulation or administrative practices, and regulate the anticompetitive behavior by incumbents. Thus, in conjunction with regulatory policies, industrial nature affects the market structure and the behavior of incumbents. In line with the SCP paradigm, the improvement of market performance requires changes in market structure and corporate behavior. As such, technical and governmental forces work together to affect market structure and market conduct, and finally lead to different market performance.In turn, improvements in market performance have an impact on the incentive to technological innovation in the next round.

As such, technological innovation, market and government regulation, these three actors affect each other and coevolve to promote the development of the telecom industry. Technological innovations in thefirst stage determine the techno-economic characteristics of the industry and industrial nature in thefirst stage,thereby affecting the market competition and regulation in this stage, and the outcome of market competition and changes in the regulatory environment will have an impact on the technological innovations in the second stage.Technological innovations in the second stage will also affect the market competition and regulation content in this stage, thus affecting technological innovations in the third stage.The term “coevolution”, which reveals the condition that all evolutions that take place in an ecosystem in which each participant’s self-directed behavior can strongly influence or sometimes determine the evolution of other participants [67], can be used to depict the relationship between technology, market and government regulation. And the coevolution path of the three actors is also similar to a kind of upward spiral relations, thus it is named spiral coevolution model.

Indeed, the TGM(SCP) framework and spiral coevolution model we proposed above have a lot of uncertain parameters which require substantial information to be quantified.Thus, they should be viewed as a rough map instead of a deterministic model. We make no attempt to parameterize all relationships to show the relative strength or quantitative causality between different factors. Instead,they should be viewed as conceptual in nature.Their utilities consist in directing attention to the core role of technology in the evolution of the telecom industry, and revealing the interaction mechanism of technology, market and government regulation.

V. POLICY IMPLICATIONS

According to the results of inductive reasoning and the history of telecom industry, telecom regulators need to continually examine the significant changes brought by technological progress in the industry, so that they can carry out the corresponding reforms for telecom regulatory system [68]. Market entry barriers can be divided into structural barriers, institutional barriers and strategic barriers. Structural barriers refer to entry barriers caused by economic factors including scale economy,absolute cost advantage of incumbents and so on; institutional barriers refer to the barriers that arise due to government regulation ; strategic barriers refer to the strategic behaviors of incumbents which are used to hinder potential entrants [69]. Technological innovation can help break through the original structural entry barriers by reducing costs and improving production efficiency, but the telecom sector is also strictly regulated by the government in most countries, thus, it need government to break the institutional barriers brought by the original regulatory regime. However, much previous literature suggests that government regulation itself tends to curb the massive changes brought by disruptive technological innovations and is reluctant to change its paradigm, there exists the problem of “regulatory disconnection” which describes the situation that the pace of technological progress is always faster than that of regulatory instruments which aim to regulate new technology [9, 70].Telecom regulators should realize that technological progress is a necessary and inevitable trend of the telecom industry, and be courageous to break the institutional barriers that hinder technological innovation.

Meanwhile, our antitrust policies need to identify whether the market powers of enterprises were achieved in a favorable way. We have noted that the potential level of competition within any given industry depends on the techno-economic characteristics of that industry. Because of the characteristics of telecom industry, the situation in real markets is generally characterized as an oligopoly and substantial market power of incumbents. Market power in the short run is the incentive that drives investment in R&D on new technology[2]. Opportunity to escape competition and obtain a monopoly position, and thus to get high profits is one of the main driving forces for enterprises to innovate [22]. Therefore,the innovative behavior of an enterprise is anticompetitive in nature, but this does not mean such conduct is surely unfavorable in terms of social benefits. Penalizing market power which is a result of innovative efforts rather than anticompetitive practices can be inefficient, especially in the long run. The inefficiency stems not only from the unrealized innovation in the current period due to fear of regulation ex-post, but also from the reduced capacity for further development and application of innovation [2, 49]. This effect is particularly significant in a dynamic telecom industry in which cumulative innovation is vital and the externalities of innovation apply to the entire economy [71, 72]. The history of telecom industry shows that the only way that market power truly disappears is through technical change and disruptive new services and technologies. In the same way, market power in the buggy-whip industry would likely have been erased by the automobile industry rather than by the courts or regulator [2]. The antitrust investigation should not only consider how consumers have been harmed, but also understand how the opportunities of market participants for innovations might be impaired.

Owing to the fact that technological innovation is the fundamental driving force of telecom industry evolution, regulators should not only adjust the regulatory regime in time to adapt to the characteristics of technological changes when technological innovations are exogenous, but also make technological progress endogenous, that is, employ incentive regulations to promote technological innovations. Although the “invisible hand” (market)is efficient in matching supply and demand, it is generally incapable of organizing the risky,long-term and complex R&D processes which are necessary for creating radical technological innovations [46]. Market is inherentlyflawed in stimulating technological innovation for the following reasons: 1) Market fails to fundamentally address the problems of innovation risk and innovation incentive, and companies may be unwilling to develop and deploy emerging technologies which may damage their existing business [73]. 2) Market itself may not be able to create a market structure that is conducive to innovation. 3) Market itself cannot create an external environment conducive to innovation, such as laws related to innovation, tariffs, policies etc. More importantly, technological innovations in IT industry, especially in telecom, are activities with high economic externalities, which can greatly stimulate economic growth and promote the development of other industries [74,75]. Some literature has pointed out that under certain conditions, regulation can at times be a powerful stimulus to innovation [76].From this standpoint, the government should create an environment that is conductive to technological innovation and adopt regulatory policies that can stimulate technological innovation. Policies which affect the innovation incentives of market players should be designed and carried out, including tax credits and subsidies for innovation and investment expenditures, accelerated depreciation, and measures that reduce interest rates and hence the capital cost [13]. Telecom regulators need to realize that technological innovation is the only essential way to reduce price and improve quality of telecom services.

In addition, the government plays a vital role in the development of radical telecom technologies and the setting of telecom standards. Some previous studies indicated radical technological innovations are more driven by the development of science and technology,rather than market demand [77]. Due the huge risk and externality of the R&D of science and technology, governments should build the national innovation system that is suitable for its domestic economic development and act as a facilitator and monitor in the innovation system[78]. Due to the complexity of telecom technology and the need for standardization,radical innovations could not be provided only by one creative enterprise or even one country[79]. Innovation regimes, which was proposed by Godoe (1995), have provided a capability of coordination, direction and leadership in the creation of many of the radical technological innovations that have emerged in the sector[80]. That is to say, radical innovations in telecom can be achieved by setting strategy goals,they are rational outcomes of the innovation regime, and governments can play important roles in the formation and maintenance of the innovation regime.

Technical standardization plays a basic and strategic role in the development of the telecom industry [81], the owner of technical standards can dominate the direction of technological progress in the future. Although standards development organizations (SDOs), such as ITU, set most of the technical standards in telecom [68], SDOs do not have the legal authority to implement a technical standard. It is government that plays a significant role in the development and adoption of technical standards [82]. The cooperation network of different technical organizations and market players(e.g. telecom operators and equipment vendors) is of vital importance to the successful development and diffusion of a standard [83].In the standardization process, government can play multiple roles as a project founder,risk undertaker, interest moderator, collaboration facilitator, and process monitor [51]. The fierce competition among European companies on GSM demonstrates the importance of government support, and the relatively weak position of CDMA indicates the negative impact of the market-based standard setting method [84]. Much literature has pointed out that Chinese government played a critical role in the development and implementation of its domestic 3G standard TD-SCDMA [51,52]. In 2000, with the support of the Chinese government, eight companies established the TD-SCDMA Technology Forum2In January 2009,TD-SCDMA Technology Forum changed its name to TD Technology Forum., which provides a venue for sharing relevant information and promoting the development and commercialization of TD-SCDMA. In order to promote the industrialization of TD-SCDMA,in October 2002, the Ministry of Information Industry (MII) established the TD-SCDMA Industry Alliance (TDIA) to promote efficient cooperation betweenfirms. In February 2004,the National Development and Reform Commission (NDRC), the Ministry of Science and Technology (MOST) and MII jointly launched the TD-SCDMA R&D and Industrialization Project (TRIP) to provide subsidization for firms to investment in the TD-SCDMA technology [51]. Chinese policymakers regard TD-SCDMA as a way to leapfrog in the global technology contest. The outcome of TD has been a mixed one thus far, however, the successful development of TD-SCDMA shows that Chinese firms have become the key participants in the standardization of complex technology systems. It helps Chinesefirms to win the discursive power and accumulate technological capabilities in the setting of TD-LTE and forthcoming 5G standard [85, 86], meanwhile promote the national positive image of China internationally [52].

VI. CONCLUSION AND FUTURE WORK

This study aims at highlighting the role of technology in the evolution of the telecom industry and discussing its interaction mecha-nisms with government regulation and market dynamics in telecom, as well as providing several relevant policy implications. In the telecom industry, technical factors not only impact specific corporate behaviors but also have a crucial role in industrial growth. Thus, from the perspective of industry evolution, technical factors should be viewed as external determinants in a macroscopic sense. In this study,we propose an industry analysis framework called TGM(SCP), based on which the spiral coevolution model is constructed to reveal the coevolutionary relationship of technology,government regulation and market dynamics in the telecom industry. Our study indicates that the evolution of the telecom industry is an interrelated process of technological innovation, government regulation and market competition, and among the three actors,technological innovation is the fundamental driving force. Relative to the “invisible hand”(market) and “visible hand” (government), we conceptualize technology as the “third hand”,which fundamentally drives the development of telecommunications industry in coordination with the other two hands. It is exactly the continuous technological advancement that gives birth to the sustained prosperity and development of the industry.

This paper attempts to refute the conviction of some policy makers that competition is the best driver of growth (“l(fā)aissez faire”) and the ultimate aim of regulation is to achieve the goal of ensuring effective market competition.We argue that ensuring the innovation rates and promoting the telecom network to upgrade steadily is the more desirable way to propel the efficient development of the telecom industry.Therefore, in addition to enabling market competition, telecom regulatory policy should shift towards technological innovation as its major goal. As the institutional condition of technological innovation, well-designed regulatory regime can guide or even force companies to invest in the R&D of new technology and innovative activities [87, 88]. Hence, shaping the existing regulatory framework to support innovation activities would have significant importance for the effective development of the telecom industry. Proper institutional and governance arrangements can have a critical role in standardization, interoperability, coordination, and thus the innovation performance of the whole system. Due to the significant importance of technological innovation and the huge costs of new infrastructure, telecom regulators must carefully examine the implications of the upcoming regulatory policies for innovation and investment decisions that shape the future development of the telecom industry. Besides, regulatory framework must set up rules and incentive mechanisms to promote technological innovation and technical standardization in the telecom industry as well as eliminate factors that may hinder the pace of technology progress, in an effort to promote the continuous development of telecom technology. As such, the overall development level of the telecom service industry can be enhanced continuously.

This study also has a number of limitations.First, although this study suggests the major goal of telecom regulatory policies is to foster technological innovation, policy makers may face a trade-off between static efficiency (lower prices in short-term competition) and dynamic efficiency (improvements in technology and upgrading infrastructure in the long run)[13]. While the rapid pace of technological advances in telecom tends to imply that dynamic efficiency is more important than static efficiency in terms of industrial development,it still remains an open question that how to balance the two efficiencies and determine their exact magnitude in order to characterize the optimal market structure in the telecom industry. Service-based competition was initially used by regulators as a “stepping stone” to develop infrastructure innovation and investment[17, 89]. However, the EU regulatory framework that derived from the LoI theory may not support infrastructure development and several recent studies have indicated the shortcomings of the European approach [31, 90]. Thus,how to design consistent policies that aim at resolving the trade-off between dynamic and static efficiency under specific institutional and market conditions shall be addressed by future work.

Second, this study mainly focuses on theoretical analysis and discussion, providing an intuitive understanding of the interaction mechanism of technology, market and government regulation in telecom. Further empirical and quantitative evidence can make our arguments more robust. However, traditional econometric methods may have difficulties capturing the dynamic interplay of technology, market and government regulation. One promising way that might help to overcome this challenge is to use simulation models or experimental approaches. It remains a task for our future research.

ACKNOWLEDGEMENT

This paper is supported by Major Program of the National Social Science Foundation of China under Grant No.15ZDB154, and National Basic Research Program of China (973 Program) under Grant No. 2012CB315805.

- China Communications的其它文章

- A Stackelberg Differential Game Based Bandwidth Allocation in Satellite Communication Network

- Joint Resource Allocation Using Evolutionary Algorithms in Heterogeneous Mobile Cloud Computing Networks

- A Master-Slave Blockchain Paradigm and Application in Digital Rights Management

- Mobile Jammer-Aided Secure UAV Communications via Trajectory Design and Power Control

- A Quantitative Security Metric Model for Security Controls: Secure Virtual Machine Migration Protocol as Target of Assessment

- A Blind Spectrum Sensing Based on Low-Rank and Sparse Matrix Decomposition